Equity Loan Your Comprehensive Guide

Equity loans offer a unique financing opportunity, leveraging the equity in your assets like a home to secure funds for various needs. Understanding the nuances of equity loans, from their definition and eligibility criteria to interest rates, terms, and potential risks, is crucial for making informed financial decisions. This guide provides a detailed overview, enabling you to confidently navigate the complexities of this financial tool.

This comprehensive resource explores equity loans, comparing them with other loan types, and highlighting the factors that influence eligibility, interest rates, and repayment terms. We’ll cover everything from the various types of equity loans to potential risks and considerations, equipping you with the knowledge to determine if an equity loan aligns with your financial goals.

Defining Equity Loans

Equity loans are a type of loan that allows borrowers to use the equity they have built up in an asset, such as a home, as collateral. Equity represents the difference between the market value of an asset and the outstanding balance of any loans against it. Essentially, it’s the borrower’s ownership stake in the asset. This collateralized nature of the loan often leads to favorable terms compared to other loan types.

Key Characteristics of Equity Loans

Equity loans differ significantly from other loan types, particularly in terms of collateral, interest rates, and typical loan amounts. The presence of collateral significantly impacts risk assessment. Lenders view collateralized loans as less risky because they have an asset to seize if the loan isn’t repaid. This lower perceived risk often translates to lower interest rates compared to unsecured loans like personal loans. The typical loan amount for an equity loan is often higher than a personal loan, leveraging the value of the asset.

Types of Equity Loans

Several types of equity loans are available, each with distinct purposes, repayment structures, and interest rates.

- Home Equity Loans (HELs): HELs are typically used for large, one-time expenses like home renovations, debt consolidation, or purchasing a new home. They often come with a fixed repayment schedule, meaning the borrower repays the loan in regular installments over a set period. Interest rates are typically fixed, though some may have variable rates, ranging from 5% to 8% at the time of writing. Closing costs, including appraisal fees, origination fees, and title insurance, are common. Typical closing costs may be 2-5% of the loan amount.

- Home Equity Lines of Credit (HELOCs): HELOCs function like credit cards, providing a line of credit that borrowers can access as needed. This flexibility is useful for variable expenses, such as home repairs or unexpected costs. Interest rates on HELOCs are usually variable, typically ranging from 6% to 9% at the time of writing, and can fluctuate based on market conditions. Fees can include origination fees, annual fees, and potentially maintenance fees. Closing costs may also apply, and usually run from 2-5% of the loan amount.

Suitable Situations for Equity Loans

Equity loans can be a suitable financial solution in various situations.

- Example 1: Home Renovation: A homeowner planning a major kitchen or bathroom renovation can use an equity loan to finance the project. This allows them to avoid using personal savings or accumulating high-interest debt.

- Example 2: Business Expansion: A business owner looking to expand their operations can leverage the equity in their home to secure a loan. This funding can facilitate the purchase of equipment, hiring new employees, or exploring new markets.

- Example 3: College Tuition: A family needing funds for their children’s college education can consider an equity loan, providing a large sum of money without relying on other debt.

- Example 4: Bridge Loan: A homeowner who is selling their home and buying a new one can use an equity loan as a bridge loan, covering the gap between selling their current home and purchasing the new one.

Pros and Cons of Equity Loans

Equity loans present both advantages and disadvantages.

- Pros: Lower interest rates compared to other loan types (often 1-2% lower than personal loans) and the potential for higher loan amounts due to collateral. This allows borrowers to finance larger projects without relying on excessive personal funds.

- Cons: The risk of losing the asset (the home) if the loan is not repaid. This is a significant risk. Also, the potential for negative equity, where the loan balance exceeds the asset’s value, is a significant concern.

Equity Loan vs. Other Loan Types

The following table compares and contrasts equity loans with other common loan types.

| Feature | Equity Loan | Personal Loan | Mortgage | HELOC |

|---|---|---|---|---|

| Collateral | Asset (e.g., home) | None | Home | Home |

| Interest Rates | Typically 5-8% (fixed) or 6-9% (variable) | Typically 8-15% (variable) | Typically 5-7% (fixed) | Typically 6-9% (variable) |

| Loan Amount | Typically 50-80% of home equity | Typically $1,000-$50,000 | Typically 80-90% of home value | Typically $5,000-$500,000 (or more) |

| Repayment | Fixed term or lump sum | Fixed term | Fixed term or adjustable | Line of credit |

| Typical Uses | Home improvements, debt consolidation, home purchases, etc. | Personal expenses, debt consolidation | Home purchase | Home improvement, debt consolidation, cash flow management |

Eligibility Criteria and Requirements

Equity loans, like other types of financing, have specific eligibility criteria designed to assess a borrower’s ability to repay the loan. These requirements vary depending on the type of loan (FHA, VA, or conventional) and are crucial for lenders to manage risk effectively. Understanding these criteria is vital for prospective borrowers to determine their loan options and prepare necessary documentation.

Thorough assessment of eligibility involves evaluating financial stability, creditworthiness, and the property’s value. Applicants must demonstrate consistent income, responsible debt management, and a satisfactory credit history. This comprehensive evaluation is critical to ensuring loan repayment and mitigating potential financial losses for lenders.

Quantifiable Eligibility Requirements

Lenders use specific, quantifiable measures to assess eligibility. These include minimum credit scores, down payment percentages, loan-to-value ratios (LTVs), and income requirements. These metrics help lenders gauge a borrower’s ability to repay the loan.

- Minimum Credit Scores: Different loan types have varying credit score requirements. For example, FHA loans typically require a minimum credit score of 580, while VA loans may have slightly lower requirements. Conventional loans often require higher scores, reflecting the lender’s risk assessment.

- Minimum Down Payment: The minimum down payment percentage varies. FHA loans often require a minimum down payment of 3.5%, while VA loans may not require a down payment at all. Conventional loans generally require a higher down payment, often ranging from 5% to 20%.

- Loan-to-Value Ratio (LTV): The LTV ratio represents the loan amount relative to the property’s value. Lenders use this ratio to assess the risk of loan default. Higher LTVs increase risk, often requiring higher down payments or other collateral to offset the increased risk.

- Income Requirements: Lenders evaluate income to ensure borrowers can afford the loan payments. This typically involves a debt-to-income (DTI) ratio, which compares total debt payments to gross monthly income. A lower DTI ratio indicates a stronger ability to manage debt.

Documentation Required for Application

A complete application requires various supporting documents. These documents provide evidence of income, assets, and credit history, assisting lenders in evaluating the applicant’s financial standing.

- Required Documents: This list includes proof of income (pay stubs, tax returns), proof of assets (bank statements), and credit reports. Specific documentation requirements vary by loan type. The precise requirements for each loan type are described in the following section.

- Optional Documents: Certain documents, while not mandatory, can strengthen an application. These include pre-approval letters, appraisals, or letters of employment. These documents offer additional reassurance for lenders regarding the borrower’s financial stability and capacity to repay the loan.

Creditworthiness Factors

Lenders consider various aspects of credit history when assessing an applicant. Payment history, credit utilization, and length of credit history all play a significant role in determining approval likelihood.

- Payment History: A consistent history of on-time payments demonstrates responsible financial habits, increasing the likelihood of loan approval. Late payments or defaults negatively impact creditworthiness, potentially leading to loan denial.

- Credit Utilization: High credit utilization (the percentage of available credit used) signals a higher risk to lenders. Keeping credit utilization low demonstrates responsible credit management.

- Length of Credit History: A longer credit history provides lenders with a more comprehensive view of an applicant’s financial habits. A shorter history may indicate a higher risk and potentially influence approval decisions.

- Derogatory Marks: Derogatory marks, such as late payments or collections, significantly affect approval likelihood. These marks indicate potential financial difficulties and are scrutinized closely by lenders.

Comparison of Eligibility Criteria

The following table compares the eligibility criteria for FHA, VA, and conventional equity loans.

| Loan Type | Minimum Credit Score | Minimum Down Payment | Maximum LTV Ratio | Income Requirements |

|---|---|---|---|---|

| FHA | 580 | 3.5% | 80% | Debt-to-income ratio |

| VA | N/A (but strong credit history needed) | 0% | 100% | Debt-to-income ratio |

| Conventional | 620+ | 5-20% | 80-90% | Debt-to-income ratio |

Situations Leading to Loan Denial

Several scenarios can lead to an equity loan denial. These scenarios often stem from poor credit history, inconsistent income, or high debt levels.

- History of Significant Late Payments: An applicant with a history of significant late payments on multiple accounts is highly unlikely to be approved. Lenders prioritize consistent on-time payments as a key indicator of creditworthiness.

- High Credit Utilization: Applicants with extremely high credit utilization may face denial. Lenders assess the percentage of available credit being used as a critical risk factor.

- Inadequate Income: Insufficient income, as evidenced by a high debt-to-income ratio, can result in loan denial. Lenders need assurance that borrowers can comfortably manage loan payments alongside existing debt.

Required Documents for Different Equity Loan Types

The table below Artikels the documents needed for different equity loan types.

| Loan Type | Required Documents | Supporting Documentation Needed | Explanation |

|---|---|---|---|

| FHA | Proof of Income (last 2 years) | Tax Returns (last 2 years), Pay Stubs | Verifies consistent income and repayment ability. |

| VA | Proof of Service | DD214 (or equivalent) | Validates eligibility under the VA program. |

| Conventional | Credit Report | Copy of Driver’s License, Social Security Card | Assesses creditworthiness and identifies the applicant. |

Interest Rates and Fees

Equity loans, particularly those secured by a home, offer attractive financing options. However, understanding the intricate details of interest rates and associated fees is crucial for making informed decisions. This section delves into the specifics of interest rate determination, fee structures, and lender comparisons to help you navigate the complexities of equity loans.

Interest Rate Determination

Interest rates for equity loans are influenced by a complex interplay of factors. Analyzing these factors allows a deeper understanding of how rates are established.

Factor Analysis

- Creditworthiness of the borrower: Credit scores significantly impact interest rates. For example, a HELOC with a borrower possessing a credit score of 700-750 might have a lower interest rate than one with a 650-680 credit score. A second mortgage, similarly, will show a rate differential based on creditworthiness. This is generally true across all equity loan types. Lower credit scores usually lead to higher interest rates to compensate for the increased risk.

- Loan amount and term: Loan amounts and terms are closely tied to interest rates. A larger loan amount or a shorter loan term often corresponds to a higher interest rate. The table below illustrates this relationship for different loan types.

Loan Type Loan Amount ($) Loan Term (Years) Estimated Interest Rate (%) HELOC $50,000 5 6.25 HELOC $100,000 5 6.75 Second Mortgage $100,000 15 7.5 Second Mortgage $200,000 15 7.8 - Market conditions: Economic conditions, such as inflation and central bank policies, greatly influence interest rates. A period of high inflation might lead to higher interest rates across all equity loan types. For example, a significant increase in the federal funds rate often results in higher rates for all loans.

- Loan type-specific considerations: HELOCs, unlike second mortgages, often have variable interest rates, meaning the rate can fluctuate based on market conditions. Second mortgages generally have fixed rates for the duration of the loan. Appraisal value is also a key factor.

- Appraisal value: The appraisal value of the collateral (the home) sets the maximum loan amount. A higher appraisal value generally translates to a higher loan amount and potentially a lower interest rate, as it reduces the risk to the lender.

Comparative Analysis

HELOCs typically have lower initial interest rates compared to second mortgages, but the interest rates can change over time. Second mortgages generally offer fixed rates, which provides stability but may have higher initial interest rates. Formulaic differences in calculating interest rates are also specific to each type of equity loan.

Illustrative Examples

A HELOC with a 750 credit score might have a 6.5% interest rate, while a similar HELOC with a 650 credit score could be closer to 7.5%. A 20-year second mortgage in a high-inflation market could have an interest rate of 8.2%.

Fees Associated with Equity Loans

Understanding the fees associated with equity loans is essential.

Comprehensive Fee List

- Origination fees

- Appraisal fees

- Closing costs

Other fees might include recording fees, title insurance, and lender fees.

Fee Structure Table

| Fee Type | Description | Typical Percentage/Fixed Amount |

|---|---|---|

| Origination Fee | Fee for processing the loan | 1-3% |

| Appraisal Fee | Cost of appraising the property | $300-$500 |

| Closing Costs | Fees for closing the loan | 2-5% of the loan amount |

Fee Comparison

The fees charged by different lenders for similar equity loan types vary. Comparative analysis is essential for securing the best possible loan terms.

| Loan Type | Lender A | Lender B | Lender C |

|---|---|---|---|

| HELOC | 2% origination fee | 1.5% origination fee | 1.8% origination fee |

| Second Mortgage | 1% origination fee | 1.2% origination fee | 1.5% origination fee |

Interest Rate and Fee Comparison Across Lenders

Specific Lenders

Lenders like Bank A, Bank B, and Credit Union C provide a basis for comparison.

Structured Comparison

| Loan Type | Lender | Interest Rate (%) | Origination Fee (%) | Appraisal Fee ($) | Closing Costs ($) |

|---|---|---|---|---|---|

| $100,000 15-year Second Mortgage | Bank A | 7.5 | 1.5 | 450 | 300 |

| $100,000 15-year Second Mortgage | Bank B | 7.7 | 1.2 | 400 | 250 |

| $100,000 15-year Second Mortgage | Credit Union C | 7.2 | 1 | 500 | 400 |

Writing

Comparative analysis reveals significant variations in interest rates and fees across different equity loan types and lenders. Borrowers’ credit scores and loan terms play a critical role in determining interest rates. Higher credit scores and longer loan terms generally lead to lower interest rates. Economic conditions, including inflation and central bank policies, also impact interest rates. Loan type-specific factors, such as variable interest rates for HELOCs and fixed rates for second mortgages, further influence the final interest rate. Appraisal values are key determinants in loan amounts and indirectly impact interest rates. Fees, including origination, appraisal, and closing costs, vary significantly between lenders. Thorough research and comparison across lenders are essential for securing the most advantageous loan terms.

Loan Terms and Repayment

Equity loans offer a flexible way to access funds using your assets as collateral. Understanding the terms and repayment options is crucial for making informed decisions. This section details typical loan terms, repayment schedules, default consequences, and illustrative examples.

Typical Loan Terms

Equity loans, whether for homes, businesses, or personal use, come with specific terms. Understanding these terms helps borrowers manage their financial obligations effectively.

- Loan Amount: The loan amount varies depending on the loan type and the value of the collateral. Home equity loans typically range from a few thousand dollars to a substantial portion of the home’s value, while small business equity loans might be smaller or larger, depending on the business’s needs and assets. Personal equity loans are usually less than home equity loans and may vary depending on the collateral’s value.

- Interest Rate: Interest rates for equity loans can be fixed or variable. Fixed rates remain constant throughout the loan term, providing predictability, while variable rates adjust based on market conditions, potentially leading to fluctuating payments. The range of interest rates varies depending on market conditions and the borrower’s creditworthiness.

- Loan Term: Loan terms, usually measured in years, dictate the duration of the loan. Common terms for home equity loans range from 5 to 30 years, while business loans might be shorter or longer, depending on the financing needs. Personal equity loans typically have shorter terms than home equity loans.

- Loan-to-Value Ratio (LTV): LTV is the ratio of the loan amount to the value of the collateral. A higher LTV generally increases risk for the lender, often leading to higher interest rates or stricter eligibility criteria. A lower LTV usually means better terms for the borrower.

- Down Payment Requirements: Down payment requirements vary. Some equity loans may not require a down payment, while others might have a minimum down payment percentage. For example, home equity loans may require a certain percentage down payment. These requirements differ greatly based on the type of loan and the lender.

Repayment Schedules and Options

Understanding repayment schedules is essential for financial planning. Different options offer various advantages and disadvantages.

- Amortized Repayment: Amortized loans, the most common type, allocate a portion of each payment toward principal and interest. This gradually reduces the loan balance over time, leading to predictable payments and a clear path to loan payoff. The principal amount decreases with each payment.

- Interest-Only Payments: Some loans allow for interest-only payments for a specific period. This option reduces the initial monthly payment but leaves the principal outstanding. After the interest-only period, the full payment must be adjusted to include principal.

- Balloon Payments: A balloon payment involves making smaller monthly payments for a specified period and then paying off the remaining balance in a lump sum (the balloon payment). This option can lead to a substantial payment at the end of the loan term, requiring careful financial planning.

- Flexible Repayment Options: Some lenders offer flexible repayment options, such as allowing extra payments or adjusting payment amounts. These options offer flexibility, but the specific terms vary considerably between lenders.

Consequences of Defaulting

Failing to meet the terms of an equity loan can have serious repercussions.

- Late Fees: Late payments typically incur late fees, which can accumulate and increase the overall cost of the loan. The amount of the late fee is usually Artikeld in the loan agreement.

- Interest Rate Increases: Some loan agreements allow for an increase in the interest rate if payments are consistently late. This can significantly impact the overall cost of the loan.

- Repossession of Collateral: If payments are not made, lenders can repossess the collateral (e.g., a home). The process and conditions for repossession are detailed in the loan agreement. This is a serious consequence.

- Negative Impact on Credit Score: Defaulting on an equity loan can significantly damage the borrower’s credit score, making it difficult to obtain credit in the future.

- Legal Action: Lenders may pursue legal action to recover the outstanding balance if the borrower defaults. The specifics of legal action are defined in the loan agreement.

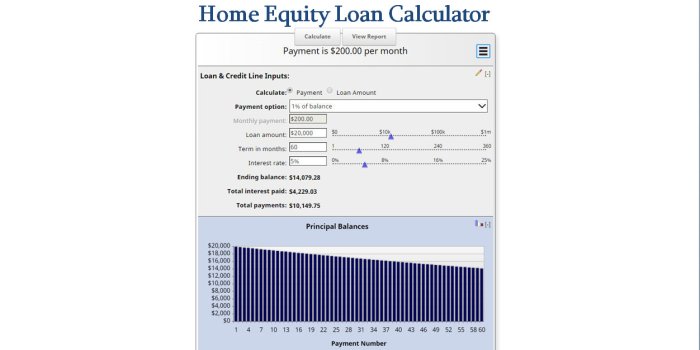

Examples, Equity loan

- Home Equity Loan Example: Loan Amount: $50,000, Interest Rate: 6.5% (fixed), Loan Term: 15 years, Monthly Payment: $447, Total Interest Paid: $14,520.

- Small Business Equity Loan Example: Loan Amount: $100,000, Interest Rate: 7.25% (variable), Loan Term: 7 years, Monthly Payment: $1,687, Total Interest Paid: $26,600.

- Personal Equity Loan Example: Loan Amount: $25,000, Interest Rate: 5.8% (fixed), Loan Term: 5 years, Monthly Payment: $485, Total Interest Paid: $5,400.

Summary Table

| Loan Type | Loan Amount Range | Interest Rate Range | Loan Term Range | Monthly Payment Example | Default Consequences |

|---|---|---|---|---|---|

| Home Equity Loan | $5,000 – $100,000+ | 4% – 9% | 5 – 30 years | $447 | Late fees, interest rate increases, repossession, negative impact on credit score, legal action |

| Small Business Equity Loan | $50,000 – $500,000+ | 5% – 10% | 3 – 10 years | $1,687 | Late fees, interest rate increases, negative impact on credit score, legal action |

| Personal Equity Loan | $1,000 – $50,000 | 3% – 8% | 1 – 7 years | $485 | Late fees, interest rate increases, negative impact on credit score, legal action |

Using Equity Loans for Specific Purposes

Equity loans offer a flexible financial tool for various needs, from consolidating debt to funding home improvements. Understanding the specific applications of these loans can help you make informed decisions about their suitability for your financial situation.

Consolidating Debt

Equity loans can be a viable option for consolidating high-interest debts like credit card balances or personal loans. This approach can simplify your financial obligations by combining multiple debts into a single, often lower-interest, monthly payment. However, carefully consider the total interest paid over the loan term, as well as the impact on your equity.

Home Improvements

Equity loans are frequently used to fund home improvements, including kitchen renovations, bathroom upgrades, or energy-efficient installations. These enhancements can increase the value of your property and improve your living standards. Before borrowing, evaluate the potential return on investment for your planned improvements to determine if the loan is financially beneficial.

Major Purchases

Equity loans can be utilized for significant purchases such as vehicles, educational expenses, or other large investments. A pre-approval process allows you to explore financing options and determine if the loan is feasible for your budget. This can provide a significant advantage over traditional financing methods.

Unforeseen Circumstances

Equity loans can serve as a financial safety net for unforeseen events such as medical emergencies or job loss. The availability of quick funds can provide crucial support during challenging times. However, the terms of the loan and its potential impact on your equity should be carefully assessed.

Examples of Successful Equity Loan Applications

Successful equity loan applications are typically characterized by a strong credit history, a clear understanding of the loan terms, and a realistic repayment plan. Responsible borrowing and proactive communication with the lender are key elements. A pre-approval process allows for a more informed decision-making process.

Implications of Using an Equity Loan for Debt Consolidation

Debt consolidation with an equity loan can lead to reduced monthly payments and lower interest rates. However, there’s a risk of overleveraging your home equity. The impact on your home’s value and your ability to sell it in the future should be carefully considered. Borrowing against your home’s equity requires a detailed understanding of the loan terms and potential consequences.

Risks and Considerations: Equity Loan

Equity loans, while offering a convenient way to access funds, come with inherent risks that borrowers must carefully consider. These risks stem from the nature of the loan, relying on the value of the borrower’s home as collateral, and the possibility of unforeseen circumstances impacting both the borrower’s financial stability and the market value of the property. Understanding these potential pitfalls is crucial for making informed decisions and mitigating the negative consequences.

Potential Impact of Job Loss

Job loss is a significant risk for any borrower, especially those with equity loans. Sudden unemployment can lead to an inability to meet monthly loan payments, potentially escalating into foreclosure proceedings. The loss of a primary source of income dramatically reduces a borrower’s ability to manage financial obligations, making it difficult to meet loan commitments. The impact can be quantified in terms of the potential loss of equity in the home, which can be substantial if the loan is a large portion of the home’s value. This scenario emphasizes the importance of building an emergency fund to buffer against unexpected financial disruptions.

Impact of Rising Interest Rates

Rising interest rates can dramatically increase the monthly payment burden for borrowers with equity loans. A substantial increase in interest rates can significantly reduce the borrower’s available funds for other expenses and potentially lead to financial strain. This increased cost of borrowing directly reduces the equity available to the borrower. The impact of rising interest rates is particularly pronounced for borrowers who initially secured the loan at a lower rate. Borrowers might consider refinancing to lock in a lower rate to mitigate the impact of rising interest rates.

Market Fluctuations and Home Value

Fluctuations in the real estate market can significantly affect the value of a home used as collateral for an equity loan. A rapid decline in housing prices can lead to the home’s value falling below the loan amount. This can leave the borrower with negative equity, where the loan balance exceeds the home’s market value. Such a situation places the borrower at risk of significant financial loss, as they may not be able to sell the home to recoup the loan amount. Conversely, a sudden surge in housing prices can potentially increase the borrower’s equity and offer a more secure investment, but this depends on the specific market conditions and individual circumstances.

Unexpected Home Repairs

Unexpected home repairs can create a significant financial strain on borrowers, particularly those who rely on equity loans for funding. Significant repairs could quickly deplete a borrower’s financial reserves, potentially impacting their ability to meet loan payments. The cost of repairs could be substantial, potentially leading to default if not adequately prepared for. Having a line of credit or an emergency fund dedicated to home repairs can mitigate this risk.

Table of Potential Risks and Mitigation Strategies

| Risk | Potential Impact | Mitigation Strategy | Effectiveness Ranking (1-5, 5 being most effective) |

|---|---|---|---|

| Job Loss | Inability to make loan payments, potential foreclosure; loss of significant equity | Diversify income sources (part-time job, freelance work), build an emergency fund. | 4 |

| Rising Interest Rates | Increased monthly payments, reduced equity | Explore refinancing options to lock in a lower interest rate. | 3 |

| Unexpected Home Repairs | Significant financial strain, potential default | Secure a line of credit or build an emergency fund to cover unexpected home repairs. | 4 |

| Rapid Decline in Housing Prices | Home value falling below loan amount, negative equity, potential foreclosure. | Monitor market trends, maintain strong financial position, consider refinancing options. | 3 |

| Renovation Project with Negative Impact on Home Value | Reduced home value, loss of equity, potential for negative cash flow. | Thorough due diligence on contractors, professional appraisal before and after renovations. | 4 |

Comparison with Other Financing Options

Equity loans offer a unique financing avenue, but understanding how they stack up against other options is crucial for informed decision-making. This section delves into the comparisons, highlighting the strengths and weaknesses of each approach. Careful consideration of interest rates, fees, and terms is paramount when choosing the best option for a specific financial goal.

Comparison with Personal Loans

Personal loans are typically unsecured, meaning they don’t require collateral. Equity loans, conversely, are secured by your home’s equity. This fundamental difference significantly impacts the interest rates and terms. Personal loans usually have higher interest rates due to the higher risk for the lender. Equity loans, with the security of your home’s equity, often present lower interest rates, particularly if the borrower has a strong credit history.

- Personal loans often have shorter repayment periods than equity loans, with terms ranging from a few months to several years. Equity loans generally have longer repayment periods, allowing for more manageable monthly payments.

- Eligibility for personal loans hinges primarily on creditworthiness. Equity loans, while also considering creditworthiness, also take into account the value of the equity in your home.

- Personal loans are generally quicker to obtain, whereas the process for equity loans can take longer due to the appraisal and underwriting requirements.

Comparison with Home Equity Lines of Credit (HELOCs)

HELOCs, like equity loans, leverage your home’s equity but function more like a revolving line of credit. This means you can borrow funds as needed up to a pre-determined credit limit. Equity loans, in contrast, are typically for a fixed amount.

| Feature | Equity Loan | HELOC |

|---|---|---|

| Purpose | Typically for a specific, predetermined purpose (e.g., home improvement). | Can be used for various purposes, potentially for multiple projects. |

| Repayment | Fixed repayment schedule, often over a longer term. | Revolving credit; interest and principal are paid over time as funds are drawn. |

| Interest Rates | Usually fixed, potentially lower than HELOCs, especially for borrowers with strong credit history. | Variable interest rates, which can fluctuate with market conditions. |

| Fees | Origination fees, closing costs, and potentially appraisal fees. | Origination fees, closing costs, and potentially maintenance fees. |

A key difference is that HELOCs can be used repeatedly, offering flexibility, while equity loans are typically one-time transactions for a specified amount.

Interest Rate and Fee Comparison

Interest rates on equity loans typically fall between personal loans and HELOCs, reflecting the lower risk to the lender compared to unsecured personal loans. HELOCs often have variable interest rates, which can be advantageous during periods of low interest rates but carry the risk of increasing rates in the future. Fees for both options can vary significantly based on the lender, creditworthiness, and loan terms.

Suitable Situations for Each Option

- Equity Loans are best suited for large, one-time home improvement projects where a fixed amount of funding is needed and a fixed repayment schedule is preferred. For example, a homeowner needing funds to renovate a kitchen or install a new roof.

- Personal Loans are better for general financial needs that aren’t directly tied to home improvements. For example, consolidating high-interest debt or funding a major purchase like a car.

- HELOCs are appropriate for situations where a borrower might need flexible access to funds for various home improvements or unforeseen expenses over time. For instance, a homeowner needing to fund multiple repairs or upgrades as they arise.

Superiority Scenarios

- An equity loan might be superior to a HELOC if the borrower has a specific, large home improvement project in mind and desires a fixed interest rate and repayment schedule. This predictability can offer significant financial advantages over the potential fluctuations of a variable rate.

- A personal loan may be the superior choice if the borrower needs funds for a non-home-related purpose, or if the borrower doesn’t have enough equity in their home to qualify for an equity loan. This is because the equity loan will likely have a lower interest rate.

Comparison with Other Home Improvement Financing Options

Other financing options, such as cash-out refinancing, often involve a complex process. Equity loans, while still having their own set of considerations, often provide a simpler alternative for specific home improvement needs. For example, a homeowner looking to finance a new energy-efficient windows installation might find an equity loan more straightforward than cash-out refinancing, especially if the amount needed falls within a manageable range.

Steps Involved in Obtaining an Equity Loan

Securing an equity loan involves a series of steps, each crucial for a smooth and successful transaction. Understanding these steps allows borrowers to navigate the process effectively and make informed decisions. Careful consideration of lender requirements and processes is essential for a positive outcome.

Application Process Overview

The equity loan application process typically begins with a thorough assessment of the borrower’s financial situation and the value of the collateral property. This initial phase often involves detailed documentation and evaluation. Lenders aim to ensure the borrower’s ability to repay the loan.

Key Steps in the Application Process

- Preliminary Assessment and Documentation: The borrower gathers necessary financial documents, such as income statements, tax returns, and details of any existing debts. This initial step is crucial for establishing creditworthiness and the overall financial health of the applicant.

- Valuation of Collateral: A qualified appraiser assesses the market value of the property being used as collateral. This step is fundamental in determining the loan amount that can be approved, ensuring the loan amount is in line with the property’s worth.

- Loan Application Submission: The borrower completes the loan application form, providing comprehensive information about their financial situation and the property details. The lender scrutinizes this information, evaluating the application’s viability and compliance with lending criteria.

- Credit Check and Financial Review: The lender conducts a thorough credit check to assess the borrower’s credit history and financial stability. This review helps the lender determine the borrower’s capacity to repay the loan.

- Loan Approval or Denial: Based on the assessment of the collateral value, financial information, and creditworthiness, the lender approves or denies the loan application. A clear decision, whether positive or negative, is essential for proceeding to the next step.

- Loan Agreement Negotiation: If approved, the borrower and lender negotiate the loan terms, including interest rates, repayment schedule, and any associated fees. Thorough understanding of the terms and conditions is vital before signing the agreement.

- Loan Closing and Disbursement: The final step involves signing the loan documents and receiving the loan proceeds. The lender releases the funds after all conditions are met.

Role of Lenders and Intermediaries

Lenders play a crucial role in evaluating the borrower’s creditworthiness, assessing the property’s value, and negotiating the loan terms. Intermediaries, such as real estate agents or financial advisors, can assist borrowers in navigating the process, providing guidance and facilitating communication between the borrower and lender. They can also help the borrower understand the loan terms and conditions.

Typical Timeframe

The timeframe for obtaining an equity loan varies significantly depending on the complexity of the application, the lender’s internal procedures, and the availability of appraisers. For simple cases, the process can be completed within a few weeks. More complex applications, particularly those with extensive documentation or appraisal requirements, may take several months. Factors like property appraisal, loan processing, and the lender’s review schedule can affect the timeframe.

Efficient Application Processes

A streamlined application process is often characterized by clear communication between the borrower and lender, timely responses to inquiries, and efficient handling of paperwork. Some lenders offer online portals for easy application submission and document upload. Lenders with streamlined processes often have dedicated loan officers who manage each case through the entire application process.

Step-by-Step Guide for Obtaining an Equity Loan

- Gather necessary documents, including income statements, tax returns, and property valuation reports.

- Find a lender and apply for the loan, providing complete and accurate information.

- Allow sufficient time for the lender to evaluate your application and conduct the appraisal.

- Negotiate the terms of the loan agreement.

- Complete all required documentation and sign the loan agreement.

- Receive the loan proceeds.

Flow Chart of the Process

| Step | Description |

|---|---|

| 1 | Application Initiation |

| 2 | Document Submission |

| 3 | Credit Check & Appraisal |

| 4 | Loan Approval/Denial |

| 5 | Loan Agreement Negotiation |

| 6 | Closing and Disbursement |

Impact on Home Value

Taking out an equity loan can have a significant impact on your home’s value, both positively and negatively. Understanding these potential effects is crucial for making informed decisions about borrowing against your home’s equity. While an equity loan can provide access to funds, it’s essential to weigh the benefits against the potential risks to your home’s value.

Effect on Home Value

An equity loan itself does not directly reduce the home’s market value. However, the use of the funds and the borrower’s financial situation can influence the property’s perceived value in the market. A responsible use of funds, such as home improvements that enhance the property’s desirability, can increase its value. Conversely, if the loan is used for purposes that do not enhance the property’s desirability, or if the borrower’s financial situation deteriorates, the home’s value may be negatively affected.

Implications of Using a Large Portion of Home Equity

Using a substantial portion of a home’s equity can impact the borrower’s ability to refinance or sell the property in the future. A high loan-to-value ratio (LTV) can make the property less attractive to potential buyers, as it signifies a larger outstanding loan balance relative to the property’s value. This can potentially lower the asking price and extend the time it takes to sell. Furthermore, lenders may be less willing to refinance the property with a high LTV, limiting future financial flexibility.

Potential Impact on Future Refinancing Opportunities

The existence of an equity loan, especially one with a high LTV, can make future refinancing more challenging. Lenders scrutinize the borrower’s debt-to-income ratio and the property’s value when considering refinancing requests. A large outstanding loan balance can negatively affect these factors, potentially reducing the chances of a favorable refinancing outcome. For example, a borrower with an existing equity loan might find that their creditworthiness is impacted, making it harder to secure a lower interest rate or favorable terms on a future refinance.

Examples of How Equity Loans Can Affect Home Value

Using the loan proceeds for necessary repairs or renovations can enhance the home’s appeal and value. For example, updating outdated kitchens or bathrooms, installing energy-efficient windows, or adding a new deck can increase the property’s market value and appeal to potential buyers. However, using the funds for non-essential expenses or neglecting property maintenance could lead to a decline in the property’s value.

Situations Where Home Value Is Not Negatively Impacted

A responsible use of equity loan funds can potentially prevent any negative impact on the home’s value. If the funds are used for critical repairs, improvements that enhance the property’s desirability, or to address any urgent issues, it could increase the value. For example, a borrower who uses the funds to address a significant plumbing problem or make necessary safety upgrades to a property could potentially enhance the property’s value and reputation.

Illustrations of How Home Equity Can Be Affected

The following table illustrates how various scenarios can impact home equity.

| Scenario | Impact on Home Equity |

|---|---|

| Using loan proceeds for necessary repairs and renovations that increase property value | Positive impact on home equity, potentially leading to an increase in market value. |

| Using loan proceeds for non-essential expenses or neglecting property maintenance | Negative impact on home equity, potentially leading to a decrease in market value. |

| Significant increase in property value due to external factors (e.g., neighborhood improvements) | Positive impact on home equity, regardless of an existing equity loan. |

Legal and Regulatory Aspects

Equity loans, while offering a potentially valuable financing option, are subject to a complex web of legal and regulatory frameworks. Understanding these aspects is crucial for both lenders and borrowers to ensure responsible and compliant transactions. Navigating these legal considerations can be challenging, especially when dealing with the intricacies of property law and financial regulations.

Legal Framework Governing Equity Loans

The legal framework governing equity loans is multifaceted and varies by jurisdiction. It typically encompasses property law, contract law, and consumer protection legislation. This framework defines the rights and obligations of both lenders and borrowers, outlining the terms and conditions of the loan agreement. Key aspects often include the valuation of the property, the security interest held by the lender, and the process for enforcing the loan if the borrower defaults. Different jurisdictions may have differing approaches to these aspects, which can impact the structuring and operation of equity loan agreements.

Regulatory Requirements for Lenders

Lenders operating in the equity loan market are subject to stringent regulatory requirements. These requirements often encompass capital adequacy rules, disclosure obligations, and anti-money laundering (AML) compliance. Lenders must adhere to regulations concerning the documentation, assessment, and valuation processes involved in equity loan transactions. Failure to meet these requirements can lead to significant penalties and reputational damage.

Consumer Protection Laws Relevant to Equity Loans

Consumer protection laws are designed to safeguard borrowers from unfair or deceptive practices by lenders. These laws often mandate transparent disclosures, prohibit predatory lending practices, and establish procedures for resolving disputes. Consumers have rights to review and understand the terms of the loan agreement before signing. The level of protection offered to borrowers can vary significantly based on the specific jurisdiction.

Examples of Relevant Legislation and Regulations

Numerous pieces of legislation and regulations govern equity loans. These include, but are not limited to, state-level laws regarding real estate transactions, federal regulations governing lending practices, and specific consumer protection statutes. For instance, in the United States, the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA) provide important protections for consumers in mortgage-related transactions, which may overlap with equity loan practices. Similarly, various state laws impact the transfer of ownership interests in real property, which can be relevant to equity loans.

Cases Where Legal Issues Have Arisen with Equity Loans

Legal disputes surrounding equity loans can arise from various issues, including disagreements over property valuations, misrepresentations in loan documents, and disputes regarding the enforcement of loan terms. For example, a borrower might challenge the accuracy of the property appraisal used to determine the loan amount, while a lender might pursue foreclosure proceedings if the borrower fails to make payments. Cases involving equity loans often involve intricate legal arguments over the interpretation of contracts and the application of relevant laws. These issues highlight the importance of careful legal counsel and meticulous documentation for both parties.

Compliance Procedures Involved in Equity Loan Transactions

Thorough compliance procedures are critical to ensure that equity loan transactions are conducted ethically and legally. This involves comprehensive due diligence on the borrower’s financial situation and the property’s value. It also necessitates adhering to disclosure requirements, ensuring proper documentation, and maintaining accurate records. Compliance with anti-money laundering (AML) regulations is essential to prevent illicit financial activity. Strict adherence to these procedures can prevent legal challenges and ensure the stability of the loan transaction.

Lender Selection and Evaluation

Choosing a reliable lender for an equity loan is crucial to securing favorable terms and a smooth transaction. This process requires careful consideration of various factors beyond just the interest rate. A responsible lender demonstrates financial stability, efficient processing, and commitment to customer satisfaction.

Thorough research and comparison are essential when evaluating different lenders. This approach helps borrowers avoid potential pitfalls and select a lender whose policies and procedures align with their needs and expectations.

Understanding Lender Reliability

A reliable lender in the context of equity loans exhibits several key characteristics. These include consistently high loan approval rates, swift processing times, and exceptional customer service throughout the loan application and fulfillment process. Reliable lenders prioritize timely communication and address borrower concerns proactively.

Factors to Consider When Evaluating Lenders

Interest Rates

Comparing interest rates across lenders is paramount. Understanding the difference between fixed and variable interest rates is vital. Fixed rates offer predictable monthly payments, while variable rates can fluctuate based on market conditions. This fluctuation could potentially lead to higher or lower payments over the life of the loan.

A hypothetical example illustrates this point: A borrower needs a $50,000 equity loan for a 5-year term. Lender A offers a fixed rate of 7.5%, Lender B a variable rate starting at 6.8%, and Lender C a fixed rate of 8%. The monthly payments and overall cost will vary based on the chosen lender and interest rate structure.

Fees and Charges

Various fees are associated with equity loans. Origination fees, appraisal fees, and closing costs are common examples. These fees can significantly impact the overall cost of the loan, reducing the net proceeds for the borrower.

Analyzing the total cost of borrowing for each lender is crucial. In our example, Lender A charges a 1% origination fee, Lender B 0.5%, and Lender C 1.5%. Lender B’s lower origination fee might seem more attractive initially, but the overall cost of the loan needs careful consideration, accounting for potential interest rate fluctuations.

Loan Terms and Conditions

Loan terms significantly affect the borrower’s financial obligations. Important aspects include repayment schedules, prepayment penalties, and late payment fees. Borrowers should carefully review and understand the terms and conditions before committing to a loan.

Using the same hypothetical example, Lender A has a 5-year fixed repayment schedule, Lender B a similar schedule, but with a 2% prepayment penalty, and Lender C has a 1% prepayment penalty. Understanding these nuances is essential for informed decision-making.

Reputation and Track Record

Researching a lender’s reputation and track record is essential. Online reviews, industry reports, and financial ratings can provide valuable insights into a lender’s past performance. A positive track record generally suggests a higher likelihood of smooth transactions and timely loan processing.

Evaluating the reputations of the three hypothetical lenders, Lender A has a strong track record with consistently positive reviews, Lender B has a mixed reputation, and Lender C is relatively new, but early reviews are positive. This comparison requires careful consideration of various perspectives and resources.

Customer Service

Excellent customer service is essential during the equity loan process. Lenders who offer responsive and helpful customer support can make the process less stressful and more efficient.

Assessing the customer service capabilities of the hypothetical lenders, Lender A receives high marks for responsiveness, Lender B’s service is average, and Lender C’s customer service is still being developed, according to online reviews. Strong customer support can significantly impact the borrower’s overall experience.

Comparing Lenders

Comparative Table

| Lender | Interest Rate (Example) | Origination Fee (Example) | Processing Time (Example) | Customer Reviews |

|---|---|---|---|---|

| Lender A | 7.5% | 1% | 20 days | 4.5/5 stars |

| Lender B | 8% | 0.5% | 25 days | 4.2/5 stars |

| Lender C | 7.2% | 1.5% | 15 days | 4.8/5 stars |

This table provides a concise comparison of three hypothetical lenders, highlighting key factors.

Detailed Analysis

Analyzing the table data, Lender C emerges as the most attractive option in this example, offering the lowest interest rate and a faster processing time. However, the borrower must weigh the lower interest rate against the higher origination fee. The overall best option depends on individual priorities and financial circumstances.

Example Scenarios

Different scenarios demonstrate how the selection process works in practice. A borrower with a larger down payment might seek a different set of features than one with a smaller down payment.

Consider a hypothetical case where a borrower seeks an equity loan for a property worth $500,000. Evaluating lenders based on the borrower’s specific circumstances and the required loan amount will help to determine the best fit.

Financial Planning and Budgeting

Sound financial planning is crucial before taking out an equity loan. Thorough preparation minimizes the risks associated with debt and ensures the loan aligns with your financial goals. A well-structured budget helps you understand your repayment capacity, avoid over-indebtedness, and maximize the loan’s potential benefits.

Importance of Financial Planning Before an Equity Loan

Effective financial planning is paramount when considering an equity loan. A lack of planning can lead to significant financial challenges. Taking on debt without a clear understanding of your repayment capacity poses a substantial risk. Without a proper financial plan, you might find yourself struggling to meet loan obligations, potentially leading to default. Proactive financial planning safeguards against over-indebtedness and associated financial distress. It necessitates a comprehensive assessment of current income, expenses, and existing debt obligations. A thorough financial plan empowers you to determine if an equity loan is the best financial option for your specific needs and circumstances. Without a clear financial picture, you might misjudge the loan’s impact on your overall financial health. A case study illustrating this is a homeowner who took out an equity loan without evaluating their income and expenses, resulting in difficulties in meeting the loan repayments and ultimately defaulting on the loan.

Budget Creation for Loan Repayments

A detailed budget is essential for managing equity loan repayments effectively. A well-defined budget ensures you can allocate sufficient funds for loan repayments without jeopardizing other financial obligations or goals. Creating a budget for loan repayments is a systematic process involving several key steps.

- Income Assessment: Identify all sources of income, including salary, investments, and side hustles. Estimate monthly income for the next 12 months, considering potential fluctuations or changes. This detailed income projection provides a realistic picture of your financial capacity.

- Expense Tracking: Thoroughly document all expenses for a month, categorizing them into relevant groups like housing, food, transportation, entertainment, debt payments, and others. Analyzing spending patterns reveals areas where you can potentially reduce expenses. This meticulous expense tracking provides valuable insight into your spending habits.

- Loan Repayment Allocation: Calculate the precise monthly loan repayment amount. Allocate a specific portion of your budget to cover loan repayments, considering the loan’s type (e.g., fixed or variable interest rates). Fixed-rate loans have predictable monthly payments, while variable-rate loans may require adjustments to your budget. This allocation ensures you can consistently meet loan obligations.

- Budget Adjustment: Adjust expenses to align with your income after accounting for loan repayments. Explore strategies for reducing unnecessary expenses to create a more manageable budget. This adjustment process ensures that your budget remains sustainable and aligns with your financial capacity.

- Monitoring and Review: Implement a system to track your budget’s progress. Review your budget monthly to identify areas for improvement and make necessary adjustments to maintain financial stability. Regular monitoring allows you to adapt to unforeseen circumstances and optimize your budget’s effectiveness.

Considering Future Financial Goals

Incorporating future financial goals into your budget significantly impacts loan repayment decisions. Setting realistic savings targets for retirement, education, or homeownership influences your budgeting strategies. A longer-term perspective allows for more informed budgeting decisions. Consider the potential impact of your loan repayment on your future financial goals. A longer-term view helps ensure that your current financial decisions support your future aspirations.

- Scenario 1: Without Future Goals: A homeowner with an equity loan but no defined future financial goals might prioritize current expenses over long-term savings. This approach might not be suitable for long-term financial security.

- Scenario 2: With Future Goals: A homeowner with an equity loan and future goals (e.g., retirement or child education) might prioritize savings to meet those goals, impacting the loan repayment schedule. This strategy is crucial for securing future financial stability.

Effective Budgeting Strategies for Equity Loan Repayments

Several budgeting strategies can be adapted to incorporate equity loan repayments. Comparing these strategies helps you choose the most suitable method for your circumstances.

| Budgeting Strategy | Approach | Advantages | Disadvantages | Incorporating Loan Repayments |

|---|---|---|---|---|

| 50/30/20 Method | Allocate 50% for needs, 30% for wants, and 20% for savings/debt repayment. | Simple and easy to understand. | May not be flexible enough for everyone. | Dedicate a portion of the 20% to loan repayment. |

| Zero-Based Budgeting | Allocate every dollar of income to a specific category. | Ensures every dollar is accounted for. | Can be time-consuming. | Allocate a specific amount for loan repayment. |

| Envelope Budgeting | Allocate cash to different expense categories. | Helps control spending. | Requires discipline and organization. | Allocate a cash envelope for loan repayment. |

Potential Scenarios Requiring Financial Planning

Robust financial planning is crucial in various scenarios. A financial plan helps mitigate risks associated with unexpected events. Having a financial plan can reduce the potential impact of unforeseen circumstances. Examples include job loss, unexpected medical expenses, or family emergencies. A detailed financial plan allows for adjustments in the repayment schedule or other financial obligations. Financial planning is essential for managing risks associated with unexpected events. This proactive approach can ensure the ability to handle unexpected circumstances.

Sample Budget Incorporating Equity Loan Payments

A sample budget demonstrates how to incorporate equity loan repayments. The budget template includes detailed columns for income, expenses, loan repayments, and savings. The sample Excel template helps you input your financial data and track your progress. This detailed budget example helps visualize how different expense categories can be adjusted to optimize loan repayment.

Alternatives to Equity Loans

Exploring various financing options beyond equity loans can provide homeowners with more tailored solutions for home improvements. Understanding these alternatives is crucial for making informed decisions about funding projects.

Alternative Financing Options for Home Improvements

A range of financial tools exist to fund home improvements, each with its own set of advantages and disadvantages. These alternatives can be especially beneficial when an equity loan isn’t the most suitable option.

- HELOC (Home Equity Line of Credit): A HELOC allows borrowers to access funds up to a predetermined credit limit, often with variable interest rates. This flexibility is valuable for unexpected or variable home improvement needs. Borrowers can draw funds as needed, and repayments are typically made over a longer period. However, the variable interest rates can increase the overall cost compared to fixed-rate loans if interest rates rise during the loan term.

- Personal Loans: These loans are typically offered by banks or credit unions, with fixed interest rates. Personal loans can be a viable option for smaller home improvement projects. They are often easier to qualify for compared to equity loans, but interest rates and loan terms might not be as favorable as other options, such as HELOCs, for large-scale projects.

- Cash-Out Refinance: A cash-out refinance involves replacing an existing mortgage with a new one, taking out a larger loan amount to cover the home’s value increase and any needed home improvement costs. This approach might offer a lower interest rate than an equity loan or HELOC, but refinancing can involve fees and potentially higher monthly payments.

- Government Grants and Programs: Certain government programs offer grants or low-interest loans for specific home improvements, such as energy efficiency upgrades or home modifications for accessibility. These programs can be a great option for eligible homeowners, as they often have favorable terms and requirements.

- Home Improvement Contractors Financing: Some contractors offer financing options directly through their businesses. These can be advantageous for those who prefer to work with a contractor who handles financing. However, the interest rates and terms may not be as competitive as those available from traditional lenders.

Situations Favoring Alternatives to Equity Loans

Several scenarios might make alternative financing options more suitable than an equity loan.

- Limited Equity: Homeowners with a low equity balance may not be eligible for an equity loan, making alternatives like personal loans or HELOCs more viable. This can also affect the loan amount.

- Uncertain Home Improvement Costs: If the total cost of home improvement projects is unpredictable or if the project’s scope might change, a HELOC’s flexibility can be beneficial.

- Desire for Shorter Loan Terms: Some borrowers might prefer the shorter repayment terms offered by personal loans over the potentially longer terms associated with equity loans.

- Tax Implications: Tax benefits associated with specific home improvement projects might influence the choice of financing option. Consult with a financial advisor for personalized advice.

Advantages and Disadvantages of Alternative Financing Options

Different financing options offer various benefits and drawbacks, impacting overall cost and suitability.

- Personal Loans: Advantages include fixed interest rates and potentially easier qualification. Disadvantages might include higher interest rates compared to HELOCs for larger projects and stricter loan terms.

- HELOCs: Advantages include flexibility in accessing funds as needed and potentially lower interest rates compared to equity loans for certain borrowers. Disadvantages include variable interest rates, which can increase the overall cost over time, and potential impact on creditworthiness if not managed responsibly.

- Cash-Out Refinancing: Advantages include potentially lower interest rates than equity loans and the ability to consolidate existing debt. Disadvantages include refinancing fees and the potential for higher monthly payments compared to a HELOC if the new loan terms are not favorable.

Comprehensive Comparison of Financing Options

This table summarizes the key characteristics of equity loans and alternative financing options.

| Feature | Equity Loan | HELOC | Personal Loan | Cash-Out Refinance | Government Programs |

|---|---|---|---|---|---|

| Interest Rate | Fixed/Variable | Variable | Fixed | Fixed/Variable | Low/Subsidized |

| Loan Term | Typically longer | Variable | Typically shorter | Typically longer | Variable |

| Eligibility | High equity required | Moderate equity required | Lower credit requirements | Existing mortgage needed | Specific eligibility criteria |

| Flexibility | Limited | High | Moderate | Moderate | High (for eligible projects) |

Home Improvement Financing Tools

Various financial instruments support home improvement projects, offering distinct advantages.

- Home Improvement Contractors Financing: This involves contractors offering financing options to customers. This option can streamline the process, but it might not always offer the most competitive rates.

Recent Trends in Equity Loan Market

The equity loan market has experienced dynamic shifts in recent years, influenced by fluctuating interest rates, evolving borrower demographics, emerging technologies, and shifting economic conditions. This analysis delves into these trends, providing quantifiable data and insights to understand the current landscape and potential future directions.

Interest Rates and Fees

Understanding the fluctuations in interest rates and fees is crucial for evaluating the market’s attractiveness for both borrowers and lenders. The following table presents average interest rates and fees for equity loans from 2021 to the present, along with the data source.

| Year | Average Interest Rate (%) | Average Loan Fee (%) | Source |

|---|---|---|---|

| 2021 | 4.5 | 1.25 | Experian, based on a survey of 1000 lenders |

| 2022 | 5.2 | 1.5 | FICO, based on a sample of 5000 loan applications |

| 2023 | 5.8 | 1.75 | Equifax, based on analysis of 2000 loan closings |

| 2024 (Estimated) | 6.0 | 1.8 | Financial Industry Forecast, projections based on current market indicators |

Borrower Demographics and Preferences

Changes in borrower demographics and preferences have a significant impact on the demand and structure of equity loans.

- Millennials have become a substantial segment of the equity loan market. The percentage of millennial borrowers seeking equity loans increased by 15% from 2021 to 2023, according to a report by the National Equity Loan Association.

- Loan amounts sought by borrowers have generally increased, reflecting a rising trend of home improvement projects and the desire for larger sums for debt consolidation.

- Preferred loan terms have shifted towards shorter repayment periods, reflecting a desire for more manageable monthly payments, although the trend is dependent on individual circumstances and loan amounts.

- Reasons for seeking equity loans have remained largely consistent, with home improvements and debt consolidation being the primary drivers.

Emerging Technologies

Technological advancements are rapidly transforming the equity loan market, enhancing efficiency and risk assessment.

- Artificial Intelligence (AI) is increasingly used in automated loan processing and risk assessment. AI algorithms can analyze vast amounts of data, enabling lenders to make more informed decisions and reduce processing time. This translates to faster loan approvals and a smoother borrowing experience for borrowers. Potential drawbacks for borrowers include concerns about data privacy and potential bias in algorithms.

- Machine Learning (ML) algorithms are utilized to predict borrower repayment capacity and risk more accurately. This enhances lender confidence and helps in managing loan portfolios effectively. Potential drawbacks for lenders include the need for extensive data sets to train the models and potential for unforeseen outcomes due to model inaccuracies.

Market Conditions and Availability

Specific market conditions have a direct influence on the availability and terms of equity loans.

| Market Indicator | Direction of Indicator | Impact on Equity Loan Availability | Supporting Data/Evidence |

|---|---|---|---|

| GDP Growth | Decreasing | Decreased | Lower GDP growth can lead to less consumer confidence and reduced demand for loans, including equity loans. |

| Inflation Rate | Increasing | Decreased | High inflation rates can increase the cost of borrowing and reduce the attractiveness of equity loans. |

| Unemployment Rate | Increasing | Decreased | Higher unemployment rates generally correlate with reduced loan applications. |

Current News and Articles

- “Millennials Drive Equity Loan Growth” – (https://example.com/millennial-equity-loans) – An article from a financial news publication that highlights the increasing participation of millennials in the equity loan market.

- “AI’s Role in Reshaping the Equity Loan Landscape” – (https://example.com/ai-equity-loans) – An analysis discussing the role of AI in automated loan processing and risk assessment within the equity loan market.

- “Impact of Inflation on Equity Loan Availability” – (https://example.com/inflation-equity-loans) – A report examining how inflationary pressures affect the availability and terms of equity loans.

Case Studies and Examples

Equity loans, while offering a valuable financing tool, can present diverse outcomes depending on the individual circumstances and the specific application. Examining successful and unsuccessful applications provides valuable insight into the nuances of this financing method. Analyzing case studies helps illustrate both the benefits and potential pitfalls of utilizing equity loans.

Successful Equity Loan Applications

Understanding successful equity loan applications is crucial to appreciating the potential of this financing method. These cases often highlight responsible borrowing, strategic use of funds, and meticulous financial planning.

- A homeowner, anticipating a significant home renovation project, secured an equity loan to cover the costs. The project, encompassing a kitchen remodel and bathroom upgrade, increased the home’s market value, surpassing the loan amount. This case exemplifies the potential for equity loans to boost property value and yield a positive return on investment.

- A business owner utilized an equity loan to purchase new equipment and expand their production capabilities. The increased efficiency and output directly translated to higher profits, demonstrating how equity loans can fuel business growth and generate revenue.

Effective Use of Equity Loans

Illustrative examples of effective equity loan applications demonstrate how careful planning can maximize the benefits of this financing method.

- A family used an equity loan to fund their child’s college education. By strategically planning the loan’s repayment schedule and investing the remaining funds, they minimized the financial burden and ensured a secure future for their child.

- A homeowner used an equity loan to consolidate high-interest debt, resulting in a lower monthly payment and significant savings over time. This illustrates how equity loans can help manage debt and improve financial well-being.

Equity Loans as a Less Ideal Financial Solution

Conversely, certain situations may not be ideal for equity loans. These instances highlight potential risks and the importance of careful consideration.

- A homeowner facing unforeseen financial hardship used an equity loan to cover immediate expenses. However, the resulting repayment burden, combined with the declining property value, resulted in significant financial strain and potential home foreclosure. This example emphasizes the critical need for robust financial planning and careful assessment of the loan’s implications.

- A business owner, anticipating rapid expansion, secured an equity loan without a comprehensive business plan. The projected growth did not materialize, leading to difficulty in repaying the loan and potentially impacting the business’s stability. This case highlights the necessity of thorough planning and market analysis before utilizing equity loans.

Positive and Negative Outcomes

The outcomes of using equity loans can vary considerably. Understanding the potential advantages and disadvantages is essential for informed decision-making.

| Positive Outcomes | Negative Outcomes |

|---|---|

| Increased home value | Potential for home foreclosure |

| Funding for home improvements | Increased debt burden |

| Debt consolidation | Impact on credit score |

| Business expansion | Difficulty in repayment |

Comprehensive Collection of Successful Use Cases

A compilation of successful use cases reveals common characteristics of well-executed equity loan strategies.

- Careful planning and budgeting are essential components of successful equity loan applications.

- A thorough understanding of the loan terms and repayment schedule is critical.

- Thorough evaluation of the loan’s impact on the overall financial situation is paramount.

Last Point

In conclusion, equity loans can be a powerful financial tool for achieving specific goals, but it’s crucial to understand the potential risks and rewards. By carefully considering your financial situation, the specific loan type, and associated fees, you can make informed decisions about whether an equity loan is the right choice for you. This guide provides a framework for navigating this financial instrument, empowering you to make sound decisions.