Cash Loan Your Quick Guide

Cash loans offer a swift solution for short-term financial needs. Different types of cash loans exist, each with its own features and characteristics. Understanding the process, factors influencing decisions, and associated risks is key to responsible borrowing. From payday loans to personal loans, cash loans can be utilized for a variety of purposes.

This guide explores the various facets of cash loans, covering everything from application procedures to potential benefits and drawbacks. The key factors impacting loan decisions are also explored, including credit history, income stability, and debt-to-income ratio. We’ll also compare different providers and offer tips for choosing the right loan for your needs.

Factors Affecting Cash Loan Decisions

Cash loan decisions are intricate processes involving a multitude of factors. Lenders meticulously evaluate various aspects of an applicant’s financial profile to determine their ability to repay the loan. This analysis ensures responsible lending practices while managing potential risks. The factors considered are not isolated but rather interconnected, with each element contributing to a holistic assessment.

Credit History & Scores

Credit history, encompassing payment history, delinquencies, credit utilization, and types of credit, significantly impacts loan approval probability. A consistent history of timely payments and low credit utilization typically translates to higher approval rates and favorable interest rates. Conversely, a history of late payments or delinquencies strongly reduces the likelihood of loan approval. Different credit scoring models, such as FICO and VantageScore, influence decisions, with each model using different algorithms to calculate scores. These models consider various aspects of credit history, but may place varying weight on specific factors, resulting in potentially different outcomes for the same credit profile.

- Excellent credit history (FICO score above 700) often leads to higher approval rates and lower interest rates. Examples include applicants with long-standing credit lines, consistently on-time payments, and low credit utilization ratios.

- A fair credit history (FICO score between 670 and 700) typically yields moderate approval rates and interest rates. Examples include applicants with a few late payments or a higher credit utilization ratio than those with excellent credit.

- Poor credit history (FICO score below 670) typically leads to lower approval rates and higher interest rates. Examples include applicants with frequent late payments, significant delinquencies, or high credit utilization.

Income & Employment Stability

Consistent, verifiable income and stable employment are crucial for loan approval. Lenders assess employment history and income stability to gauge an applicant’s ability to repay the loan. Different income types, such as salary and self-employment income, are evaluated differently, considering the consistency and predictability of the income stream. Fluctuating income or recent job changes may trigger a more rigorous evaluation, as lenders want to ensure the applicant’s ability to repay the loan is not jeopardized by financial instability.

- Consistent income from stable employment significantly increases the likelihood of loan approval. Examples include applicants with a consistent salary and an established employment history.

- Fluctuating income or recent job changes may lead to a more thorough review of the applicant’s financial situation. Examples include applicants who have recently changed jobs, experienced a reduction in income, or have self-employment income that is inconsistent.

- Income verification methods, such as pay stubs and tax returns, play a critical role in assessing an applicant’s income stability. Examples of these methods help lenders ascertain the applicant’s ability to repay the loan.

Debt-to-Income Ratio (DTI)

The debt-to-income ratio (DTI) is a crucial factor in assessing an applicant’s financial burden. It is calculated by dividing total monthly debt payments by gross monthly income. Different DTI levels significantly affect loan eligibility. A low DTI generally indicates a higher probability of loan approval, as it suggests the applicant has sufficient disposable income to handle the loan repayment. Conversely, a high DTI may result in loan denial or unfavorable loan terms, as it suggests the applicant may struggle to manage additional debt. Acceptable DTI ranges vary depending on the type of loan and the lender’s risk tolerance.

- A low DTI (e.g., below 43%) typically leads to higher approval rates and more favorable interest rates. Examples include applicants with low monthly debt obligations compared to their income.

- A moderate DTI (e.g., between 43% and 50%) usually results in a moderate likelihood of approval. Examples include applicants with a balanced mix of income and debt obligations.

- A high DTI (e.g., above 50%) often leads to lower approval rates or more stringent loan terms. Examples include applicants with high monthly debt obligations relative to their income.

Loan Amount & Repayment Terms

The loan amount significantly influences approval rates. Larger loan amounts often require more stringent credit assessments and favorable financial profiles. The relationship between loan amounts and interest rates is generally direct; larger loans often come with higher interest rates to reflect the increased risk for the lender. Flexible repayment terms, such as longer loan periods, may reduce the monthly payment but increase the total interest paid over the life of the loan. Lenders consider loan amounts and repayment terms to assess the risk and affordability of the loan for the borrower.

- Larger loan amounts require a more thorough evaluation and typically come with higher interest rates. Examples include applicants seeking larger loans to fund significant purchases.

- Longer repayment terms reduce the monthly payment but increase the total interest paid. Examples include applicants who prefer to spread out their payments over a longer period.

- Lenders consider the borrower’s ability to manage the monthly payments and the total cost of the loan when evaluating loan amounts and repayment terms. Examples include applicants who have demonstrated a consistent history of on-time payments.

Additional Considerations

Other factors, such as credit mix (secured vs. unsecured loans), collateral (if any), and geographic location (if relevant), may influence loan decisions. Lenders may consider these factors in their risk assessment. However, it is crucial to approach these factors with caution to avoid potential biases.

Understanding the Benefits of Cash Loans

Cash loans offer a potential solution for individuals facing short-term financial needs. They provide a direct pathway to accessing funds quickly, but it’s crucial to approach these loans with a clear understanding of the associated advantages and considerations. This article delves into the various benefits of cash loans, highlighting specific scenarios and comparing them to alternative financial solutions.

Short-Term Financial Needs

Cash loans can effectively alleviate short-term financial pressures. For example, a sudden car repair costing $1,500 can be addressed promptly with a cash loan. This avoids delaying necessary repairs, which could lead to more significant and costly issues down the road. The loan provides immediate relief, enabling individuals to address the problem without accumulating further debt or relying on other potentially less convenient options. Repayment terms and interest rates should be carefully considered to ensure the loan doesn’t create further financial strain.

Unexpected Expenses

Cash loans provide a rapid solution to unexpected expenses. Comparing a cash loan to alternative solutions like borrowing from friends or family or using a credit card demonstrates the benefits. A sudden home appliance repair costing $300 might be covered quickly with a cash loan, potentially avoiding the interest charges and high APR associated with credit cards. The speed and convenience of cash loans can be a critical factor in managing unexpected financial situations. It is crucial to carefully evaluate the terms of the loan and consider the potential long-term financial implications.

Credit History Building

Certain cash loans can contribute to building a positive credit history. These loans typically require responsible borrowing practices, including timely repayments. The key lies in understanding the loan terms and consistently meeting repayment obligations. This consistent behavior demonstrates financial responsibility, which can positively impact credit scores over time. Not all cash loans are created equal, so borrowers should carefully evaluate the specific loan options and associated requirements.

Specific Purposes

Cash loans can be utilized for various purposes, from home improvements to educational expenses or small business startups. A $5,000 cash loan can be used to fund a small business startup, potentially leading to a return on investment. However, it’s important to thoroughly analyze the financial implications of the loan, including potential risks and projected returns. The specific purpose and potential financial outcomes should be carefully evaluated before considering a cash loan.

Quick Access to Funds

Cash loans offer a swift and convenient way to access funds. The processing time and documentation required for a cash loan can be significantly faster than other financing options, such as personal loans or bank loans. This rapid access can be crucial for addressing urgent financial needs. The specific requirements and processing times vary among lenders, so it’s essential to compare different loan options and understand the terms.

Risks and Drawbacks of Cash Loans

Cash loans, while offering quick access to funds, come with inherent risks that borrowers should carefully consider. Understanding these potential downsides is crucial to making an informed decision and avoiding unnecessary financial hardship. These risks often stem from the attractive, but potentially deceptive, nature of short-term financing.

High-Interest Rates & Short Repayment Periods

High-interest rates are a common characteristic of cash loans, particularly those with short repayment periods. Lenders often charge higher interest rates to compensate for the risk of borrowers defaulting and the need to collect interest quickly. This mechanism often results in higher effective interest rates for borrowers, significantly impacting their financial health. The shorter the repayment timeframe, the higher the interest rate tends to be. This is because lenders need to recover their principal amount plus interest within a shorter period. For example, a loan with a 12% interest rate and a 3-month repayment period might result in a total interest cost that is substantially higher than a loan with a similar interest rate but a 12-month repayment period. This increased cost can quickly lead to financial difficulties for borrowers if not carefully calculated and understood.

Financial Hardship Scenarios

Cash loans can lead to significant financial hardship if not managed responsibly. Unexpected events, such as medical emergencies, job loss, or increased living expenses, can strain a borrower’s ability to repay the loan. Borrowers who take out cash loans without a clear plan for repayment, or those who underestimate the impact of interest and fees, are particularly vulnerable. For instance, a borrower who takes out a cash loan to cover unexpected medical expenses might face difficulty in repayment if the medical bills exceed the anticipated amount. Similarly, job loss can lead to an inability to meet loan obligations, triggering a cascade of financial problems.

Consequences of Default

Defaulting on a cash loan can have severe consequences. Lenders may initiate legal action to recover the outstanding balance. This can lead to court appearances, judgments, and potentially wage garnishment. Defaulting also severely impacts a borrower’s credit score, making it difficult to obtain future loans, mortgages, or credit lines. Collection agencies may also become involved, pursuing the borrower for repayment and potentially leading to further financial stress and damage to their reputation.

Hidden Fees & Charges

Cash loans often come with hidden fees and charges beyond the stated interest rate. These can include application fees, processing fees, origination fees, or prepayment penalties. These fees can significantly increase the total cost of the loan and make it harder for borrowers to repay. For example, a seemingly attractive cash loan might have an origination fee of 2% of the loan amount, which would need to be factored into the total cost. Similarly, prepayment penalties could significantly increase the cost if the borrower decides to repay the loan early.

Predatory Lending Practices

Predatory lending practices, in the context of cash loans, involve tactics that exploit borrowers’ financial vulnerability. These tactics might include high-pressure sales tactics, manipulating loan terms, or providing misleading information. Lenders may also target borrowers with poor credit or those who are financially vulnerable. For example, a lender might offer a loan with an incredibly high interest rate and short repayment period, and fail to inform the borrower about the true cost of the loan. These practices are illegal and unethical, and borrowers should be wary of lenders employing such strategies.

Comparative Analysis

Comparing cash loans to other borrowing options, such as personal loans or credit cards, reveals crucial differences in terms of interest rates, repayment periods, and fees. Cash loans typically have higher interest rates and stricter repayment terms, making them potentially more costly than alternative options. Borrowers should carefully evaluate the cost-benefit analysis of cash loans compared to personal loans or credit cards.

Consumer Protection Measures

Consumer protection measures aim to safeguard borrowers from predatory lending practices. These measures might include regulations regarding interest rates, fees, and loan terms. State and federal laws may also provide avenues for borrowers to dispute unfair practices or seek redress if they are victims of predatory lending. Borrowers should be aware of their rights and seek assistance if they encounter suspicious or unfair loan terms.

Alternative Financial Solutions

Before resorting to a cash loan, borrowers should explore alternative financial solutions. These could include seeking assistance from family or friends, exploring options from credit unions or community banks, or exploring budgeting strategies to manage unexpected expenses. Borrowers could also consider negotiating with existing creditors or exploring options such as a balance transfer. These alternative solutions might offer more favorable terms and reduce the potential for financial hardship.

Comparison of Different Cash Loan Providers

Cash loans offer a readily available source of funds for various needs. However, the landscape of cash loan providers can be complex, with varying terms and conditions. Understanding these differences is crucial for borrowers to make informed decisions. This analysis compares key aspects of several providers, focusing on interest rates, fees, application processes, customer service, and repayment options.

Interest Rates and Fees

Different cash loan providers employ varying approaches to pricing. Interest rates and fees significantly impact the overall cost of borrowing. A crucial factor to consider is whether the interest rate is fixed or variable. Fixed rates offer predictability, while variable rates can fluctuate, potentially increasing the total cost. Loan terms, such as the duration (e.g., 30, 60, or 90 days), also affect interest rates.

| Loan Provider | Interest Rate (30 days, 10,000 USD) | Origination Fee |

|---|---|---|

| Provider A | 15% APR, Fixed | 5% of loan amount |

| Provider B | 12% APR, Variable | 2% of loan amount |

| Provider C | 18% APR, Fixed | 3% of loan amount |

Note: Interest rates and fees are examples and may vary depending on individual circumstances. Actual rates should be confirmed with the provider directly.

Application Process

The application process for cash loans varies by provider. The ease and speed of the process can significantly influence the borrower’s experience.

- Provider A: The application process involves an online application, verification, and approval. Required documents might include identification and proof of income. Processing time is typically within 24 hours.

- Provider B: A similar online application is used, followed by verification and a credit check. The processing time may be slightly longer, potentially taking up to 48 hours.

- Provider C: The application process is mostly online, but may require additional documentation. The processing time is often quicker than Provider B, typically under 24 hours.

Customer Service

The quality of customer service is another important consideration when choosing a cash loan provider. Responsive and helpful customer service can be vital during the loan process.

- Provider A: Offers 24/7 phone, email, and live chat support.

- Provider B: Provides phone support during business hours (Monday-Friday) and email support.

- Provider C: Offers phone and email support during business hours.

Loan Repayment Options

The repayment options available can greatly affect the borrower’s convenience. Flexible repayment options are beneficial for those with different financial situations.

- Provider A: Supports automatic deductions, online payments, and in-person payments. Accepted payment methods include bank transfers and checks.

- Provider B: Offers in-person and online payments via bank transfer and other methods.

- Provider C: Supports online and in-person payments. Methods include bank transfers, money orders, and cash deposits.

Legal and Regulatory Aspects

Navigating the world of cash loans requires a strong understanding of the legal framework governing these transactions. Different jurisdictions have varying regulations, impacting everything from interest rates to loan terms and borrower protections. This section delves into the crucial legal and regulatory aspects to help borrowers make informed decisions.

Legal Regulations Governing Cash Loans

Various jurisdictions have specific laws and regulations in place to govern the provision of cash loans. These regulations aim to protect borrowers from predatory lending practices and ensure fair dealings between lenders and borrowers. The scope of these regulations often encompasses interest rate caps, loan terms, and procedures for debt collection. Understanding these regulations is paramount to avoiding potential legal issues and ensuring a smooth loan experience.

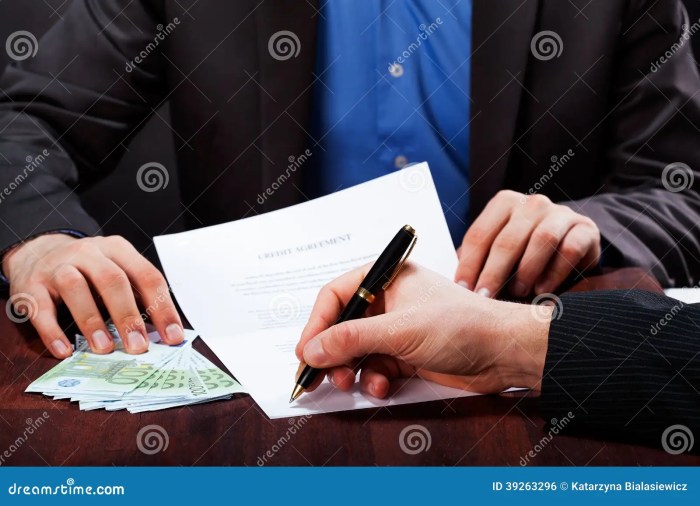

Importance of Understanding Loan Terms and Conditions

Loan agreements, often dense documents, contain crucial information about the loan’s terms. Understanding these terms is vital for borrowers to comprehend their financial obligations and potential risks. Thorough review and comprehension of all aspects of the agreement, including interest rates, repayment schedules, fees, and penalties, are critical to avoid unforeseen financial burdens.

Consumer Protection Measures for Cash Loan Borrowers

Consumer protection measures vary by jurisdiction but typically aim to safeguard borrowers’ rights. These measures can include regulations on loan terms, interest rates, and debt collection practices. Borrowers should be aware of their rights and understand how to exercise them in the event of disputes or concerns.

Role of Financial Regulators in Overseeing Cash Loan Providers

Financial regulators play a critical role in monitoring cash loan providers to ensure compliance with regulations and protect consumer interests. Their oversight includes inspections, audits, and enforcement actions against lenders who violate regulations. These regulators help maintain a level playing field and promote fair lending practices.

Summary of Applicable Laws and Regulations, Cash loan

A comprehensive summary of applicable laws and regulations for cash loans is not feasible within this format. The specifics vary significantly by jurisdiction, making a universally applicable summary impractical. Borrowers should consult legal counsel or relevant financial regulatory bodies in their specific region for the most up-to-date and relevant information. This is crucial to ensure accurate and detailed knowledge of the legal and regulatory framework in place for cash loans within their particular location.

Responsible Cash Loan Use

Taking out a cash loan can be a helpful financial tool, but it’s crucial to approach it responsibly. Understanding the implications of borrowing and implementing sound financial strategies can significantly impact your ability to manage the loan effectively and avoid potential financial difficulties. A responsible approach ensures you leverage the loan for its intended purpose and repay it without undue stress.

Responsible borrowing is paramount to a successful financial outcome. It involves more than just securing the loan; it encompasses careful planning, effective repayment strategies, and a comprehensive understanding of the total cost of borrowing. This proactive approach minimizes the risk of falling into debt traps and maximizes the benefits of the loan.

Importance of Budgeting and Financial Planning

Thorough budgeting and financial planning are essential steps before considering any loan, including cash loans. A well-defined budget allows you to assess your current financial situation, identify your needs and priorities, and determine if a loan is truly necessary. Without a clear financial plan, you risk overextending yourself and accumulating unnecessary debt.

Strategies for Managing Loan Repayments

Effective repayment strategies are critical to managing a cash loan. Developing a structured repayment plan helps ensure you meet your obligations on time and avoid penalties or interest charges. This plan should align with your income and financial capacity.

- Create a realistic repayment schedule: Break down the loan amount into manageable monthly payments. Consider factors like your income, other financial obligations, and potential unexpected expenses. For example, a detailed monthly budget can show where your income goes and identify areas where you might reduce spending to allocate more funds to loan repayments.

- Automate payments: Setting up automatic payments through your bank account ensures timely repayments and eliminates the risk of missed payments due to forgetfulness or unforeseen circumstances. This helps in maintaining a consistent repayment schedule.

- Seek advice if needed: If you’re having trouble managing your repayments, consider consulting a financial advisor or counselor for guidance and support. They can offer tailored advice and help you develop a sustainable repayment strategy.

Understanding the Total Cost of Borrowing

Understanding the total cost of borrowing is crucial. This involves more than just the interest rate. Consider all associated fees, charges, and potential penalties to determine the overall financial burden of the loan. A complete cost analysis helps you make an informed decision and avoid surprises.

- Review the loan agreement carefully: Thoroughly review all terms and conditions of the loan agreement. Pay close attention to interest rates, fees, and any penalties for late payments. This meticulous review helps avoid any hidden costs that could affect your budget.

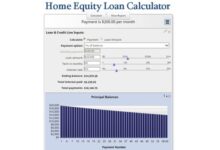

- Calculate the total interest payable: Utilize online calculators or loan amortization schedules to calculate the total interest you will pay over the life of the loan. This enables you to compare different loan options based on their overall cost.

Process of Contacting a Financial Advisor or Counselor

Seeking guidance from a financial advisor or counselor can be a valuable step in managing your finances. These professionals can provide expert advice and support in developing a financial plan, including loan management.

- Research qualified advisors: Seek recommendations from trusted sources or consult online directories to find qualified financial advisors or counselors in your area. Consider their experience, credentials, and fees.

- Schedule a consultation: Arrange a consultation to discuss your financial situation and goals with a potential advisor. During this consultation, discuss your loan situation and seek their guidance on managing your finances effectively.

- Ask questions and seek clarification: During the consultation, don’t hesitate to ask questions about the loan’s terms and potential implications. Seek clarification on any aspects that are unclear. This proactive approach ensures you understand the entire process and make informed decisions.

Alternatives to Cash Loans

Seeking short-term financial solutions often leads individuals to explore options beyond traditional cash loans. Understanding the various alternatives and their associated advantages and drawbacks is crucial for making informed decisions. These alternatives can offer comparable access to funds but with different terms and conditions.

A range of financial tools can provide alternatives to cash loans, each with its own strengths and weaknesses. Careful consideration of individual financial situations and circumstances is vital when selecting the most suitable alternative. The availability and terms of these options may vary depending on location and individual circumstances.

Saving and Budgeting Strategies

Building a financial cushion through disciplined saving and budgeting is a crucial first step for managing short-term financial needs. Regular savings, coupled with a well-defined budget, can mitigate the need for external borrowing. This approach fosters financial independence and reduces reliance on loans.

Utilizing Existing Resources

Exploring readily available resources like credit cards or lines of credit can offer an alternative to cash loans, especially for smaller amounts. These options often have established credit terms and conditions, but may come with higher interest rates compared to savings accounts.

Borrowing from Family or Friends

Borrowing from trusted family members or friends can be a viable alternative, particularly in cases of urgent need. This method can foster strong personal relationships and potentially offer favorable interest rates or terms. However, establishing clear repayment plans and agreements is crucial to avoid potential conflicts.

Peer-to-Peer Lending Platforms

Peer-to-peer (P2P) lending platforms connect borrowers directly with potential lenders, often individuals or small investment groups. This method bypasses traditional financial institutions, potentially offering faster approval and varied interest rates. However, borrowers should carefully assess the platform’s reputation and terms.

Small Business Loans or Grants

For individuals seeking to start or grow a small business, alternative funding options exist beyond cash loans. Government-backed grants or small business loans can provide substantial capital for expansion. Researching and understanding the specific requirements and criteria of such programs is vital.

Government Assistance Programs

Many governments offer financial assistance programs to address specific needs, like unemployment benefits, or subsidized loans for education. These programs can provide a vital alternative for individuals facing temporary financial hardship. Knowing the eligibility criteria and procedures is key to accessing these resources.

Comparison Table of Alternatives

| Alternative | Pros | Cons | Comparison to Cash Loans |

|---|---|---|---|

| Savings & Budgeting | Builds financial stability, avoids debt | Requires discipline, may not address immediate needs | Long-term solution, avoids interest charges |

| Existing Resources (Credit Cards, Lines of Credit) | Faster access to funds | Higher interest rates, potential for debt accumulation | Can be a faster option, but with potential drawbacks |

| Family/Friends | Potential for favorable terms, strong relationships | Repayment issues, strained relationships if not managed well | Personal, potentially better rates, but risk of strained relationships |

| P2P Lending | Potentially faster approval, varied rates | Risk associated with platform reliability, potential high rates | Direct lending, potentially quicker but with varying risks |

| Small Business Loans/Grants | Significant capital for business growth | Strict eligibility criteria, lengthy application process | Specialized loans, suited for specific business needs |

| Government Assistance | Address specific needs, subsidies | Limited availability, eligibility criteria | Targeted aid, suited to temporary hardship |

Illustrative Scenarios: Cash Loan

Understanding different financial situations and their implications when considering a cash loan is crucial. This section provides illustrative scenarios to help evaluate the suitability and potential consequences of cash loans in various circumstances.

Emergency Cash Loan Scenario

A sudden, unexpected financial emergency can significantly impact individuals’ financial stability. This scenario highlights the importance of having a financial safety net.

A single mother with two children, earning $30,000 annually, faces a sudden car breakdown requiring a $1,500 repair. Her existing savings amount to $500, leaving an urgent need for $1,000.

Obtaining a small cash loan can provide immediate relief. Potential loan terms might include a repayment period of 3-6 months, with an interest rate varying based on the lender and the applicant’s creditworthiness. A repayment schedule, outlining monthly payments, would be crucial for managing the financial burden.

Compared to other options like selling possessions or seeking assistance from family, a cash loan offers a quick solution for this immediate need. However, it’s essential to carefully assess the interest rates and repayment terms to avoid adding to existing financial pressures. The borrower should thoroughly analyze the pros and cons before proceeding. The long-term impact of the loan on her financial stability should be a primary consideration.

Non-Emergency Cash Loan Scenario

Non-essential purchases, while tempting, can lead to unforeseen financial consequences. Careful planning and budgeting are essential before considering any loan.

A recent college graduate with limited income opts for a cash loan to purchase a high-end gaming console. This decision may lead to increased debt and missed opportunities to build an emergency fund. The potential consequences include:

- Increased debt burden:

- Missed opportunities to save for future goals (e.g., down payment on a house, retirement):

- Potential for accumulating credit card debt due to inability to make timely loan payments:

- Impact on long-term financial stability:

A comparison with the alternative—saving for the console—demonstrates the long-term benefits of financial discipline.

Effective Cash Loan Management Scenario

Successful loan management involves meticulous planning and responsible financial practices.

A young professional with $40,000 in student loan debt and a monthly income of $5,000 takes out a $2,000 cash loan for a necessary appliance repair. Effective management involves creating a detailed budget and allocating a portion of income for loan repayment.

Key steps for successful repayment include:

- Creating a detailed budget that prioritizes loan repayment:

- Allocating a specific portion of income for loan repayment:

- Developing a repayment schedule to ensure timely payments:

- Avoiding further debt accumulation by prioritizing loan repayment over other non-essential expenses:

By meticulously planning and managing finances, the borrower can effectively repay the loan without jeopardizing other financial obligations.

Debt Cycle Avoidance Scenario

A debt cycle, where individuals borrow to cover previous debts, often leads to severe financial consequences. Proactive steps are necessary to break free from this cycle.

A person with multiple small loans and high-interest credit card debt takes out another loan to cover minimum payments on existing debts. This decision leads to a compounding effect of escalating interest rates and increasing difficulty in managing repayments.

Avoidance strategies include:

- Creating a comprehensive debt repayment plan:

- Prioritizing savings to build an emergency fund:

- Seeking professional financial counseling to develop a personalized strategy for debt management:

- Avoiding unnecessary expenses to reduce debt burden:

By implementing these strategies, the individual can break free from the cycle and regain financial stability.

Financial Emergency Fund Building Scenario

Building an emergency fund is crucial for financial security. Consistent saving, even in small amounts, can provide significant protection against unexpected events.

A recent immigrant with irregular income, initially saving only $50 per month, illustrates the process of building an emergency fund over 3 years.

Effective saving strategies include:

- Setting realistic savings goals and gradually increasing contributions:

- Implementing automatic transfers from checking to savings accounts:

- Identifying and reducing non-essential expenses:

- Monitoring progress and adjusting strategies as needed:

Consistent saving, regardless of income level, is key to building a financial safety net.

Illustrative Case Studies

Cash loans, while offering a quick solution for financial needs, can lead to various outcomes. Understanding the experiences of others can provide valuable insights into the potential benefits and drawbacks of borrowing money. This section explores real-world examples, highlighting both successful and unsuccessful applications of cash loans.

Successful Cash Loan Experiences

These examples illustrate situations where cash loans proved beneficial, enabling borrowers to achieve specific goals. Careful planning and responsible borrowing are key to success.

- Business Startup: A young entrepreneur, facing startup costs, secured a cash loan to purchase essential equipment and stock. The loan allowed them to launch their business, and within six months, the business generated sufficient revenue to repay the loan and surpass initial projections. The entrepreneur’s diligent business plan and strong market analysis were crucial factors in their success.

- Home Repair: A homeowner faced unexpected home repair expenses. A cash loan enabled them to address crucial repairs, such as a leaky roof or plumbing issues. This prevented further damage and maintained the value of their property. The timely repairs avoided future, more significant, and potentially costly issues.

- Medical Expenses: A family faced substantial medical bills for a loved one. A cash loan provided the necessary funds for critical treatments and medications. The family’s meticulous budgeting and commitment to repayment ensured the loan was managed responsibly.

Unsuccessful Cash Loan Experiences

These examples showcase situations where cash loans had negative consequences due to poor planning or an inability to manage repayments.

- Unforeseen Expenses: An individual took out a cash loan to cover unexpected expenses, but the costs quickly escalated. Their inability to manage the additional debt led to accumulating interest charges and further financial strain. The lack of a clear repayment plan and understanding of loan terms played a significant role in the negative outcome.

- Poor Financial Management: A borrower used a cash loan for non-essential purchases, without a solid plan to repay. The inability to manage the additional debt led to missed payments and accumulating interest. The lack of financial discipline and budgeting skills contributed to the negative experience.

- High-Interest Loans: A borrower chose a cash loan with excessively high interest rates. The high interest significantly increased the total cost of borrowing, making it challenging to repay the loan. The lack of comparison shopping for the best loan options contributed to this negative outcome.

Case Study: Sarah’s Experience

Sarah needed a cash loan to cover urgent veterinary expenses for her pet. She carefully researched different loan providers and chose a reputable lender with reasonable terms. She developed a detailed repayment plan, including allocating a portion of her monthly income towards loan repayments. She successfully repaid the loan within the agreed-upon timeframe, demonstrating responsible borrowing practices.

Financial Outcomes

| Case Study | Financial Outcome |

|---|---|

| Business Startup | Successful repayment and business growth |

| Home Repair | Property maintenance and value preservation |

| Medical Expenses | Covered critical treatments and medications |

| Unforeseen Expenses | Accumulating debt and financial strain |

| Poor Financial Management | Missed payments and high interest charges |

| High-Interest Loans | Significant increase in total loan cost |

| Sarah’s Experience | Successful repayment within the agreed-upon timeframe |

Tips for Choosing a Cash Loan

Choosing the right cash loan can significantly impact your financial well-being. Carefully considering various factors and comparing different offers is crucial to avoid potential pitfalls. This section provides practical guidance to help you make informed decisions.

Understanding the specific needs and circumstances surrounding your borrowing request is paramount. Factors such as the loan amount, repayment timeframe, and interest rates should be carefully evaluated before making a commitment.

Factors to Consider When Choosing a Loan Provider

A thorough evaluation of potential loan providers is essential. This includes assessing their reputation, financial stability, and customer service record. Consider their loan terms, interest rates, and associated fees.

- Reputation and Reliability: Research the lender’s history and online reviews. A reputable lender with a strong track record of responsible lending practices is a safer choice.

- Financial Stability: Ensure the lender is financially stable and has a proven ability to meet its obligations. Check for regulatory compliance and licensing.

- Loan Terms and Conditions: Scrutinize the loan terms carefully, including interest rates, repayment schedules, and any associated fees. Understand the implications of prepayment penalties, if applicable.

- Customer Service: Evaluate the lender’s customer service response time and effectiveness. A responsive and helpful customer service team can be invaluable if issues arise.

Comparing Different Loan Offers

Comparing various loan offers effectively is key to obtaining the most favorable terms. A systematic approach can simplify this process.

- Create a Spreadsheet: Compile loan details, including the loan amount, interest rate, fees, repayment period, and total repayment amount into a spreadsheet. This organized approach facilitates comparison.

- Calculate Total Cost: Calculate the total cost of each loan option, considering all fees and interest. This holistic view reveals the true cost of borrowing.

- Compare APRs: The Annual Percentage Rate (APR) is a standardized measure of the cost of borrowing. Compare APRs across different lenders to gain a clearer picture of loan affordability.

- Consider Hidden Fees: Be aware of any hidden fees or charges that might not be immediately apparent. Thorough review is essential to avoid unexpected costs.

Checklist of Questions Before Applying

A pre-application checklist can help ensure you’ve considered all the necessary factors.

- What is the loan amount needed?

- What is the desired repayment timeframe?

- What are the interest rates and associated fees?

- What are the repayment options available?

- What are the prepayment penalties, if any?

- Are there any hidden fees or charges?

- How is the lender regulated and licensed?

Evaluating Potential Loan Options

A structured approach to evaluating potential loan options will facilitate informed decision-making.

- Prioritize your needs: Clearly define your financial requirements and priorities. Focus on the specific loan terms that best suit your needs.

- Compare multiple lenders: Obtain quotes from several lenders to compare various loan offers and choose the most favorable option.

- Review the fine print: Thoroughly review all loan terms and conditions before committing to any loan agreement. Understand the implications of the agreement.

- Seek professional advice: Consult with a financial advisor if needed to ensure you understand the loan terms and implications.

Loan Repayment Strategies

Choosing the right repayment strategy for your cash loan is crucial for managing your finances effectively and avoiding potential difficulties. A well-structured repayment plan can significantly impact your overall borrowing experience. Understanding the various options available and their associated benefits and drawbacks is key to making an informed decision.

Different repayment strategies cater to varying financial situations and preferences. Some prioritize minimizing the overall cost of borrowing, while others focus on reducing the monthly burden. A well-considered plan can help you achieve financial stability and maintain a positive credit history.

Different Repayment Options

Different repayment strategies offer varying advantages and disadvantages. Understanding these distinctions allows you to choose the plan that best suits your needs. Common options include:

- Fixed-Installment Plans: These plans involve equal monthly payments over a predetermined period. This predictable structure simplifies budgeting and helps you manage your cash flow consistently. However, it might not be ideal if your income fluctuates significantly. Fixed-installment plans typically result in higher total interest paid over the life of the loan compared to other plans, as the principal is paid off more slowly.

- Variable-Installment Plans: These plans allow for varying monthly payments. Sometimes, payments can be lower during periods of lower income and higher during times of higher income. This flexibility can be beneficial for individuals with fluctuating incomes. However, it can be more complex to budget with, and the overall interest paid may be higher than fixed installment plans due to the variable nature of payments.

- Accelerated Repayment Plans: These plans involve paying more than the minimum required monthly payment. This strategy can significantly reduce the total interest paid and the overall loan term. The benefit is the quicker payoff of the loan, but it may put a greater strain on your monthly budget.

- Balloon Payment Plans: These plans involve making smaller payments for a specified period, followed by a large final payment (the balloon payment). This can be advantageous if you expect a significant income increase in the future that can cover the balloon payment. However, the large final payment can be a burden if your income doesn’t increase as anticipated. It is critical to consider the financial capability of making the balloon payment.

Impact of Interest Rates

Interest rates directly affect the total repayment amount. A higher interest rate translates to a larger overall cost of borrowing.

Higher interest rates result in a larger proportion of your payments going towards interest, leaving less of your payment to reduce the principal balance.

For instance, a $10,000 loan with a 10% interest rate will have a different repayment structure than the same loan with a 5% interest rate. The higher interest rate will lead to higher monthly payments and a greater total amount paid over the loan term. Borrowers should compare interest rates from different lenders before making a decision.

Comparing Repayment Plans

The following table provides a comparison of different repayment plans, highlighting key aspects:

| Repayment Plan | Description | Benefits | Drawbacks |

|---|---|---|---|

| Fixed-Installment | Equal monthly payments | Predictable budgeting, consistent cash flow | Potentially higher total interest paid |

| Variable-Installment | Variable monthly payments | Flexibility for fluctuating income | More complex budgeting, potentially higher total interest |

| Accelerated Repayment | Payments exceeding minimum | Reduced total interest, shorter loan term | Increased monthly burden |

| Balloon Payment | Smaller payments followed by a large final payment | Potentially lower monthly payments initially | Significant risk if the anticipated income increase does not materialize |

Avoiding Late Payments

Late payments can damage your credit score and lead to penalties or fees. To avoid late payments, consider the following strategies:

- Set up reminders: Utilize calendars, reminders on your phone, or online tools to ensure timely payments.

- Budget effectively: Allocate sufficient funds for loan payments in your monthly budget.

- Track your payments: Regularly monitor your account activity to ensure accurate payment records.

- Contact the lender promptly: If you anticipate difficulty making a payment, contact your lender immediately to discuss potential solutions, such as a payment plan.

Impact of Cash Loans on Personal Finance

Cash loans can significantly impact personal finances, offering both potential benefits and drawbacks. Understanding these impacts is crucial for making informed decisions and ensuring responsible borrowing practices. The impact varies greatly depending on individual circumstances, including loan amount, term, interest rate, purpose, existing debt, and income.

Overview of Cash Loans and Impact on Personal Finances

Cash loans can be a valuable tool for addressing short-term financial needs, but they can also lead to long-term financial difficulties if not managed carefully. Analyzing the potential positive and negative impacts requires a nuanced approach, moving beyond simplistic assessments. For instance, a $500 loan, taken out for a necessary appliance repair, might temporarily ease financial strain but could increase overall debt if not repaid promptly. Conversely, a well-managed loan used for a down payment on a home, while increasing debt, could potentially yield significant long-term financial gains through property appreciation.

Impact on Credit Scores

Cash loans affect credit scores through various mechanisms, primarily by influencing loan applications, payment history, and credit utilization. A new loan application, even if approved, can temporarily lower a credit score. The impact is more pronounced with a larger loan amount, higher interest rate, or a shorter loan term. Consistently making timely payments on a cash loan, however, is crucial for maintaining a healthy credit score. Conversely, failing to make timely payments can significantly damage a credit score. For example, a small, well-managed loan, with regular and timely payments, will likely have a positive impact on the credit score. In contrast, a large loan with a high-interest rate and missed payments will severely damage the credit score. Furthermore, the utilization of available credit can be impacted by taking out a cash loan. The higher the proportion of available credit that is used, the lower the credit score.

Impact on Long-Term Financial Goals

Cash loans can either support or hinder long-term financial goals. For example, a loan for educational expenses can potentially lead to increased earning potential and a higher income, which can support long-term savings. Conversely, a loan for an extravagant purchase may not generate similar returns, potentially hindering savings for a down payment or retirement. Consider a loan for a down payment on a house. While the loan might help acquire the property, it can also increase monthly expenses and potentially reduce the amount available for other savings goals.

Strategies to Mitigate Negative Effects

Effectively managing cash loans requires proactive strategies. Pre-approval for a loan can help borrowers understand the interest rates and terms available. A well-defined budget that includes loan repayments is essential for effective management. Making extra payments whenever possible can significantly reduce interest costs and the overall loan term.

| Strategy | Description | Example | Potential Benefit | Potential Drawback |

|---|---|---|---|---|

| Pre-Approval | Getting pre-approved for a loan before needing it | Pre-qualifying for a personal loan | Allows you to understand interest rates and terms | Might affect credit score briefly |

| Budgeting | Creating a detailed budget that incorporates loan payments | Tracking income and expenses, and allocating funds for loan repayments | Helps you understand your financial situation and plan repayments effectively | Requires discipline and may feel restrictive |

| Paying Early | Paying more than the minimum payment whenever possible | Paying $100 extra on a $500 loan each month | Shortens the loan term, reduces interest costs | Requires conscious effort and discipline |

Maintaining a Healthy Financial Relationship with Cash Loans

A healthy financial relationship with cash loans hinges on responsible borrowing and repayment. Understanding the interest rate, loan terms, and repayment schedule is essential. It’s crucial to avoid high-interest loans and predatory lending practices. Borrow only what is needed and ensure the ability to repay the loan on time.

Glossary of Terms Related to Cash Loans

Understanding the language of cash loans is crucial for making informed decisions. This glossary provides clear definitions and examples to help you navigate the process. Familiarizing yourself with these terms will empower you to ask the right questions and ensure you understand the implications of your loan options.

Key Loan Terms

This section defines fundamental terms used in the context of cash loans.

| Term | Definition (Simple Explanation) | Example Usage in a Cash Loan Scenario |

|---|---|---|

| Loan Amount | The total sum of money borrowed. | “The loan amount was $5,000.” |

| Interest Rate | The percentage cost of borrowing money. This can be a fixed rate or a variable rate. | “The interest rate on the loan is 12% per year.” |

| APR (Annual Percentage Rate) | The total cost of borrowing, including interest and fees, expressed as an annual rate. This is a crucial figure for comparing loan options. | “The APR for this loan is 15.99%.” |

| Loan Term | The length of time the borrower has to repay the loan. This is typically expressed in months or years. | “The loan term is 36 months.” |

| Monthly Payment | The amount the borrower pays each month to repay the loan, including principal and interest. | “Your monthly payment is $175.” |

| Origination Fee | A fee charged for processing the loan application. This fee is often a percentage of the loan amount or a flat fee. | “There’s a $100 origination fee.” |

| Late Fee | A fee charged if a payment is made after the due date. | “A late fee of $25 will apply.” |

| Prepayment Penalty | A fee charged if the loan is paid off early. This is not always present. | “There’s a prepayment penalty of 1% of the remaining balance.” |

| Credit Score | A numerical representation of a borrower’s creditworthiness, based on their payment history. A higher score usually means better loan terms. | “A good credit score is crucial for getting a loan with favorable terms.” |

| Co-signer | An individual who agrees to repay the loan if the primary borrower defaults. This can improve a borrower’s chances of loan approval. | “I need a co-signer to qualify for this loan.” |

| Collateral | An asset pledged as security for the loan. This provides a backup for the lender in case the borrower defaults. | “A house can be used as collateral for a mortgage.” |

| Default | Failure to make required payments on a loan. This can have serious consequences for the borrower’s credit history and financial standing. | “Defaulting on the loan will result in negative consequences.” |

| Loan Repayment Schedule | A detailed breakdown of the loan’s payments, including dates and amounts. This schedule helps the borrower plan their budget. | “Review your repayment schedule for accuracy.” |

Conclusive Thoughts

In conclusion, cash loans can be a helpful tool for managing short-term financial needs, but careful consideration of the associated risks and benefits is crucial. Understanding the factors that influence loan decisions, comparing various providers, and prioritizing responsible borrowing practices are vital steps for borrowers. This guide equips you with the knowledge to make informed choices and navigate the world of cash loans effectively.