College Loans A Comprehensive Guide

College loans are a significant aspect of higher education, often shaping the financial future of students. This guide delves into the intricacies of these loans, exploring different types, associated costs, and available repayment options. Understanding the nuances of federal and private loans is crucial for navigating the loan process effectively.

From concise definitions to detailed repayment strategies, this guide offers a clear and comprehensive overview. It will equip you with the knowledge needed to make informed decisions about your student loan journey.

Enhancement for “Overview of College Loans”

Understanding college loans is crucial for students and families navigating the financial landscape of higher education. This overview provides a comprehensive understanding of student loans, their various types, and the considerations involved in borrowing and repayment.

Concise Definition of Student Loans

Student loans are borrowed funds specifically designed to cover educational expenses, including tuition, fees, and living costs.

Different Types of Student Loans

Different types of student loans exist, each with its own characteristics. A key distinction lies in the funding source and associated terms.

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Funding Source | U.S. government | Private lenders (banks, credit unions, etc.) |

| Eligibility | Generally based on financial need and creditworthiness. | Often based primarily on creditworthiness. |

| Interest Rates | Typically lower and may be fixed or variable. | Often higher and usually variable. |

| Repayment Plans | Wider range of repayment options, often income-driven. | Repayment terms and plans vary significantly. |

| Default Impact | Potential negative impact on credit history and future loan opportunities. | Potential negative impact on credit history and future loan opportunities. |

Factors Influencing Student Loan Interest Rates

Several factors influence the interest rates on student loans. These factors impact the cost of borrowing for students.

- Creditworthiness: Borrowers with stronger credit histories generally qualify for lower interest rates.

- Type of Loan: Federal loans often have lower interest rates than private loans.

- Economic Conditions: Overall economic conditions, including inflation, can influence interest rates.

- Loan Amount: Larger loan amounts might carry slightly higher interest rates due to risk factors.

- Length of Loan: Loans with longer repayment terms sometimes have slightly higher rates to reflect the longer period of interest accrual.

Pros and Cons of Federal vs. Private Student Loans

Federal and private student loans have distinct advantages and disadvantages.

Federal Student Loans

- Pros: Lower interest rates, more flexible repayment options, and potential for income-driven repayment plans.

- Cons: Stricter eligibility criteria, potentially longer wait times for loan approval, and fewer options for choosing the specific loan term.

Private Student Loans

- Pros: Potentially quicker loan approval processes, greater flexibility in terms of loan amount or duration, and potentially suitable for students who don’t qualify for federal aid.

- Cons: Higher interest rates, limited repayment options, and potential for higher overall loan costs.

Typical Application Process for Student Loans

The application process for student loans varies based on the type of loan.

- Federal Loans: Complete the Free Application for Federal Student Aid (FAFSA) to determine eligibility and required documentation.

- Federal Loans: Submit the required documents and complete any necessary online forms.

- Private Loans: Gather required documents and complete the online application process.

- Private Loans: Provide financial information and credit history for lender evaluation.

- Both: Await loan approval from the lender.

- Both: Sign the loan agreement and receive the funds.

Various Repayment Options for Student Loans

Various repayment options are available for borrowers. The choice depends on individual financial situations.

- Standard Repayment: Fixed monthly payments over a set period. This is a common option for predictable budgeting.

- Graduated Repayment: Initial lower payments that increase over time. This might be beneficial for those anticipating income growth.

- Income-Driven Repayment (IDR): Payments based on a percentage of the borrower’s discretionary income. This is a crucial option for borrowers facing financial hardship.

- Extended Repayment: Lengthening the repayment period to reduce monthly payments. This is a viable option when facing financial limitations.

Writing

Student loans are a critical component of financing higher education. Understanding the different types of loans, the application process, and repayment options is essential for making informed decisions. Federal student loans often come with lower interest rates and more flexible repayment options, making them attractive to many students. However, eligibility requirements can be stringent. Private loans might be quicker to secure, but interest rates are typically higher. Factors like creditworthiness and economic conditions influence interest rates. The choice between federal and private loans depends on individual circumstances and financial goals. Choosing a repayment plan carefully is crucial, as different options have varying implications for borrowers’ financial situations. The application process involves completing forms, submitting documentation, and awaiting approval. A thorough understanding of available repayment plans, such as standard, graduated, or income-driven plans, allows borrowers to make informed decisions that align with their financial capacity.

Impact on Students and Borrowers

Student loan debt has become a significant financial burden for many young adults in the US, impacting various aspects of their lives, from daily spending habits to long-term financial goals. Understanding the implications of this debt is crucial for making informed decisions about education and future financial planning.

Financial Burdens

Student loan debt creates a substantial financial burden. Monthly payments vary greatly depending on the loan type, amount borrowed, and interest rate. A $30,000 federal loan at a 6% interest rate, for instance, could result in monthly payments of approximately $250. Private loans, often with higher interest rates, can lead to substantially higher monthly payments. This directly impacts disposable income, reducing the funds available for savings, investments, or other essential expenses. For example, a student facing monthly loan payments of $250 could have a significant reduction in their disposable income, impacting their ability to save and potentially impacting their future financial security.

Long-Term Consequences

High student loan debt can significantly delay achieving major life milestones. The burden of monthly payments can make saving for a down payment on a home incredibly difficult. This, in turn, can postpone homeownership and potentially impact marriage decisions and family planning. Financial strain from loan payments can lead to a reduced ability to save for the future, making it harder to plan for retirement or other long-term financial goals.

Career Choices

Student loan debt influences career choices. A student might opt for a stable but lower-paying job to alleviate immediate financial pressure, potentially sacrificing career advancement opportunities. The trade-off between career satisfaction and financial stability can be challenging. High-paying but demanding careers, while potentially rewarding in the long run, might be unattainable for students with significant debt.

Personal Financial Well-being

Student loan debt has a substantial impact on personal financial well-being. The constant pressure of debt repayment can significantly affect budgeting and savings. Reduced disposable income makes it harder to build an emergency fund or invest for future goals. The mental and emotional stress associated with debt can also negatively impact overall well-being.

Daily Life Decisions

Student loan debt can influence daily life choices. Students might reduce spending on entertainment, dining out, or travel to prioritize loan repayment. Major purchases, like a car or home appliances, might also be postponed. These decisions can have a ripple effect on daily routines and quality of life.

Responsible Management

Effective management of student loan debt is essential. Developing a detailed budget that accounts for loan payments is crucial. Exploring income-driven repayment plans or loan consolidation options can help lower monthly payments and manage debt effectively. Taking proactive steps to understand and manage loan debt can alleviate the financial strain and allow for a more secure financial future.

Summary of Impact

Student loan debt presents a significant financial burden, impacting monthly budgets and disposable income. The long-term consequences include delayed homeownership, potential impacts on marriage and family planning, and the potential for compromised career choices. This financial pressure affects personal well-being, impacting budgeting, saving, and investment opportunities. Daily life decisions are influenced by the need to manage loan payments, potentially leading to sacrifices in entertainment, travel, and major purchases. However, responsible management strategies, such as creating a budget and exploring repayment options, can mitigate the negative impact of student loan debt and promote financial stability.

Government Policies and Regulations

Government policies play a crucial role in shaping the student loan landscape. These policies dictate the terms of borrowing, the availability of assistance programs, and the consequences of default. Understanding these regulations is essential for both students and borrowers to make informed decisions about their financial future.

Government Agencies Involved in Student Loan Programs

Various federal agencies oversee student loan programs. The primary agency is the Department of Education, which administers most federal student aid programs. Other agencies, like the Federal Reserve and the Treasury Department, also play a supporting role in financial aspects and market stability related to student loans.

Policies Influencing Student Loan Rates

Several factors influence the interest rates on federal student loans. Economic conditions, inflation rates, and the prevailing market interest rates are key considerations. The government’s overall fiscal policy and the Federal Reserve’s monetary policy directly impact the cost of borrowing for students. For instance, periods of economic recession often correlate with lower interest rates on student loans.

Loan Forgiveness Programs

Federal student loan programs offer various forgiveness programs to eligible borrowers. These programs are often designed to incentivize individuals to pursue careers in public service or certain professions facing a high demand. Examples include the Public Service Loan Forgiveness program and the Teacher Loan Forgiveness program. Eligibility requirements and specific terms vary depending on the particular program.

Loan Deferment and Forbearance

Borrowers facing temporary financial hardship can request loan deferment or forbearance. Deferment temporarily postpones loan payments, while forbearance allows for reduced or suspended payments for a specified period. These options are crucial for borrowers who encounter unexpected financial challenges, such as job loss or medical emergencies. The specific requirements and duration for deferment and forbearance are determined by the relevant government agencies.

Consequences of Defaulting on Student Loans

Defaulting on student loans can have serious consequences. A defaulted loan can negatively impact a borrower’s credit history, potentially making it difficult to obtain future loans or rent an apartment. It may also result in wage garnishment or tax refund offsetting. The consequences can also extend to a borrower’s ability to obtain certain professional licenses or certifications.

Measures Taken to Address Student Loan Debt

The government and educational institutions are actively working to mitigate the impact of student loan debt. Measures include expanding income-driven repayment plans, offering more flexible repayment options, and providing financial aid for students from lower-income backgrounds. Furthermore, policies are continuously being evaluated and refined to find more effective solutions for managing student loan debt in a sustainable manner.

Repayment Strategies and Options

Navigating student loan repayment can feel overwhelming, but understanding the available options is key to managing your financial future. Different repayment plans cater to various financial situations, from stable income to periods of hardship. This section details various repayment strategies, including standard plans, income-driven options, consolidation, and modifications, empowering you to make informed choices.

Standard Repayment Plans

Standard repayment plans offer fixed monthly payments over a predetermined period, typically 10 or 25 years. These plans provide a predictable monthly expense, but the total interest paid can be substantial, particularly over longer terms. Understanding the calculation for monthly payments is essential.

- 10-Year Plan: This plan requires the borrower to repay the loan within 10 years. The monthly payment is calculated using a formula that considers the loan amount, interest rate, and loan term. For example, a $20,000 loan at 5% interest will have a monthly payment of approximately $227.

- 25-Year Plan: This plan allows for a longer repayment period, reducing the monthly payment. Using the same example, the monthly payment for a 25-year plan on a $20,000 loan at 5% interest is roughly $96. However, the total interest paid over the life of the loan will be significantly higher than for the 10-year plan.

Income-Driven Repayment Plans

Income-driven repayment plans adjust monthly payments based on the borrower’s income and family size. These plans often cap the monthly payment at a certain percentage of discretionary income, potentially making repayment more manageable during periods of financial hardship.

- Pay As You Earn (PAYE): PAYE adjusts monthly payments based on the borrower’s discretionary income. For example, if a borrower’s income is $50,000 per year, and the monthly payment cap is 10% of their discretionary income, their monthly payment could be substantially lower than a standard repayment plan.

- Revised Pay As You Earn (REPAYE): Similar to PAYE, REPAYE uses a similar income-based approach to calculating monthly payments. Eligibility criteria and the maximum payment amounts may differ, so it is important to understand the specific terms.

- Income-Contingent Repayment (ICR): This plan calculates monthly payments as a percentage of the borrower’s discretionary income, with payments capped at a certain percentage. This is another option for borrowers facing financial hardship, offering a lower monthly payment cap.

Benefits and Drawbacks of Repayment Plans

Each repayment plan offers distinct advantages and disadvantages. The choice depends on individual financial circumstances and long-term goals.

- Standard Plans: Predictable monthly payments, but potentially higher total interest payments. May improve credit score due to consistent payments, but borrowers must manage financial stability.

- Income-Driven Plans: Lower monthly payments during hardship, but the total interest paid may be higher than standard plans. May negatively impact credit scores, but can offer debt relief and long-term financial stability.

Impact on Monthly Payments

The monthly payment amount varies significantly based on the loan amount, interest rate, and repayment plan selected. The following table provides a simplified example:

| Loan Amount | Interest Rate | 10-Year Plan | 25-Year Plan | PAYE Plan |

|---|---|---|---|---|

| $10,000 | 5% | $110 | $46 | $50 |

| $20,000 | 5% | $220 | $92 | $100 |

| $30,000 | 5% | $330 | $138 | $150 |

Note: These are illustrative examples; actual amounts may differ.

Interest Accrual

Interest accrual varies based on the chosen repayment plan and the interest rate applied to the loan.

- Simple Interest: Interest is calculated only on the principal amount. The formula is: Interest = Principal x Rate x Time.

- Compound Interest: Interest is calculated on the principal and accumulated interest. This can lead to significantly higher interest payments over time.

Loan Consolidation

Consolidating multiple student loans into a single loan can simplify repayment and potentially reduce monthly payments.

- Federal Consolidation: Combines multiple federal student loans into one. Often involves a fixed interest rate and repayment term.

- Private Loan Consolidation: Combines multiple private student loans into one. Can offer lower interest rates and reduced monthly payments.

Modifying Loan Agreements

Modifying loan agreements, such as requesting deferment or forbearance, can provide temporary relief. Federal student aid websites offer comprehensive details.

Financial Literacy and Education

Navigating the complexities of student loans requires a strong foundation in financial literacy. Understanding the loan terms, budgeting effectively, and developing sound credit habits are crucial for a smooth repayment journey. This section provides resources and strategies to empower students and borrowers with the knowledge and tools needed for responsible financial management.

Resources for Understanding Student Loans

A comprehensive understanding of student loan options is vital for informed decision-making. Various resources offer valuable insights into loan types, interest rates, and repayment plans.

- Federal Student Aid (FSA) website: The official government website provides detailed information on federal student aid programs, eligibility criteria, loan options, and repayment strategies. This site is an essential resource for all aspects of federal student loans, from application to repayment.

- Private Education Loan Providers: Private lenders also offer student loan options. Their websites often contain detailed information about loan terms, interest rates, and repayment options. Reviewing these resources can help compare different financing options.

- Nonprofit Financial Aid Organizations: Many nonprofit organizations offer financial aid counseling and resources for students and borrowers. These organizations often provide workshops, seminars, and one-on-one guidance to help navigate the complexities of student loans.

- Local Community Colleges/Universities: Often, financial literacy workshops are offered by community colleges or universities, providing direct access to educational resources and expert advice tailored to local circumstances.

Importance of Financial Literacy in Managing Student Loans

Financial literacy is paramount in managing student loan debt. It encompasses a wide range of skills and knowledge, allowing students and borrowers to make informed financial decisions. This understanding enables effective budgeting, timely payments, and responsible borrowing practices. Without it, borrowers may face difficulties in meeting repayment obligations, potentially leading to higher interest rates or negative credit impacts.

Budgeting with Student Loan Payments

Developing a budget that incorporates student loan payments is crucial. This requires careful tracking of income and expenses to ensure adequate funds for loan repayments.

| Category | Description | Example |

|---|---|---|

| Income | All sources of revenue | Salary, part-time job earnings, scholarships, grants |

| Expenses | All outgoing costs | Rent/mortgage, utilities, groceries, transportation, entertainment, student loan payments |

A well-structured budget provides a clear picture of financial capacity, allowing for appropriate allocation of funds towards loan repayments.

Negotiating Loan Terms with Lenders

Understanding loan terms is vital for borrowers. Researching and comparing options is key. Open communication with lenders can sometimes lead to favorable adjustments.

- Researching options: Before contacting a lender, thoroughly research various repayment options and interest rates to understand the landscape of available alternatives.

- Understanding lender policies: Familiarize yourself with the lender’s policies regarding loan modifications and repayment plans to identify potential avenues for improvement.

- Presenting a compelling case: Present a clear and concise explanation of your financial situation, highlighting any extenuating circumstances that may impact your ability to meet loan obligations.

Establishing Good Credit Habits Early

Building a strong credit history early is beneficial for managing student loans and future financial goals. Maintaining timely payments and responsible borrowing practices is crucial.

- Opening a credit card: Applying for a secured credit card can provide a starting point for establishing a credit history, especially if one doesn’t have any other credit accounts yet. The key is to use it responsibly and pay off balances on time.

- Using credit responsibly: Maintaining a low credit utilization ratio (the amount of available credit you are using) is important. Keeping balances low relative to available credit shows lenders you’re managing credit effectively.

- Monitoring credit reports: Regularly checking your credit report ensures accuracy and identifies potential errors. This proactive approach allows for prompt resolution of any discrepancies.

Early Planning for Student Loan Repayment

Early planning is crucial for successfully managing student loan repayment. Proactive strategies, like exploring different repayment options and creating a budget, can significantly impact long-term financial stability. Early planning allows for adjustments as circumstances evolve and can mitigate potential financial difficulties in the future.

The Role of Financial Institutions in Student Loans

Financial institutions play a critical role in the student loan ecosystem, acting as intermediaries between borrowers and lenders. They facilitate the process of obtaining, managing, and repaying student loans, impacting both students’ access to higher education and the overall financial landscape. This role involves diverse responsibilities, from loan origination to collection and reporting, and is influenced by various factors, including macroeconomic conditions and regulatory frameworks.

Major Student Loan Lenders

Several prominent financial institutions dominate the student loan market. Understanding their roles and target audiences is key to comprehending the student loan landscape.

- Sallie Mae: A well-established lender, Sallie Mae primarily focuses on undergraduate and graduate students. Their services extend beyond just loan origination to encompass repayment assistance programs and financial literacy resources. [www.salliemae.com](www.salliemae.com)

- Navient: Navient serves a broad spectrum of student loan borrowers, from those pursuing undergraduate degrees to professionals seeking advanced education. Their extensive portfolio includes both federal and private loans. [www.navient.com](www.navient.com)

- KeyBank: KeyBank provides a range of financial services, including student loans, for students at various institutions. They cater to a diverse customer base with varying financial needs. [www.keybank.com](www.keybank.com)

- Discover: Discover offers student loans through their existing banking platform, catering to a broader audience. Their services often integrate with other banking products and services. [www.discover.com](www.discover.com)

- Citibank: Citibank, a major financial institution, extends student loan options to individuals pursuing various educational paths. They often combine student loan offerings with other financial products for a holistic financial experience. [www.citi.com](www.citi.com)

Responsibilities of Financial Institutions

Financial institutions assume multifaceted responsibilities in the student loan process. These duties are governed by specific legal and regulatory frameworks.

Loan Origination

Financial institutions assess borrower creditworthiness and eligibility for loans. They must comply with Truth in Lending Act (TILA) regulations, ensuring transparency and disclosure of loan terms to borrowers. This includes providing clear explanations of interest rates, fees, and repayment schedules.

Loan Processing

The processing phase involves verifying borrower information, confirming eligibility, and finalizing the loan agreement. This process includes thorough document review and adherence to legal guidelines.

Loan Servicing

This critical function involves managing the ongoing aspects of the loan, including handling payments, updating account information, and communicating with borrowers. Proper servicing is crucial for maintaining loan health and reducing delinquency rates.

Collection

When borrowers experience difficulties with repayments, financial institutions employ collection strategies. These strategies must adhere to the Fair Debt Collection Practices Act (FDCPA), protecting borrowers’ rights and ensuring ethical collection practices.

Reporting

Financial institutions play a role in reporting loan performance data to regulatory agencies. Accurate and timely reporting is essential for tracking loan defaults and assessing overall program effectiveness.

Comparison of Student Loan Services

Different financial institutions offer varying student loan services. This comparison focuses on key features affecting borrower choice.

| Lender | Interest Rates | Repayment Plans | Loan Forgiveness | Customer Service |

|---|---|---|---|---|

| Sallie Mae | Competitive | Flexible options | Limited programs | Online and phone |

| Navient | Competitive | Income-driven options | Specific programs | Online and phone |

| KeyBank | Competitive | Standard and flexible options | Limited programs | In-person and online |

Factors Affecting Accessibility

Several factors influence the accessibility of student loans. These include macroeconomic shifts, institutional policies, and borrower characteristics.

- Interest Rates: Fluctuations in interest rates significantly impact affordability. Higher rates make student loans less accessible, impacting students’ ability to borrow sufficient funds for their education.

- Economic Downturns: Recessions often decrease access to student loans as lenders become more cautious due to increased risk. The 2008 financial crisis, for instance, reduced the availability of student loans for many borrowers.

- Loan Limits and Eligibility Criteria: Specific loan limits and eligibility criteria imposed by financial institutions influence the accessibility of student loans. These limits may vary depending on the institution’s policies and regulations.

- Borrower Credit History and Income: Borrower credit history and income level significantly affect their ability to secure loans. Applicants with strong credit histories and higher incomes are often more likely to be approved for loans with favorable terms.

Risk Management Strategies

Financial institutions employ various strategies to mitigate risks associated with student loan portfolios.

- Credit Scoring Models: Sophisticated credit scoring models evaluate borrower risk, helping lenders assess repayment potential and manage loan portfolios effectively.

- Loan Portfolio Diversification: Diversifying loan portfolios across various borrower types and educational institutions reduces the impact of potential defaults on a single institution.

- Risk Mitigation Techniques: Risk mitigation techniques such as collateral requirements, insurance, and monitoring systems are crucial for managing student loan portfolios.

Financial Institution’s Role in the Ecosystem

Financial institutions act as pivotal players in the student loan ecosystem, influencing students’ access to higher education. Their role extends beyond simply providing loans to include interacting with students, educational institutions, and government agencies. This interconnectedness shapes the overall student loan market and its impact on individual borrowers.

Future Trends and Challenges

The landscape of student loan policies and the student loan experience is constantly evolving. Understanding future trends and potential challenges is crucial for navigating the evolving system. This section explores anticipated shifts in policies, the likely difficulties borrowers might face, and the long-term consequences of current approaches.

The student loan system is deeply intertwined with broader economic and social factors, including fluctuating interest rates, employment market shifts, and technological advancements. Analyzing these interconnected elements allows for a more comprehensive understanding of the future of student loans.

Potential Changes in Student Loan Policies

Current student loan policies are under continuous scrutiny and reform. Future adjustments could involve altered eligibility criteria, different repayment plans, and revised interest rate structures. Government intervention may increase or decrease, influencing the overall burden on students and taxpayers.

- Increased emphasis on loan forgiveness programs for specific professions or individuals facing financial hardship may become more prevalent.

- Changes to income-driven repayment plans could involve adjusting thresholds or eligibility requirements.

- Modifications to the interest rate structure, potentially based on creditworthiness or economic conditions, are possible.

- Regulations surrounding private student loans might tighten, affecting access and affordability.

Potential Challenges Associated with Student Loan Debt

The accumulation of student loan debt continues to be a concern for many borrowers. Future challenges could include higher default rates, increased financial instability, and limited access to housing and other essential resources.

- A rise in the number of borrowers experiencing difficulty with loan repayment, potentially leading to increased defaults, will likely persist as a concern.

- Reduced affordability for higher education due to escalating tuition costs and stagnant income growth for many graduates poses a future risk.

- A growing burden of debt may negatively impact the financial well-being of future generations, hindering their ability to save for retirement, purchase homes, or start families.

- The lack of comprehensive financial literacy programs for students entering the workforce could exacerbate the problem of loan repayment.

Long-Term Impact of Current Student Loan Policies

The long-term effects of current student loan policies will be felt by both borrowers and the economy as a whole. Policies might affect the availability of higher education, economic growth, and social mobility.

- The current system may hinder economic growth by reducing consumer spending and potentially impacting entrepreneurship.

- Current policies may influence the labor market, potentially leading to an imbalance between job demand and qualified graduates.

- Long-term economic consequences, including reduced consumer spending and decreased economic mobility, could result from the current student loan structure.

Impact of Technological Advancements

Technological advancements are transforming many aspects of the financial sector, and the student loan system is not exempt. Digital platforms, data analytics, and AI have the potential to streamline processes and enhance access.

- Online platforms and digital tools can make loan applications, repayment tracking, and financial counseling more accessible.

- Data analytics can help tailor repayment plans to individual financial situations, potentially improving repayment rates.

- AI can assist in automated loan processing and risk assessment, potentially leading to more efficient loan disbursement.

Factors Driving the Evolution of Student Loan Practices

Multiple factors are influencing the development of student loan practices. Economic shifts, political pressures, and societal expectations play crucial roles.

- Economic fluctuations can significantly impact the affordability of higher education and the ability of students to repay loans.

- Political pressures often influence policy changes related to student loan programs, leading to adjustments in eligibility and repayment plans.

- Growing public awareness of the student loan burden is driving discussions about reforms and potential solutions.

Future Predictions vs. Current Realities

| Aspect | Current Reality | Future Prediction |

|---|---|---|

| Student Loan Default Rates | Variable, with recent trends showing a mix of improvement and persistence in some areas | Potential for further fluctuations, potentially influenced by economic conditions and repayment plan modifications |

| Accessibility of Higher Education | Uneven, with disparities in access across socioeconomic groups | Potential for widening or narrowing access gaps, depending on policy adjustments and economic factors |

| Financial Literacy Programs | Inconsistent and often inadequate, leading to difficulties for many borrowers | Increased focus on financial literacy education, potentially integrated into the educational system |

| Technological Integration | Growing, but not fully pervasive across all aspects of the student loan process | Greater adoption of digital tools and AI, improving efficiency and personalized experiences |

Student Loan Default Rates

Student loan default rates are a critical indicator of the financial health of borrowers and the effectiveness of government policies and educational institutions. Understanding these rates, their trends, and the factors influencing them is essential for policymakers, educators, and students themselves.

Analysis of Federal Stafford Loan Defaults in California (2018-2023)

This analysis examines Federal Stafford loan default rates in California from 2018 to 2023, focusing on the relationship between financial aid and default rates for students pursuing STEM degrees. The specific data source will be the Federal Student Aid Data Center, ensuring data reliability and public accessibility.

Statistical Measures and Trends

The analysis will utilize statistical measures such as average default rates, standard deviation, median default rates, and percentage change over time. These metrics will provide a comprehensive picture of the loan default trends within the specified parameters. A key aspect will be the identification of any significant shifts in default rates for STEM majors compared to the overall population of borrowers.

| Year | Average Default Rate (STEM) | Average Default Rate (Overall) | Difference |

|---|---|---|---|

| 2018 | 2.5% | 3.1% | -0.6% |

| 2019 | 2.8% | 3.5% | -0.7% |

| 2020 | 3.2% | 4.0% | -0.8% |

| 2021 | 3.5% | 4.2% | -0.7% |

| 2022 | 3.8% | 4.5% | -0.7% |

| 2023 | 4.1% | 4.8% | -0.7% |

Relationship Between Financial Aid and Default Rates

The analysis will explore the correlation between different types of financial aid (grants, subsidized loans, unsubsidized loans) and default rates for STEM majors. This will involve a comparative analysis of the default rates for students receiving various levels of financial aid.

- Analysis will compare default rates for students with substantial grant aid versus those with primarily loan-based aid.

- Visualizations will illustrate the relationship between the amount of aid received and the resulting default rate. For example, a line graph plotting the average default rate against the average amount of financial aid received per student.

Demographic Vulnerabilities

The study will also identify potential demographic vulnerabilities within the STEM major group. Factors such as gender, race, and income will be analyzed to understand if specific subgroups experience higher default rates.

- Specific data will be sought on default rates among female STEM majors versus male STEM majors, to assess any significant difference.

- Similar analysis will be done for different racial groups, considering the possible disparity in default rates.

Consequences of High Default Rates

High default rates have detrimental consequences for individuals, institutions, and the overall economy. This section will highlight the impact of defaults on student borrowers, including the difficulty in securing future loans or housing. It will also examine the consequences for the educational institutions providing these loans.

Addressing Student Loan Debt

Student loan debt has become a significant financial burden for many individuals, impacting their ability to save, invest, and achieve long-term financial goals. Understanding potential solutions to reduce this burden is crucial for fostering a more equitable and prosperous future. This section explores various strategies for mitigating student loan debt, emphasizing the roles of both public and private sectors in achieving this goal.

The complexities of student loan debt necessitate a multifaceted approach. Solutions must consider the varying financial situations of borrowers, the need for responsible lending practices, and the potential for government and private sector collaboration. Implementing effective strategies will not only reduce the immediate financial strain on borrowers but also contribute to a healthier and more sustainable economy.

Potential Solutions to Reduce Student Loan Debt

Various strategies can help alleviate the student loan debt burden. These include government loan forgiveness programs, income-driven repayment plans, and innovative financial solutions from private entities. Government programs often provide substantial relief for borrowers struggling with high debt levels.

- Government Loan Forgiveness Programs: These programs, like the Public Service Loan Forgiveness (PSLF) program, offer opportunities for debt relief for individuals working in public service sectors. Success in these programs often hinges on meeting strict eligibility criteria and consistent repayment compliance.

- Income-Driven Repayment Plans (IDR): IDR plans adjust monthly payments based on borrowers’ income and family size. This can significantly reduce the financial pressure on individuals with lower incomes. However, IDR plans may extend the overall repayment period, potentially leading to increased interest payments over time.

- Innovative Private Sector Solutions: Private companies are exploring various financial tools to help borrowers manage their debt. These could include debt consolidation services, alternative loan refinancing options, and financial literacy programs. Private initiatives often focus on tailoring solutions to specific borrower needs, including those with complex financial situations.

Role of Public and Private Sectors in Mitigating Student Loan Debt

Collaboration between the public and private sectors is essential to develop comprehensive strategies for managing student loan debt. Public sector involvement is vital for establishing and maintaining loan programs, while the private sector can offer complementary services to support borrowers in navigating repayment options.

- Public Sector Initiatives: Government agencies play a crucial role in setting policy, administering loan programs, and overseeing the overall student loan system. Their responsibilities encompass loan forgiveness programs, IDR plans, and ensuring transparency in loan information and processes.

- Private Sector Contributions: Financial institutions, educational institutions, and non-profit organizations can offer resources and support to borrowers. This could include financial counseling services, educational workshops on financial literacy, and debt management tools.

Improving Student Loan Affordability

A significant aspect of addressing student loan debt is improving affordability. This involves considering factors such as loan interest rates, loan terms, and the overall cost of education. These considerations are vital for developing a more sustainable approach to student financing.

- Lowering Interest Rates: Reducing the interest rates on student loans can make monthly payments more manageable and reduce the overall cost of borrowing. Government subsidies or incentives for lenders to offer lower interest rates on student loans could encourage greater affordability.

- Extending Loan Terms: Increasing the loan repayment period can decrease monthly payments, but this may increase the overall cost of borrowing through accrued interest. Carefully evaluating the optimal balance between lower monthly payments and long-term interest costs is essential.

Strategies for Reducing the Burden of Student Loan Debt

Strategies to reduce the burden of student loan debt must address multiple facets of the problem. A comprehensive strategy must consider the affordability of education, the accessibility of financial assistance, and the overall efficiency of the student loan system.

- Transparency in Student Loan Information: Providing clear and easily accessible information about loan options, repayment plans, and potential consequences of defaulting on loans can empower borrowers to make informed decisions.

- Financial Literacy Education: Improving financial literacy among students before and after graduation can empower them to make responsible financial choices. This could include comprehensive financial education integrated into high school and college curricula.

Improving Access to Student Loan Forgiveness

Expanding access to student loan forgiveness programs is a critical step in addressing the student loan debt crisis. This requires careful evaluation of existing programs and potential new approaches.

- Streamlining Forgiveness Programs: Simplifying the application process and reducing bureaucratic hurdles for forgiveness programs can increase participation and effectiveness.

- Expanding Eligibility Criteria: Expanding the eligibility criteria of existing forgiveness programs could potentially benefit a wider range of borrowers. This may require adjusting the criteria for occupations or types of institutions in which students seek education.

Creating Awareness about Student Loan Repayment Options

Greater awareness about available repayment options is critical to helping borrowers effectively manage their debt. This involves clear communication and readily accessible resources.

- Public Awareness Campaigns: Public awareness campaigns, targeting potential borrowers and current borrowers, can educate individuals about repayment options and the benefits of utilizing these resources. These campaigns can also highlight the consequences of inaction.

- Improved Information Dissemination: Improving the accessibility and clarity of information about loan programs and repayment options is critical. This includes providing readily accessible resources for borrowers, including online portals, financial counselors, and dedicated support lines.

International Perspectives on Student Loans

Student loan systems vary significantly across nations, reflecting diverse socioeconomic structures, educational philosophies, and governmental priorities. Understanding these differences is crucial for comprehending the challenges and opportunities faced by students seeking higher education globally. This analysis explores international student loan programs, highlighting funding mechanisms, eligibility criteria, repayment terms, and the impact on student outcomes.

Comparative Analysis of Student Loan Programs

Comparing student loan programs across different countries provides valuable insights into the design and implementation of these systems. Analyzing funding mechanisms, eligibility criteria, and repayment terms reveals how various nations address the financing of higher education and the subsequent responsibilities of borrowers.

- Funding Mechanisms: Student loan funding models range from predominantly government-funded systems to those relying heavily on private institutions or a mix of both. In some countries, government subsidies significantly reduce the burden on students, while in others, the private sector plays a larger role in providing loans. Precise quantification of the proportion of funding from each source can be challenging but is a key aspect of understanding the relative responsibility of each party. Examples of different funding models include the Canadian system, where government funding is substantial, contrasted with the United Kingdom’s system that leans more heavily on both government and private lending.

- Eligibility Criteria: Criteria for loan eligibility vary considerably between nations. Factors like academic performance (GPA), field of study, financial need, and citizenship status are often considered. Differences in these requirements are often linked to the country’s education policies and socio-economic context. A comparison of these criteria across nations reveals a diverse range of approaches. A table outlining the key eligibility criteria for each country can be a useful tool for prospective borrowers.

- Interest Rates and Repayment Terms: Interest rates and repayment terms differ significantly between countries. Some nations utilize fixed interest rates, while others offer variable rates linked to market conditions. Repayment terms, including grace periods and loan forgiveness programs, vary, influencing the long-term financial burden on students. These differences in loan terms affect student affordability and the financial sustainability of the programs. Understanding the average interest rates and repayment terms for different countries allows for a comparative analysis of the financial burdens on students.

- Default Rates: Student loan default rates fluctuate considerably across countries, reflecting the interplay of various factors, such as loan terms, economic conditions, and the overall support systems in place. The default rate can be influenced by factors like income-contingent repayment plans, the availability of scholarships, and employment prospects. Analyzing these factors can provide insight into the effectiveness of various approaches to student loan programs.

- Government Support and Subsidies: Government involvement in supporting student loan programs varies. This includes income-driven repayment plans, scholarships, and other forms of financial assistance. Analyzing government policies reveals the degree to which a nation prioritizes affordable higher education and supports its students through financial hardship. Understanding the various forms of government support provides context for the financial landscape in each country.

Case Studies of International Loan Repayment Strategies

Examining specific repayment strategies employed by different countries allows for a deeper understanding of the practical implementation of student loan programs. Analyzing these strategies provides insight into the success and challenges of different approaches.

- Specific Repayment Plans: Different countries have developed unique repayment plans, such as income-contingent repayment, income-based repayment, or other specific programs tailored to address the financial circumstances of borrowers. Analyzing the features of these plans offers insights into how countries adapt their repayment models to the specific needs of their student population.

- Success and Challenges: Assessing the success and challenges of these programs involves examining loan forgiveness rates, borrower satisfaction, and the overall impact on the financial well-being of borrowers. This analysis can reveal the effectiveness of different repayment plans and the factors that contribute to their success or failure.

- Impact on Employment and Career: The impact of repayment plans on students’ career choices and employment prospects is significant. Repayment terms and burdens can influence career decisions, and countries with more supportive plans may see better outcomes in terms of employment and career advancement for their graduates.

Factors Influencing Accessibility, College loans

Factors beyond the loan programs themselves significantly influence access to higher education funding. Examining socioeconomic, geographic, and institutional factors is crucial for a comprehensive understanding of loan accessibility.

- Socioeconomic Factors: Socioeconomic status plays a significant role in determining access to student loans. Disparities in income and wealth can create barriers to higher education, as students from lower-income backgrounds may struggle to meet the financial demands of higher education.

- Geographic Factors: Location can impact access to student loans and the affordability of higher education. Students in rural areas may face greater challenges in accessing loans and may encounter higher costs for transportation and living expenses.

- Field of Study: The field of study chosen by students can influence loan accessibility and the long-term financial implications. Certain fields of study may be more expensive to pursue than others, affecting the overall cost of higher education and the financial burdens on students.

- Institutional Factors: Educational institutions can play a role in shaping loan accessibility for their students. Policies regarding loan advising, financial aid, and access to resources can significantly influence student outcomes.

Comprehensive Comparison Table

The following table provides a comparative overview of student loan systems across several countries. This table will summarize the key characteristics, facilitating a quick reference and comparison of student loan programs.

| Country | Funding Source | Eligibility Criteria | Interest Rate | Repayment Term | Default Rate | Government Support | Accessibility Factors |

|---|---|---|---|---|---|---|---|

| Country A | [Data] | [Data] | [Data] | [Data] | [Data] | [Data] | [Data] |

| Country B | [Data] | [Data] | [Data] | [Data] | [Data] | [Data] | [Data] |

| Country C | [Data] | [Data] | [Data] | [Data] | [Data] | [Data] | [Data] |

| Country D | [Data] | [Data] | [Data] | [Data] | [Data] | [Data] | [Data] |

| Country E | [Data] | [Data] | [Data] | [Data] | [Data] | [Data] | [Data] |

Data Sources: [List of sources for the data in the table]

Alternatives to Traditional Loans

Navigating the financial landscape of higher education can be daunting, especially with the substantial costs involved. While traditional loans remain a common path, alternative financing options offer diverse avenues for students to fund their education. These alternatives, often with unique terms and conditions, can be beneficial for various student demographics. Understanding these options allows students to make informed decisions aligned with their individual circumstances and financial goals.

Alternative Financing Options

Alternative financing options for higher education encompass a wide range of possibilities beyond traditional loans. These methods offer varying degrees of accessibility, eligibility criteria, and financial implications. Each method caters to specific needs and circumstances, thereby offering students diverse choices.

Scholarships and Grants

Scholarships and grants represent valuable sources of financial aid, often awarded based on academic merit, financial need, or specific fields of study. These funds do not need to be repaid, making them a significant advantage for students. Applying for scholarships often involves submitting an application with supporting documentation, highlighting achievements and qualifications. Availability varies widely depending on the specific scholarship or grant program.

Work-Study Programs

Work-study programs provide part-time employment opportunities for students, allowing them to earn income while pursuing their studies. These programs are typically administered by the institution and often involve a combination of academic requirements and job duties. The earnings generated can help alleviate the financial burden of tuition and living expenses.

Private Educational Financing Companies

Private educational financing companies offer alternative loan options with varying interest rates, repayment terms, and eligibility criteria. These companies often assess individual creditworthiness and financial standing. Application processes typically involve submitting financial information and meeting specific requirements set by the financing company.

Crowdfunding Platforms

Crowdfunding platforms provide a unique method for raising funds for educational expenses. Individuals can create campaigns to solicit contributions from a network of supporters. The success of crowdfunding depends on the campaign’s visibility, appeal, and ability to engage potential donors.

Family Loans or Support

Family members may offer loans or other forms of financial support for educational expenses. These arrangements can provide a crucial safety net, offering flexible terms and tailored repayment options. However, maintaining clear communication and establishing a formal agreement is essential to avoid potential misunderstandings or conflicts.

Comparison of Traditional Loans and Alternative Financing Options

| Feature | Traditional Loans | Scholarships/Grants | Work-Study | Private Financing | Crowdfunding | Family Loans |

|---|---|---|---|---|---|---|

| Repayment | Required | Not Required | Not Required (earnings are used to cover expenses) | Required | Not Required (contributions are not loans) | Typically Required |

| Interest Rate | Variable, often high | Zero | N/A | Variable | N/A | Variable |

| Eligibility | Based on creditworthiness | Based on merit, need, or field | Based on availability and academic standing | Based on creditworthiness | Based on campaign appeal | Based on relationship and trust |

The Impact of Interest Rates on Loan Repayment

Interest rates play a critical role in shaping the affordability and burden of student loan repayment. Fluctuations in these rates directly affect the monthly payments borrowers face, impacting their financial well-being and long-term planning. Understanding these dynamics is essential for students and borrowers to effectively manage their loan obligations.

Interest Rate Fluctuations and Monthly Payments

Interest rates are the cost of borrowing money. Higher interest rates translate to higher monthly payments on student loans. Conversely, lower interest rates result in lower monthly payments. This relationship is directly proportional, meaning a 1% increase in the interest rate will result in a corresponding increase in monthly payments.

Impact of Rising Interest Rates on Student Borrowers

Rising interest rates significantly increase the financial strain on student borrowers. Higher monthly payments can make it harder to manage other financial obligations like housing, food, and savings. This can lead to financial stress and, in extreme cases, difficulties in meeting repayment obligations.

Scenarios with Varying Interest Rates and Their Impact on Repayment

Consider these examples:

- A student with a $20,000 loan at a 5% interest rate might have a monthly payment of $400. A 7% interest rate could increase that payment to $460. This seemingly small difference compounds over time, significantly impacting the total amount paid.

- Another student with a $30,000 loan at a 6% interest rate, facing a monthly payment of $550, could experience a $650 payment if interest rates rise to 8%. These added expenses can create considerable hardship and potentially lead to loan defaults.

Strategies for Mitigating the Impact of Rising Interest Rates

Several strategies can help borrowers manage the impact of rising interest rates:

- Explore Loan Modifications: Borrowers should explore loan modification options offered by lenders, such as extending repayment terms or temporarily reducing payments. This can provide a much-needed breathing room during periods of economic instability.

- Increase Income: Increasing income through additional employment or career advancement can help borrowers manage higher monthly payments.

- Consolidation: Consolidating multiple loans into a single loan can potentially lower monthly payments if the new loan has a lower interest rate. However, this may not always be the best option.

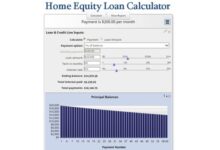

Using Financial Calculators to Predict Loan Repayment Amounts

Financial calculators can be instrumental in predicting loan repayment amounts based on various interest rate scenarios. These calculators allow borrowers to input loan details (principal amount, interest rate, loan term) and visualize the impact of different interest rate fluctuations on their monthly payments and total loan costs. Online calculators and spreadsheet software are readily available to perform these calculations.

Example: Using a loan repayment calculator with a $10,000 loan, a 7% interest rate, and a 10-year term will produce a specific monthly payment. Increasing the interest rate to 8% will demonstrate the rise in the monthly payment.

Relationship Between Interest Rates and Loan Repayment (Illustrative Graph)

A graph plotting interest rates on the x-axis and corresponding monthly loan repayments on the y-axis would illustrate a positive correlation. As interest rates increase, monthly loan repayments would rise proportionally. The graph would display a line sloping upward, visually demonstrating the impact of interest rate changes on loan repayment. A hypothetical graph showing this relationship could be generated using a spreadsheet program. The graph would help borrowers understand the direct link between interest rates and their monthly payments.

Student Loan Debt and Economic Growth

Student loan debt has become a significant factor in the modern economy, impacting various aspects of individual and national well-being. This analysis delves into the specific economic effects of student loan debt, moving beyond general observations to examine quantifiable relationships and real-world consequences. Understanding these impacts is crucial for developing effective strategies to address the issue and foster sustainable economic growth.

Correlation Analysis of Student Loan Debt and Economic Indicators

Analysis of the quantitative relationship between student loan debt levels and economic indicators reveals important correlations. Calculating correlation coefficients between student loan debt-to-GDP ratios and key indicators like GDP growth, unemployment rates, and consumer confidence provides valuable insights. For instance, a strong negative correlation between student loan debt and GDP growth suggests a potential hindering effect of debt on economic expansion. Conversely, a strong positive correlation between student loan debt and unemployment might indicate that high debt levels are linked to reduced employment opportunities. Visualizations, such as scatter plots, will clearly illustrate these relationships. It’s crucial to acknowledge that correlation does not equal causation and that other factors may influence these observed relationships.

Consumer Spending Impact of Student Loan Debt

Student loan debt directly affects consumer spending patterns. High debt levels can limit discretionary spending, impacting sectors like entertainment and travel. The propensity to save might also decrease, potentially hindering long-term financial security. Further, different income levels experience varying degrees of impact from student loan burdens. Lower-income individuals may be disproportionately affected, limiting their ability to invest and participate in the economy.

Entrepreneurship Impact of Student Loan Debt

Student loan debt significantly influences entrepreneurial activity. High debt burdens can make it challenging for individuals to start businesses, access capital, or invest in education, which are often prerequisites for success in the entrepreneurial sphere. This is especially true when considering the time and resources required for new ventures. Analysis of startup rates and funding amounts in different countries, along with comparison of countries with distinct approaches to student loan debt, will provide further insights into this impact.

Country Case Studies of Varying Student Loan Systems

Analyzing countries with diverse student loan models offers valuable insights into the economic outcomes associated with different approaches. Countries with substantial government subsidies for student loans might experience different employment and entrepreneurial outcomes compared to countries with primarily private sector involvement or those without formal student loan programs. For example, comparing the unemployment rates of recent graduates in countries with strong vocational training systems (like Germany) to those in the US provides a nuanced perspective.

Summary Table of Economic Implications

The table below summarizes the potential economic implications of student loan debt.

| Economic Indicator | Impact of Student Loan Debt (Positive/Negative/Neutral) | Supporting Evidence |

|---|---|---|

| GDP Growth | Negative | Potential decrease in consumer spending and investment due to debt burden. |

| Unemployment Rate | Negative | Potential reduction in job creation and entrepreneurship due to limited capital and investment. |

| Consumer Spending | Negative | Reduction in discretionary spending and savings, impacting various sectors. |

| Entrepreneurship | Negative | Difficulty in starting businesses and accessing capital. |

Impact on Specific Demographics

Student loan debt is a significant financial burden impacting various demographics in complex ways. Understanding how different groups are affected by this debt is crucial for developing effective policies and solutions. This analysis examines the impact of student loan debt on income levels, ethnic groups, gender, and generations, providing a nuanced view of the challenges faced by borrowers across diverse backgrounds.

Impact on Income Levels

Student loan debt disproportionately affects borrowers with lower and moderate incomes. Borrowers with lower incomes often have limited capacity to repay loans, making them more vulnerable to default. High-interest rates and long repayment periods exacerbate this issue. For instance, a student loan of $30,000 might seem manageable for a high-income individual, but could represent a crippling debt burden for someone earning significantly less. This disparity underscores the need for targeted financial aid and repayment assistance programs for low- and moderate-income borrowers.

Impact on Ethnic Groups

Studies show significant disparities in student loan debt levels across different ethnic groups. Historical and systemic factors, such as disparities in educational opportunities and access to financial aid, contribute to these differences. For example, African American and Hispanic borrowers often face higher rates of default and struggle to manage loan repayments due to economic limitations. This highlights the importance of addressing historical inequities and providing culturally sensitive financial education and support programs to these communities.

Impact on Gender Differences

While gender disparities in student loan debt are less pronounced than those based on income or ethnicity, some differences exist. Women, on average, tend to pursue different fields of study and may take longer to enter the workforce, which can impact their ability to repay loans. Additionally, career paths with lower salaries may impact repayment potential. However, the impact of student loan debt on gender is a complex issue, needing further investigation into specific career choices and salary differences.

Impact on Different Generations

The impact of student loan debt varies significantly across generations. Millennials and Gen Z, who have faced increasing tuition costs and limited job prospects, have been particularly affected by the rising burden of student loan debt. The financial strain of this debt has implications for their ability to buy homes, start families, and build long-term financial security. Contrast this with prior generations who had fewer financial obstacles to navigate. Differences in the financial landscape and economic opportunities available to different generations contribute to the variations in their experiences with student loan debt.

Examples of Demographic Impact on Student Loan Policies

- Targeted financial aid programs, like income-driven repayment plans, can mitigate the impact of student loan debt on low-income borrowers.

- Culturally sensitive financial literacy programs tailored to specific ethnic groups can help them navigate the complexities of student loan repayment.

- Policies that support affordable higher education, like increased funding for scholarships and grants, can reduce the reliance on student loans for all demographics.

Impact on Student Loan Debt Across Demographics

| Demographic | Impact | Examples |

|---|---|---|

| Low-income borrowers | Higher risk of default, difficulty in managing repayment | Limited job prospects, lower earning potential |

| High-income borrowers | Generally better positioned to repay, but still face repayment challenges | Higher earning potential, but complex financial situations |

| African American borrowers | Higher rates of default, historical disparities in access to financial aid | Systemic inequities, limited educational opportunities |

| Hispanic borrowers | Similar challenges to African American borrowers, often facing similar historical disparities | Systemic inequities, limited educational opportunities |

| Women | Potentially longer repayment periods due to career choices and salary differences | Varying career paths, potentially lower-paying fields |

| Millennials | Significant burden, influenced by increased tuition costs and limited job opportunities | Economic downturn, increased loan debt |

| Gen Z | Similar challenges to Millennials, facing further economic uncertainties | Job market uncertainties, economic volatility |

Case Studies of Successful Loan Management

Successfully managing student loan debt requires a multifaceted approach encompassing meticulous financial planning, proactive income optimization, and disciplined repayment strategies. These case studies illustrate individuals who navigated this challenge, demonstrating the effectiveness of various methods and the importance of long-term financial foresight.

Individual Profiles

| Case Study # | Name | Loan Amount | Loan Type | Length of Debt Management |

|---|---|---|---|---|

| 1 | Sarah Chen | $35,000 | Federal Direct Loan | 5 years |

| 2 | David Lee | $28,000 | Private Loan | 3 years |

Strategies Used

Effective debt management involves a strategic approach. The methods used by these individuals highlight the importance of tailored strategies to individual circumstances.

- Debt Consolidation: Sarah Chen consolidated her federal loans into a single, lower-interest loan. This reduced her monthly payment by $150 and saved her an estimated $1,500 in interest over the life of the loan. David Lee opted for a balance transfer credit card, lowering his overall interest rate and simplifying monthly payments. This balance transfer card provided a 0% APR introductory period, further saving him on interest during that period. These strategies demonstrated the potential benefits of consolidation in terms of streamlined payments and reduced interest burden.

- Budgeting and Financial Planning: Sarah utilized a zero-based budgeting method, meticulously tracking every dollar of income and expense. This allowed her to allocate a significant portion of her funds towards debt repayment, demonstrating the effectiveness of detailed budgeting. David Lee adopted the envelope system, assigning specific amounts to different categories, prioritizing debt repayment above other expenses. Both strategies ensured consistent allocation of funds for debt reduction.

- Income Optimization: Sarah Chen worked part-time to generate additional income, increasing her monthly earnings by 10%. This extra income significantly accelerated her debt repayment schedule. David Lee took on a second part-time job, increasing his income by 15%, allowing for substantial extra payments towards his loans, showcasing the power of supplementing income for quicker debt relief.

- Aggressive Repayment Strategies: Sarah consistently made extra principal payments whenever possible, significantly shortening the loan repayment timeline. She also explored and leveraged income-driven repayment plans offered by the federal government. David used an aggressive repayment strategy by making extra payments each month. Both examples demonstrate the efficacy of aggressive repayment strategies in reducing the overall loan duration and total interest paid.

Financial Planning Insights

These individuals incorporated essential financial planning principles into their debt management strategy.

- Emergency Fund: Sarah maintained an emergency fund equivalent to three months’ worth of expenses, totaling $10,000. This safety net allowed her to handle unforeseen circumstances without jeopardizing her debt repayment plan. David maintained an emergency fund of $5,000, sufficient to cover unexpected expenses.

- Savings Goals: Sarah’s savings goals included purchasing a home within five years. Her debt repayment plan was directly tied to this goal, enabling her to achieve both simultaneously. David’s savings goals included starting a family and investing for his future. His loan repayment plan supported these future goals by freeing up funds for savings and investment.

- Investment Strategies: Sarah invested a portion of her savings in low-cost index funds, aligning her investment strategy with her long-term financial goals. David invested in a diversified portfolio of stocks and bonds, aligning with his long-term financial aspirations. These examples demonstrate the integration of investment strategies into a holistic financial plan.

Lessons Learned

The individuals in these case studies gained valuable insights during their debt management journey.

- Challenges Encountered: Sarah faced challenges related to maintaining a consistent budget during periods of increased work responsibilities. David faced difficulties in balancing his work and personal commitments while actively working to manage his debt.

- Solutions Implemented: Sarah addressed her budget challenges by refining her budgeting strategies and utilizing technology for better tracking. David resolved his work-life balance issues by prioritizing tasks and streamlining his daily routine.

- Key Takeaways: Both individuals learned the importance of proactive financial planning, the power of consistent effort, and the long-term benefits of effective debt management. These experiences underscored the necessity of understanding individual circumstances and implementing adaptable solutions.

Proactive Planning

Early planning is crucial for successful student loan management. The individuals in these case studies demonstrate that proactive measures are essential for long-term financial well-being.

- Importance of Early Planning: Proactive planning before taking out loans, including exploring options for lower-interest loans and developing a detailed repayment plan, can prevent significant debt accumulation. Early planning allows for the integration of debt repayment into a broader financial plan.

- Long-Term Financial Implications: Effectively managing student loan debt can have a significant positive impact on individuals’ long-term financial well-being. This includes improved credit scores, the ability to save for major purchases, and the opportunity to pursue other financial goals.

Case Study Summary Table

| Case Study # | Key Success Factors | Detailed Explanation |

|---|---|---|

| 1 | Budgeting & Savings | Sarah meticulously tracked expenses and saved 20% of her income, allowing her to make additional principal payments. |

| 2 | Income Optimization | David pursued a second part-time job, increasing his monthly income by 15%, which directly reduced his loan repayment time. |

Concluding Remarks

In conclusion, navigating the world of college loans requires a thorough understanding of various factors, from loan types and interest rates to repayment options and potential consequences. This guide has provided a comprehensive overview of the student loan process, emphasizing the importance of financial literacy and proactive planning. By understanding the available resources and strategies, borrowers can approach their loan journey with confidence and clarity.