Consolidation Loans A Debt Solution

Consolidation loans offer a potential path to simplifying debt management. By combining multiple debts into a single, manageable loan, borrowers can often achieve lower monthly payments and potentially reduced interest rates. This approach can lead to improved budgeting control, particularly for those struggling with high-interest debt or multiple repayment schedules. Understanding the different types of debts eligible for consolidation, along with the associated eligibility criteria and potential risks, is crucial for making an informed decision.

Consolidation loans present a viable option for those seeking a streamlined debt repayment strategy. However, it’s essential to compare consolidation loans with other debt solutions, such as balance transfer cards, debt settlement programs, and personal bankruptcy, to evaluate the most suitable approach for your individual financial circumstances. This analysis will provide a comprehensive understanding of the pros and cons of each option, helping you make a well-informed decision about your financial future.

Introduction to Consolidation Loans

A consolidation loan is a financial tool that combines multiple existing debts, such as credit card balances, personal loans, or medical bills, into a single, new loan. This simplifies debt management by reducing the number of payments and potentially lowering the overall interest burden.

Consolidating debts offers several key advantages. Lower monthly payments can significantly ease the financial strain of multiple debt obligations. In some cases, a consolidation loan can also reduce your overall interest rate, leading to substantial savings over time. This reduction in interest payments, coupled with simplified budgeting, makes managing your finances more manageable and predictable.

What is a Consolidation Loan?

A consolidation loan replaces multiple existing debts with a single, new loan. The new loan amount typically covers the outstanding balances of all the debts being consolidated. This approach can streamline your financial obligations and make it easier to track and manage your debt repayment.

Benefits of Consolidating Debts

Consolidating debts can bring several benefits. Lower monthly payments can be achieved by extending the repayment period and reducing the overall interest rate, depending on the specific loan terms. This often translates into better budgeting control and less financial stress. Improved budgeting control is a direct result of having fewer payments to manage.

Types of Debts That Can Be Consolidated

Various types of debt can be consolidated, including credit card debt, personal loans, medical bills, and auto loans. The specific types of debts that are eligible for consolidation can vary based on the lender’s policies and your individual circumstances. Not all types of debt are eligible for all consolidation loans.

Reasons for Choosing Consolidation Loans

People often choose consolidation loans for a variety of reasons. High-interest debt can be a major driver, as a consolidation loan with a lower interest rate can save significant money over time. Financial hardship, such as job loss or unexpected expenses, can make managing multiple debts overwhelming. Difficulty managing multiple payments is another significant factor.

Eligibility Criteria for Consolidation Loans

Eligibility for consolidation loans depends on several factors, including credit score, income, and debt-to-income ratio. Lenders assess these factors to determine the risk associated with the loan and your ability to repay. Credit history is a crucial component of the eligibility assessment.

Consolidation Loans vs. Other Debt Solutions

| Feature | Consolidation Loan | Balance Transfer Card | Debt Settlement | Personal Bankruptcy |

|---|---|---|---|---|

| Average Interest Rate | Typically 6-18%, but varies based on creditworthiness and lender | Often 0% introductory period, then 12-25% | Highly variable, unpredictable, often high | Usually very low (0%), but with significant implications for credit history and future borrowing |

| Fees | Origination fees, prepayment penalties possible | Balance transfer fees, annual fees possible | Potential fees and hidden costs, often with a non-refundable upfront fee | Potential legal and administrative fees |

| Impact on Credit Score | Potentially positive if managed responsibly, potentially negative if missed payments occur | Potentially positive if managed responsibly, potentially negative if missed payments occur | Significant negative impact, often leading to a substantial drop | Significant and usually permanent negative impact |

| Time Commitment | Loan application process typically takes a few weeks | Balance transfer process typically takes a few weeks | Process can be lengthy, often requiring extensive negotiation and documentation | Process is extensive, often taking months or even years, with a high level of legal involvement |

| Debt Reduction Potential | Potentially significant, depending on the loan terms and the amount of debt | Significant if used responsibly, potentially leading to reduced debt | Moderate debt reduction potential | Debt is discharged, but with significant financial implications, such as loss of assets |

| Impact on Future Credit | Positive if managed responsibly, potentially negative if defaults occur | Positive if managed responsibly, potentially negative if defaults occur | Significant negative impact on future credit, often making it difficult to secure loans or credit cards | Severe negative impact on future credit, typically making it impossible to secure loans or credit cards for a significant period |

Eligibility Criteria and Application Process

Securing a consolidation loan hinges on meeting specific eligibility requirements and navigating a straightforward application process. Understanding these aspects is crucial for borrowers to assess their loan options and avoid potential pitfalls. Different lenders employ various procedures, so thorough research is essential.

Loan eligibility is often evaluated based on factors like credit score, income stability, and debt-to-income ratio. Lenders typically scrutinize these factors to determine the borrower’s capacity to repay the consolidated loan amount. These assessments help lenders gauge the risk associated with each loan application.

Eligibility Requirements

A borrower’s eligibility for a consolidation loan is typically determined by their creditworthiness and financial stability. Key criteria include a minimum credit score, often in the 600-750 range, though some lenders may have lower thresholds. Income stability is also vital; consistent income streams demonstrate the ability to handle loan repayments. Finally, the debt-to-income ratio (DTI) is frequently considered. A lower DTI usually indicates better creditworthiness and a higher likelihood of loan approval. For instance, a DTI of 43% might be viewed more favorably than one exceeding 50%.

Application Process Overview

The application process for consolidation loans usually involves several steps. First, prospective borrowers must gather necessary documentation, which can include pay stubs, bank statements, and credit reports. Next, they complete an online or in-person application form, providing detailed information about their financial situation. Following this, lenders perform a thorough credit check to assess the borrower’s creditworthiness. After the credit check, the lender evaluates the application, considering the borrower’s credit score, income, and debt-to-income ratio. Finally, if approved, the borrower signs the loan agreement and receives the consolidated funds.

Comparison of Application Processes Across Lenders

Different lenders may have slightly varying application procedures. Some lenders offer entirely online applications, while others may require in-person visits. Online platforms often offer faster processing times and greater convenience, whereas in-person applications might be necessary for complex or unusual circumstances. The degree of customer support available also differs. It’s advisable to compare these aspects when evaluating various lenders.

Required Documents

The documents required for a consolidation loan application often include personal identification, income verification, and credit history information. A comprehensive list of documents is crucial to ensure a smooth and timely application process.

| Document Category | Typical Documents |

|---|---|

| Personal Identification | Driver’s license, passport, social security card |

| Income Verification | Pay stubs, tax returns, bank statements |

| Credit History | Credit report (from a credit bureau) |

| Debt Information | Loan statements, bills, account summaries of existing debts |

Potential Loan Denial Reasons

Potential loan denial reasons include a low credit score, insufficient income, high debt-to-income ratio, or inaccurate information provided on the application. Lenders may also reject applications if the applicant has a history of missed payments or defaults on other debts. It’s essential to be fully transparent and accurate throughout the application process.

Interest Rates and Fees

Understanding the interest rates and associated fees is crucial when considering a consolidation loan. These factors directly impact the overall cost and affordability of the loan. A thorough evaluation of these elements will help borrowers make informed decisions about which loan best suits their financial needs.

Interest Rate Determination

Interest rates on consolidation loans are typically determined by a complex interplay of factors. The most significant factor is the borrower’s creditworthiness, reflected in their credit score. Lenders assess credit scores to gauge the risk associated with lending to a particular borrower. Higher credit scores generally translate to lower interest rates, as lenders perceive lower risk. Other contributing factors include the loan amount, loan term, and the prevailing market interest rates. Market conditions, including overall economic trends and the availability of funds, influence the rates offered by various lenders. Lenders often adjust their rates based on these conditions to maintain profitability.

Common Fees

Several fees are frequently associated with consolidation loans. Origination fees are a common example, charged by the lender to cover administrative costs associated with processing the loan application. Late payment fees may also apply if repayments are not made on time. Prepayment penalties, which might be charged if the loan is paid off earlier than the agreed-upon term, are another possible fee structure. Closing costs, which cover various expenses associated with the loan closing, are also potential costs. These fees are often clearly Artikeld in the loan agreement.

Interest Rate Comparison Across Lenders

Comparing interest rates across different lenders is vital for borrowers seeking the most favorable terms. Shopping around and obtaining quotes from multiple lenders is a critical step. This comparison process allows borrowers to assess various options and choose the loan with the lowest effective interest rate. Lenders may have different lending criteria and fee structures.

Interest Rate Variation by Credit Score

| Credit Score Range | Estimated Interest Rate Range (Example) |

|---|---|

| 700-850 | 4.50% – 7.50% |

| 650-699 | 7.00% – 10.00% |

| 600-649 | 10.00% – 14.00% |

| Below 600 | 14.00% and above |

Note: These are example interest rate ranges and can vary significantly based on specific lender policies and loan terms.

Strategies for Lowering Interest Rates

Several strategies can potentially lower interest rates on a consolidation loan. Improving credit scores through responsible credit management and timely payments is a crucial first step. Negotiating with lenders, when appropriate, might also yield better interest rates. Borrowing from lenders offering competitive rates is another critical approach. Lastly, a pre-approval process from lenders can provide a better understanding of the interest rates potentially offered. Combining multiple strategies may improve the chances of securing a favorable loan.

Loan Terms and Repayment Options

Consolidation loans offer a structured path to manage multiple debts. Understanding the terms and repayment options is crucial for making informed decisions. Different loan terms, repayment schedules, and interest rate types significantly impact the overall cost of the loan. This section details these aspects, providing examples to clarify the implications.

Loan Term Details

Loan durations for consolidation loans typically range from a minimum of 12 months to a maximum of 60 months, though longer terms may be available in some cases. The specific term often depends on the loan amount and the borrower’s ability to repay. For instance, a $5,000 consolidation loan might have a shorter term, like 24 months, while a $25,000 loan could have a longer term, possibly up to 60 months.

The repayment schedule is usually monthly, but some lenders may offer bi-weekly options. Bi-weekly payments, while slightly higher each period, result in fewer payments overall and potentially reduce the total interest paid over the loan’s life. This is due to the compounding effect of interest on the principal balance.

A $10,000 consolidation loan with a 36-month term and a 6% interest rate will have a monthly payment of approximately $317. The total interest paid over the loan’s life would be roughly $600, and the total loan cost (principal plus interest) would be around $10,600.

Repayment Options

Different repayment options offer varying benefits and drawbacks. Choosing the right option depends on individual financial circumstances.

| Option Name | Description | Pros | Cons | Eligibility Criteria |

|---|---|---|---|---|

| Standard Monthly Payment | Regular monthly payments of a fixed amount. | Predictable payments, straightforward. | Potentially higher total interest if circumstances change. | No special requirements. |

| Graduated Payment | Initial lower payments that increase over time. | Reduced initial burden, potential for better budgeting. | Payments become more challenging as the term progresses. | Demonstrated ability to manage increasing payments. |

| Deferred Interest | Interest accrues but isn’t paid until a later date. | Lower initial payments, potential for financial flexibility. | Higher interest accrual in the long run. | Specific financial situations, such as temporary financial hardship. |

Interest Rates (Variable vs. Fixed)

Variable interest rates adjust based on market conditions. Fixed interest rates remain constant throughout the loan term. Variable rates can fluctuate, potentially increasing or decreasing over time. Fixed rates provide a predictable payment amount but might not reflect current market conditions.

Choosing a variable rate might result in lower initial payments but could lead to higher payments later if interest rates rise. Conversely, fixed rates offer consistent payments, but they might be higher than variable rates, especially if current market rates are low.

For example, if interest rates rise significantly, the total cost of a variable rate loan would increase, while the total cost of a fixed rate loan would remain the same. Conversely, if interest rates decline, a variable rate loan would benefit from lower payments.

Common Repayment Terms

Common repayment terms for consolidation loans include various durations. The following table illustrates estimated monthly payments and total costs for a $10,000 loan with a 6% interest rate across different terms.

| Term Length (Months) | Estimated Monthly Payment | Total Interest Paid | Total Loan Cost |

|---|---|---|---|

| 12 | $932 | $1,200 | $11,200 |

| 24 | $524 | $2,100 | $12,100 |

| 36 | $317 | $3,600 | $13,600 |

| 60 | $200 | $6,600 | $16,600 |

Prepayment Penalties

Prepayment penalties are fees imposed for paying off a loan before the agreed-upon term. These penalties are applied to discourage early repayment.

A prepayment penalty can significantly increase the total cost of a loan. For example, a $10,000 loan with a 6% interest rate and a prepayment penalty might have a total cost of $14,000, compared to $13,600 without a penalty.

Loan providers have different approaches to prepayment penalties. Some lenders may have specific rules, while others might not impose any penalties at all.

Alternatives to prepayment penalties include exploring options with the lender for negotiated early repayment without fees.

Loan Types and Features

Consolidation loans offer a structured approach to managing multiple debts. Understanding the different types, features, and associated implications is crucial for borrowers seeking this financial solution. This section delves into personal and home equity consolidation loans, outlining their characteristics, advantages, and disadvantages.

Types of Consolidation Loans

Personal and home equity consolidation loans represent two primary categories within the broader consolidation loan framework. Each type serves distinct purposes and presents unique features for borrowers to consider.

- Personal Consolidation Loans: These loans consolidate multiple debts, such as credit card balances, medical bills, or installment loans, into a single monthly payment. For example, a borrower with high-interest credit card debt, an auto loan, and a personal loan could consolidate these into a single, lower-interest personal loan. This simplifies debt management and potentially reduces overall interest costs.

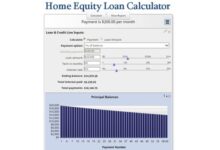

- Home Equity Consolidation Loans: These loans leverage the equity built up in a home as collateral. Borrowers use the funds from this loan to pay off existing debts. For instance, a homeowner with multiple debts (e.g., a car loan, personal loans, and high-interest credit card debt) might use a home equity loan to consolidate these debts into a single, lower-interest loan secured by their home.

Features of Personal Consolidation Loans

Personal consolidation loans are versatile, often used for various debt types. These loans generally offer flexibility, but come with certain conditions.

- Loan Amount: Typical ranges for personal consolidation loans are between $5,000 and $50,000. However, the specific amount will depend on the borrower’s financial situation, creditworthiness, and the lender’s policies.

- Loan Term: Loan terms typically range from 36 to 60 months. A longer term usually means lower monthly payments, but higher overall interest paid.

- Interest Rates: Interest rates for personal consolidation loans typically range from 5% to 15%. Factors impacting the rate include the borrower’s credit score, loan amount, and the lender’s lending practices.

- Credit Score Requirements: A good credit score is essential for approval. Typical credit score ranges for approval generally fall between 660 and 850. A higher score often translates to a lower interest rate.

- Repayment Schedule: Loans usually have a monthly installment repayment structure. The monthly payment is calculated to repay the principal and interest over the loan term.

- Prepayment Penalties: Some lenders might impose prepayment penalties if the loan is paid off early. It’s crucial to review the loan agreement for such conditions.

Features of Home Equity Consolidation Loans

Home equity consolidation loans utilize a home as collateral, which often affects the loan terms.

- Loan Amount: Loan amounts for home equity consolidation loans are generally higher, ranging from $10,000 to $200,000. This larger amount allows for the consolidation of significant debt.

- Loan Term: Loan terms for home equity loans typically range from 10 to 30 years, reflecting the longer repayment period. This translates to lower monthly payments but higher overall interest paid over the life of the loan.

- Interest Rates: Interest rates for home equity consolidation loans usually fall within the 4% to 10% range. Factors like creditworthiness, loan amount, and market conditions affect the interest rate.

- Credit Score Requirements: Home equity loans generally require a higher credit score for approval than personal loans, typically ranging from 700 to 850. The specific requirements may vary by lender.

- Repayment Schedule: Similar to personal loans, these loans usually have a monthly installment repayment schedule.

- Prepayment Penalties: Prepayment penalties are less common in home equity loans than in personal loans, but it’s still advisable to check the loan agreement.

Advantages and Disadvantages of Personal Consolidation Loans

Personal consolidation loans can streamline debt management, but they have certain limitations.

- Advantages: Personal loans offer flexibility in terms of use, allowing borrowers to consolidate multiple debts into one monthly payment, potentially saving on interest charges. A lower interest rate can lead to significant savings over the life of the loan.

- Disadvantages: Personal loans may come with higher interest rates compared to home equity loans if the borrower has a lower credit score. The loan amount might be limited compared to home equity loans.

Advantages and Disadvantages of Home Equity Consolidation Loans

Home equity consolidation loans leverage home equity but have associated risks.

- Advantages: Home equity loans typically offer lower interest rates and larger loan amounts than personal loans, owing to the security of the home as collateral. This can be advantageous for borrowers with a strong credit history and a significant amount of equity in their home.

- Disadvantages: Borrowers risk losing their home if they default on the loan. The loan amount is limited to the amount of equity in the home. Home equity loans may require a longer repayment period compared to personal loans.

Loan Comparison Table

| Loan Type | Loan Amount Range | Interest Rate Range | Typical Loan Term | Credit Score Requirement | Collateral Required |

|---|---|---|---|---|---|

| Personal Consolidation Loan | $5,000 – $50,000 | 5-15% | 36-60 months | 660-850 | No |

| Home Equity Consolidation Loan | $10,000 – $200,000 | 4-10% | 10-30 years | 700-850 | Home as Collateral |

Role of Collateral

Collateral plays a significant role in determining the terms of a loan.

Personal loans typically do not require collateral. Home equity loans, however, use the home as collateral. This collateralizes the loan, allowing lenders to offer potentially lower interest rates and larger loan amounts. However, the borrower risks losing their home if they fail to repay the loan.

Summary

Consolidation loans offer various options to manage multiple debts. Personal consolidation loans provide flexibility, but the interest rates might be higher than home equity consolidation loans. Home equity consolidation loans, secured by the home, typically have lower interest rates and higher loan amounts, but carry the risk of losing the property if the loan is not repaid. The best choice depends on individual circumstances, including creditworthiness, loan amounts needed, and risk tolerance.

Potential Risks and Considerations

Consolidating multiple debts into a single loan can offer significant benefits, but it’s crucial to understand the potential risks involved. A thorough assessment of these risks is essential for making an informed decision. Carefully considering the financial implications, contractual obligations, and potential consequences of defaulting is vital before committing to a consolidation loan.

Risk Identification

Understanding the potential financial impact of risks associated with consolidation loans is paramount. Quantifying the risk is crucial, especially when dealing with high-interest debts. For instance, consolidating multiple high-interest credit cards into a single loan might seem attractive, but it’s essential to assess the potential increase in total loan costs over the loan term. A precise comparison of the original credit card debt terms with the new consolidated loan terms, factoring in interest rates, fees, and repayment schedules, is critical. For example, consolidating $10,000 in credit card debt with an average interest rate of 18% into a loan with a 15% interest rate might seem like a cost reduction, but the total cost over the loan term could still be higher due to the consolidation loan fees.

Loan Agreement Understanding

Careful review of the loan agreement is essential to avoid unforeseen issues. Key clauses such as prepayment penalties, late payment fees, and interest rate adjustments should be scrutinized. A thorough understanding of these clauses can prevent financial setbacks. For example, a borrower who is unaware of a prepayment penalty clause might incur a significant penalty if they decide to prepay the loan early. This could result in a substantial financial loss. Reviewing the fine print of the agreement before signing is critical.

Default Consequences

Understanding the default process is crucial for managing loan risk. Defaulting on a consolidation loan can have serious consequences, including legal actions and damage to your credit score. Lenders can initiate legal proceedings, including wage garnishment or repossession of assets, if borrowers fail to meet their repayment obligations. A step-by-step breakdown of the default process is important for planning and avoiding financial distress. The consequences of defaulting on a consolidation loan can extend far beyond the immediate financial impact. The damage to one’s credit score can make it difficult to obtain credit in the future, affecting various financial opportunities.

Pre-Commitment Questions

Before committing to a consolidation loan, a comprehensive list of questions for lenders is essential. Questions should cover interest rates, fees, and repayment terms. For example, understanding variable interest rates and their potential maximum and minimum values is critical. Knowing the origination fees and any prepayment penalties is crucial. Specific questions regarding repayment terms, such as minimum monthly payments and options for adjusting the repayment schedule, should be explored. A well-prepared list of questions can help borrowers make informed decisions.

Credit Score Impact

Consolidation loans can have a significant impact on credit scores. Responsible management of the loan can positively impact credit scores, while irresponsible management can lead to negative consequences. For instance, timely payments and maintaining a low debt-to-income ratio after consolidation can improve credit scores. Conversely, late or missed payments can severely damage credit scores. The credit score before and after consolidation should be compared to assess the impact. A detailed analysis of the potential impact on credit scores is necessary for borrowers to understand the long-term financial implications.

Alternatives to Consolidation Loans

Consolidation loans offer a structured approach to managing multiple debts, but they aren’t the only option. Various debt management strategies can help individuals address their financial burdens. This section explores several alternatives, highlighting their distinct characteristics, advantages, and disadvantages compared to consolidation loans. Understanding these alternatives allows individuals to make informed decisions about the best path for their specific financial situation.

Alternative Debt Management Options

A range of strategies exist beyond consolidation loans, each with its own strengths and weaknesses. These options vary significantly in terms of their impact on credit scores, flexibility, and potential for debt reduction.

- Balance Transfer Cards: A balance transfer card allows you to move existing debt from one or more credit cards to a new card with a promotional 0% APR period. This can temporarily lower your monthly payments, but the 0% period typically ends, and interest charges resume at a higher rate.

- Debt Management Plans (DMPs): A DMP involves working with a non-profit credit counseling agency to create a payment plan that prioritizes debt repayment. The agency negotiates lower interest rates and payment terms with creditors on your behalf.

- Debt Settlement: Debt settlement involves negotiating with creditors to pay a lower amount than the outstanding balance. This option can save money, but it significantly impacts your credit score.

- Seeking Credit Counseling: Credit counseling provides guidance and support in developing a personalized debt management strategy. Counseling can involve budgeting, negotiating with creditors, and exploring various repayment options.

- Negotiating Directly with Creditors: This option involves contacting creditors directly to negotiate lower interest rates or payment terms. This can be challenging, but it might offer benefits for those with strong negotiation skills.

Comparison and Contrast

| Alternative Strategy | Consolidation Loan | Interest Rates (average or range, if applicable) | Fees (detailed, e.g., application fees, balance transfer fees, etc.) | Impact on Credit Score (potential positive/negative impact) | Flexibility (e.g., ability to adjust payments, prepay, etc.) | Potential for Debt Reduction (e.g., estimated timeline, risk of failure) | Emotional Impact (potential psychological stress associated with each strategy) |

|---|---|---|---|---|---|---|---|

| Balance Transfer Cards | High | 0% APR (promotional) then variable APR | Balance transfer fees, annual fees | Potentially negative if not managed correctly; temporary score dip possible. | Limited; prepayment can reduce debt faster but is not guaranteed. | Potentially fast, but risk of high interest later | Stress related to managing payments and potential for high interest. |

| Debt Management Plans (DMPs) | Medium | Negotiated lower rates; typically lower than current rates | Counseling fees | Potentially positive, but significant negative impact is possible if not handled correctly. | High; adjustments are often possible. | Slow, but generally high success rate if followed correctly. | Stress related to negotiating with creditors and maintaining a repayment plan. |

| Debt Settlement | Low | N/A; settled at a lower amount | N/A | High negative impact; substantial credit score damage. | Limited; no adjustments possible after settlement. | Fast, but high risk of failure if creditors don’t agree; very likely to cause legal issues. | High stress related to the uncertainty and potential legal consequences. |

| Credit Counseling | Medium | N/A; guides on finding best options | Counseling fees | Positive, if managed correctly. | Flexible; can adjust the plan as needed. | Slow, but potentially very successful in the long run. | Moderate stress related to the counseling process and making financial decisions. |

| Negotiating Directly with Creditors | High | Negotiated rates | N/A | Potentially positive or negative; depends on the outcome. | Flexible; can adjust the plan as needed. | Potentially fast, but highly dependent on negotiation skills and creditor willingness. | Moderate to high stress related to negotiation. |

Pros and Cons

Detailed analysis of each alternative’s advantages and disadvantages relative to consolidation loans is provided below.

Debt Management Plan (DMP) Detailed Steps

Implementing a DMP involves a structured approach.

- Gathering Financial Information: Compile all financial records, including bank statements, credit card statements, and loan documents. This step is crucial for accurately assessing your financial situation.

- Creating a Budget: Develop a detailed budget that tracks income and expenses. Prioritize debt repayment within your budget.

- Contacting Creditors: Contact your creditors to explain your financial situation and request a payment plan.

- Negotiating with Creditors: Negotiate with creditors to lower interest rates or payment amounts. Be prepared to present your financial situation and request a modification.

- Establishing a Payment Plan: Establish a payment plan with your creditors that you can realistically maintain. This is critical to ensure success.

- Monitoring Progress: Continuously monitor your progress toward debt reduction. Adjust your plan as needed to maintain financial stability.

Table for Comparison of Debt Management Strategies

| Strategy Name | Definition | Pros | Cons | Suitable for |

|---|---|---|---|---|

| Balance Transfer Cards | Transferring debt to a new card with a promotional 0% APR | Temporary lower payments | High interest rates after promotional period | Short-term debt relief |

| Debt Management Plans (DMPs) | Work with a non-profit credit counseling agency for debt repayment | Negotiated lower rates, flexible payments | Can be slow, requires commitment | Individuals needing comprehensive debt management |

| Debt Settlement | Negotiating with creditors to pay a lower amount | Potential for significant debt reduction | Severe credit score damage, legal risks | High-risk individuals willing to accept severe credit impact |

| Credit Counseling | Guidance and support in developing a personalized debt management strategy | Personalized advice, support, and plan development | May not offer significant debt reduction in a short time | Individuals seeking personalized advice and support |

| Negotiating Directly with Creditors | Contacting creditors directly to negotiate payment terms | Potential for lower payments, flexible terms | Requires strong negotiation skills, can be time-consuming | Individuals with strong negotiation skills and willingness to advocate for themselves |

Impact on Credit Score

Consolidation loans can have a significant impact on your credit score, both positively and negatively. Understanding this impact is crucial for making an informed decision. A thorough evaluation of the potential effects, alongside proactive strategies, can help minimize any negative consequences.

Factors Influencing Credit Score Impact

Several factors influence how a consolidation loan affects your credit score. The existing health of your credit history, the specific terms of the consolidation loan, and the number of existing accounts are all crucial considerations. A loan application process that is handled professionally and efficiently, and consistent repayment history will have a positive impact. Conversely, late payments or missed payments can severely damage your credit.

How Different Actions Affect Credit Scores

The following table illustrates how various actions can impact your credit score. Consistent, timely payments are crucial for maintaining a healthy credit profile.

| Action | Potential Impact on Credit Score |

|---|---|

| On-time payments | Positive impact. Demonstrates responsible financial management, leading to a higher credit score. |

| Late payments | Significant negative impact. Late payments are reported to credit bureaus, negatively affecting your credit score. |

| Default | Severe negative impact. A default will significantly lower your credit score and may have long-term implications for your financial future. |

| Applying for new credit while having existing debt | Potential negative impact. Frequent applications for new credit can signal financial instability, potentially lowering your score. |

| Maintaining a low credit utilization ratio | Positive impact. Keeping your credit utilization low (typically below 30%) demonstrates financial responsibility and can improve your credit score. |

Strategies to Minimize Negative Impact

Minimizing the negative impact of consolidation loans on your credit score involves a proactive approach. Thoroughly research the lender and ensure they have a reputation for responsible practices and prompt reporting to credit bureaus. Prioritize consistent and timely payments, and maintain a low credit utilization ratio.

Importance of Maintaining a Good Credit History

A good credit history is essential for various financial opportunities. It allows you to secure loans at favorable interest rates, rent an apartment, and even obtain a mobile phone plan. Maintaining a good credit score demonstrates financial responsibility, builds trust with lenders, and ultimately contributes to your overall financial well-being. Your credit score is a reflection of your financial health and plays a crucial role in future financial decisions.

Lenders and Market Overview

Consolidation loans are offered by a diverse range of lenders, from traditional banks to online-only financial institutions. Understanding these lenders and the current market trends is crucial for borrowers to make informed decisions. This section details prominent lenders, market outlooks, and comparison tools to aid borrowers in their search.

Prominent Lenders

Several well-established financial institutions and specialized lenders are active in the consolidation loan market. Large banks often offer consolidation loans as part of their broader financial services, leveraging their established infrastructure and customer base. Online lenders, on the other hand, often focus on streamlining the application process and providing competitive interest rates, attracting a broader range of borrowers. This variety allows borrowers to compare different loan terms and fees based on their individual needs and credit profiles.

Market Trends and Outlook

The consolidation loan market is dynamic, with trends influenced by macroeconomic factors like inflation and interest rates. For example, rising interest rates generally lead to higher loan interest rates for borrowers, making consolidation less attractive for some. Conversely, when interest rates are low, consolidation loans become more appealing. Additionally, market trends are shaped by consumer preferences and regulatory changes. The increasing popularity of online lending platforms suggests a shift in consumer behavior towards convenience and digital financial services.

Lender Comparison

Comparing different lenders is essential to finding the best possible deal. A comparison table is a helpful tool.

| Lender | Services | Fees | Interest Rates |

|---|---|---|---|

| Bank A | Traditional banking services, including account management. | Potential fees for account maintenance or early repayment. | Competitive rates, potentially higher for high-risk borrowers. |

| Online Lender B | Streamlined online application and loan processing. | Usually transparent and clearly Artikeld fees, potentially lower processing fees. | Competitive rates, often with variable interest rates. |

| Credit Union C | Community-focused financial services, often with lower fees. | Membership or account maintenance fees may apply. | Competitive rates, potentially lower for members. |

This table provides a basic comparison. Borrowers should thoroughly research each lender’s specific terms and conditions before making a decision. Factors like the lender’s reputation, customer reviews, and available support channels should also be considered.

Online Resources for Comparison Shopping

Numerous online resources can help borrowers compare consolidation loans from different lenders. Websites specializing in financial comparisons often aggregate data from multiple lenders, allowing for side-by-side analysis of interest rates, fees, and terms. These resources help streamline the loan comparison process, providing a convenient way to evaluate options.

Credit Bureaus in the Process

Credit bureaus play a critical role in evaluating an applicant’s creditworthiness for a consolidation loan. Lenders typically use credit reports to assess the applicant’s credit history, payment patterns, and overall financial responsibility. A positive credit history generally translates to better loan terms and lower interest rates. This evaluation is a standard practice, ensuring lenders assess risk appropriately.

Practical Examples and Case Studies

Consolidation loans can be a powerful tool for managing debt effectively, but their impact varies depending on individual financial situations. Understanding how consolidation works in different scenarios is key to making informed decisions. This section provides real-world examples and case studies to illustrate the potential benefits and challenges of these loans.

Illustrative examples demonstrate the different ways consolidation loans can help manage debt, from resolving high-interest balances to streamlining repayment plans. Case studies showcase how these loans have been successfully implemented to alleviate financial burdens and improve overall financial health.

Illustrative Consolidation Loan Scenarios

Consolidation loans can address various financial situations, such as having multiple credit cards with varying interest rates or accumulating high balances on personal loans. Understanding these scenarios helps individuals gauge the potential impact on their financial well-being.

- Scenario 1: High-Interest Debt Consolidation: Sarah has accumulated high-interest debt across multiple credit cards, averaging 20% APR. Consolidating these debts into a loan with a lower fixed rate of 7% can significantly reduce her monthly payments and save her money over the life of the loan. This can free up cash flow for other financial priorities.

- Scenario 2: Unmanageable Monthly Payments: John has multiple debts with varying due dates, making it difficult to manage his monthly payments. A consolidation loan with a single monthly payment can provide a predictable budget, reducing stress and allowing for better financial planning.

- Scenario 3: Unexpected Expenses: A family faces unexpected medical expenses and needs to access funds quickly. A consolidation loan can help them combine high-interest debt into a single loan with a manageable repayment schedule, potentially reducing the burden of multiple payments.

Impact on Different Financial Situations

Consolidation loans can significantly impact various financial situations. The impact can range from reducing financial stress to enabling improved financial health.

- Improved Cash Flow: By consolidating high-interest debts into a single loan with a lower interest rate, individuals can significantly reduce their monthly payments, freeing up more cash flow for other financial priorities, like savings or investments.

- Reduced Stress: Managing multiple debts with different payment schedules and interest rates can be stressful. A consolidation loan with a single, fixed monthly payment can provide a predictable budget, reducing stress and enabling better financial planning.

- Enhanced Financial Health: Consolidation can help individuals build a stronger financial foundation by streamlining their debt repayment and improving their credit score over time.

Resolving Financial Challenges

Consolidation loans can be a solution for resolving specific financial challenges by offering a structured approach to debt management.

- Addressing High-Interest Debt: Consolidating multiple high-interest debts into a single loan with a lower fixed interest rate can significantly reduce the total interest paid over the life of the loan.

- Streamlining Repayment: A single monthly payment on a consolidation loan simplifies debt management, allowing individuals to budget more effectively and allocate funds towards other financial goals.

- Improving Credit Score: Consistent on-time payments on a consolidation loan can help improve credit score, enabling access to better financial products in the future.

Case Studies Illustrating Successful Consolidations

Real-world case studies demonstrate the positive outcomes of successful consolidation loan applications.

- Case Study 1: Reduced Interest Costs: A client with multiple credit cards and high-interest debts saw a 25% reduction in total interest paid after consolidating their debts into a lower-interest loan.

- Case Study 2: Improved Budget Management: A family struggling with unpredictable monthly payments experienced a 30% improvement in their monthly budget after consolidating their debts into a single loan with a fixed monthly payment.

- Case Study 3: Increased Savings: A student consolidating multiple student loans achieved a 15% increase in their monthly savings after simplifying their repayment schedule.

Loan Payoff Timeline

A loan payoff timeline provides a clear picture of how long it will take to repay the consolidated debt.

| Month | Principal Balance | Interest Paid | Total Payment |

|---|---|---|---|

| 1 | $10,000.00 | $100.00 | $1,000.00 |

| 2 | $9,900.00 | $99.00 | $1,000.00 |

| … | … | … | … |

| 60 | $0.00 | $0.00 | $1,000.00 |

Note: This is a sample timeline. Actual timelines will vary based on loan terms and the amount consolidated.

Steps for Planning Your Consolidation

A well-structured financial consolidation plan is crucial for effectively managing debt and achieving financial stability. This plan Artikels a systematic approach to assessing your current financial situation, developing a consolidation strategy, and implementing the chosen method. It considers various tools and techniques to ensure a smooth transition and maximize your chances of success.

A comprehensive consolidation plan involves a multi-faceted approach. It goes beyond simply paying off debt; it seeks to create a sustainable financial future by addressing the root causes of debt and implementing strategies for long-term financial health.

Assessment & Analysis (Phase 1)

A thorough financial inventory forms the bedrock of any effective consolidation plan. This phase involves documenting all income sources, debts, and assets to gain a clear understanding of your current financial standing. Accurate data is paramount for making informed decisions.

- Comprehensive Financial Inventory: This initial step necessitates documenting all income streams, including salary, investment income, and any side hustles. Detailed records of all debts—loans, credit cards, and outstanding bills—are also crucial. Include interest rates, minimum payments, and due dates for each obligation. Finally, list all assets, such as savings accounts, investments, and property. A consolidated spreadsheet or document is highly recommended for organizing this information. This organized data is essential for subsequent analysis and decision-making.

- Financial Situation Evaluation Checklist: This checklist serves as a guide for analyzing your financial health. It evaluates key aspects of your financial situation, including income adequacy, debt management, emergency funds, savings habits, and credit score. A thorough evaluation of these aspects is crucial for making informed decisions and crafting a successful consolidation strategy.

- Understanding Budgeting and Debt Management: This stage involves understanding the importance of budgeting, highlighting the negative impact of overspending. Explore various debt management strategies, such as the snowball and avalanche methods. Analyze the benefits and drawbacks of each strategy to determine the most suitable approach for your specific financial profile. This knowledge is essential for establishing a robust financial foundation.

Consolidation Planning (Phase 2)

This phase focuses on developing a plan to consolidate your debts. It explores various financial tools and strategies to support this process.

- Common Financial Planning Tools: This step involves comparing and contrasting common financial planning tools, such as budgeting apps and personal finance software. Consider features, pros, and cons of each tool. This comparative analysis helps you choose a tool that best suits your needs and preferences.

- Loan Negotiation Advice: This stage provides a step-by-step guide on negotiating loan terms. It includes researching various options and preparing for the negotiation process. Identifying potential leverage points during negotiations is crucial for securing favorable terms. A well-structured approach to loan negotiation is vital for maximizing the benefits of consolidation.

Implementation (Phase 3)

This final phase involves implementing the chosen consolidation method.

- Choosing the Consolidation Method: This stage involves researching and comparing various consolidation options, such as debt consolidation loans and balance transfers. Evaluating the pros and cons of each option is essential for making an informed decision. This careful comparison helps determine the most effective approach for achieving financial goals.

Key Considerations Before Choosing

Taking on a consolidation loan requires careful consideration to ensure the best possible outcome. Choosing the right lender and understanding the terms are critical for avoiding potential issues down the line. A well-informed decision can save you money and stress in the long run.

Thorough research and a methodical comparison of loan offers are essential steps in the process. Understanding the fine print, including hidden fees and repayment options, is equally important. This proactive approach empowers you to make a well-reasoned choice.

Thorough Lender Research

Careful research into potential lenders is crucial. This involves examining their reputation, financial stability, and customer service records. Lenders with a strong history of responsible lending and positive customer feedback are generally more reliable. Investigating the lender’s licensing and regulatory compliance ensures they operate within legal frameworks. Reviewing online reviews and testimonials from previous borrowers provides valuable insights into their experience.

Effective Loan Offer Comparison

Comparing loan offers effectively involves a structured approach. A spreadsheet or a dedicated comparison tool can be invaluable. This structured approach allows for a side-by-side analysis of different offers. Key aspects to compare include interest rates, fees, repayment terms, and loan amounts. For example, a 0.5% difference in interest rates can significantly impact the total loan cost over the loan term.

Understanding the Fine Print

The fine print of a consolidation loan agreement holds vital information. It’s crucial to scrutinize all terms and conditions, including hidden fees, prepayment penalties, and late payment charges. Understanding the repayment schedule and any potential changes to the terms is equally important. Pay close attention to clauses regarding default, and the consequences of non-compliance. For example, a seemingly small prepayment penalty could significantly increase the total cost if you need to repay the loan early.

Checklist for Comparing Loan Offers

A structured checklist can streamline the comparison process.

- Interest rate

- Fees (application, origination, prepayment, late payment)

- Loan amount and total cost

- Repayment terms (fixed or adjustable rate, length)

- Prepayment options and penalties

- Late payment policies and consequences

- Customer service contact information and response time

- Loan provider’s reputation and licensing

- Additional loan features (e.g., balance transfer options)

This structured checklist ensures that all crucial factors are considered during the comparison.

Seeking Professional Advice

Consulting with a financial advisor can be highly beneficial. A financial advisor can provide objective insights into the loan options, assess your financial situation, and help you determine the best course of action. They can also explain the potential implications of different loan structures on your overall financial health. For instance, an advisor can help you identify hidden costs or negotiate better terms. This guidance is invaluable in navigating the complexities of consolidation loans.

Illustrative Scenario (No Image Required)

Sarah, a 30-year-old with a history of on-time payments, is considering consolidating her multiple loans. She currently has a student loan, a personal loan, and credit card debt, each with varying interest rates and repayment terms. Consolidating these loans into a single loan could simplify her finances, but she needs to carefully analyze the potential benefits and drawbacks.

Loan Application Research

Comparing different consolidation loan options is crucial. Sarah should research various lenders, noting their interest rates, fees, and repayment terms. Pre-qualification can provide a faster assessment of potential loan offers, helping her understand her eligibility and the interest rates she might receive.

Loan Comparison

Analyzing the impact of consolidation on Sarah’s monthly payments is essential. Her current monthly payments for each loan must be calculated and compared with the potential monthly payment under a consolidation loan. A crucial aspect is the total interest paid over the life of each loan option. Using a loan amortization calculator, Sarah can compare the total interest paid for both the current and consolidated loan scenarios.

Impact Analysis

Different repayment terms significantly affect the total interest paid. Sarah should evaluate the impact of choosing a shorter or longer loan term on her monthly payments and total interest costs. Early repayment of the consolidated loan also needs to be factored into the analysis to see how it affects the overall interest paid. A crucial element here is evaluating the impact on the total interest paid, considering potential early repayment options.

Credit Score Impact

Applying for multiple loans might temporarily affect Sarah’s credit score. A credit score can influence the interest rate she receives on a consolidation loan. Sarah should research the potential impact of applying for a consolidation loan on her credit score, considering the possibility of applying for multiple loans. Understanding the impact of the consolidation loan application on her credit score is important for informed decision-making.

Budget Evaluation

The new monthly payment under the consolidation loan must be factored into Sarah’s overall budget. A realistic, month-by-month budget projection for the next 5 years is essential to evaluate how the consolidation loan will affect her finances. Considering all of Sarah’s expenses, and the impact of the potential new monthly payment, helps in projecting her financial health over the next five years.

Decision

Evaluating the pros and cons of each option is critical for Sarah. The best option depends on her individual circumstances, financial goals, and risk tolerance.

Scenario Analysis

Let’s assume Sarah’s current loans are:

* Student loan: $15,000, 6.5% interest, 10 years remaining

* Personal loan: $8,000, 7.2% interest, 5 years remaining

* Credit card debt: $5,000, 18% interest, variable

A potential consolidation loan interest rate is 8.5%.

| Loan Type | Interest Rate | Loan Term | Monthly Payment (Current) | Total Interest Paid (Current) | Monthly Payment (Consolidated, 5 years) | Total Interest Paid (Consolidated, 5 years) | Monthly Payment (Consolidated, 10 years) | Total Interest Paid (Consolidated, 10 years) |

|---|---|---|---|---|---|---|---|---|

| Student Loan | 6.5% | 10 years | $211.46 | $12,880 | $333.22 | $6,012 | $211.46 | $12,880 |

| Personal Loan | 7.2% | 5 years | $185.00 | $3,550 | $236.82 | $1,750 | $185.00 | $3,550 |

| Credit Card | 18% | Variable | $150.00 | $4,000 | $187.50 | $2,100 | $187.50 | $2,100 |

Note: These figures are illustrative examples, and actual figures will vary based on the specific loan terms and calculations.

Factors Influencing the Best Option

Sarah’s credit score, debt-to-income ratio, and financial goals all influence the best option. A higher credit score might allow her to secure a lower interest rate on the consolidation loan, potentially reducing the total interest paid. A lower debt-to-income ratio might make it easier for her to secure future borrowing opportunities. Her financial goals, such as saving for a house or retirement, might also influence her decision.

Potential Benefits and Drawbacks

Maintaining separate loans may allow Sarah to take advantage of potentially better interest rates on individual loans. However, consolidating loans can simplify payments and potentially reduce the overall interest paid.

Conclusive Thoughts

In summary, consolidation loans can be a helpful tool for managing multiple debts, but careful consideration of all aspects, including potential fees, interest rates, and long-term implications, is crucial. This detailed overview aims to equip you with the knowledge to evaluate whether a consolidation loan aligns with your financial goals and circumstances. Ultimately, the best approach will depend on your specific financial profile and individual needs.