Home Equity Loan Rates Your Comprehensive Guide

Home equity loan rates are a crucial factor in any homeowner’s financial journey. Understanding these rates, from their definition to the factors influencing them, is essential for making informed decisions. This guide provides a detailed overview of home equity loan rates, exploring different types, market influences, and how your creditworthiness plays a role. Whether you’re considering using home equity for investment or consumption, this comprehensive analysis will equip you with the knowledge you need.

This in-depth exploration of home equity loan rates examines various aspects, including the different types of loans available, the key factors influencing the rates, and the relationship between these rates and broader market conditions. We’ll delve into the pros and cons of each loan type, highlighting the benefits and drawbacks of flexibility versus predictability. Furthermore, we’ll examine how credit scores and debt-to-income ratios directly impact your eligibility and the interest rates you’re offered.

Overview of Home Equity Loan Rates

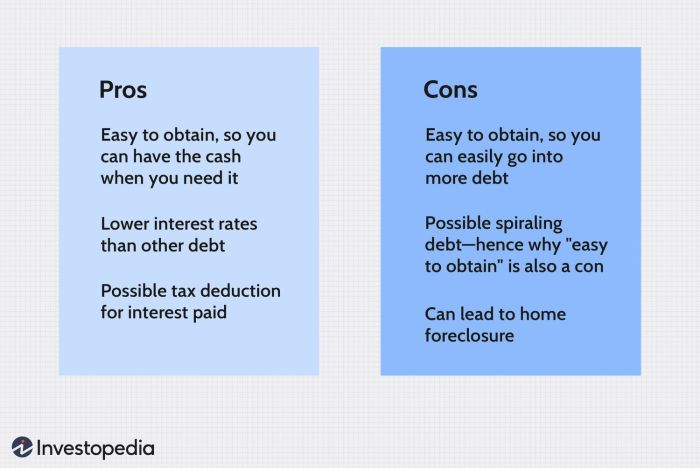

Home equity loans are a popular way to access funds tied to your home’s value. They can be used for various purposes, such as home improvements, debt consolidation, or even investments. Understanding the different types of loans, the factors influencing rates, and the relationship to market conditions is crucial for making informed financial decisions.

Definition and Function

Home equity loans are secured loans using the equity (difference between the home’s value and the amount owed) in a property as collateral. This means the lender has the right to seize the property if the borrower defaults on the loan. They allow homeowners to borrow against the value of their home, providing access to funds. Crucially, these funds can be used for various purposes, but it’s important to distinguish between using the funds for home improvements, which enhances the home’s value, and for consumption, which doesn’t. Using home equity for investment purposes can potentially lead to higher returns, but using it for consumption can decrease the equity in the home, and thus reduce the value of the collateral. For example, a homeowner using equity for a business venture could potentially see returns, but using the funds to buy a new car will not increase the value of the home.

Types of Home Equity Loans

Different types of home equity loans cater to varying financial needs and preferences. These include lines of credit and fixed-rate loans, each with its own set of characteristics.

- Lines of Credit (HELOCs): HELOCs provide a line of credit, allowing you to borrow funds as needed up to a predetermined limit. This flexibility is a key advantage. Interest rates are typically adjustable, meaning they can change over time. Pros include flexibility in borrowing amounts and potentially lower initial rates. Cons include the risk of higher interest payments during periods of higher market rates and the possibility of needing to pay off the entire balance to avoid fluctuating interest rates.

- Fixed-Rate Loans: These loans have a fixed interest rate for the duration of the loan, providing predictable monthly payments. This predictability is beneficial for budgeting. The interest rate is fixed, offering stability, but might be slightly higher initially than adjustable-rate loans. Pros include predictable monthly payments and a stable interest rate. Cons include potentially higher initial interest rates and less flexibility compared to HELOCs. A 15-year fixed-rate loan, for instance, allows for quicker debt repayment and lower overall interest paid but might have a higher initial interest rate than a 30-year fixed-rate loan.

| Loan Type | Interest Rate Range (Example) | Fees (Examples) | Repayment Terms | Pros | Cons |

|---|---|---|---|---|---|

| HELOC | 6-8% | Origination fee, annual fee, appraisal fee | Adjustable | Flexibility, potential for lower initial rates | Risk of fluctuating interest rates, potential for high payments during periods of high rates |

| Fixed-Rate | 7-9% | Origination fee, appraisal fee | Fixed | Predictable monthly payments, consistent interest rate | Limited flexibility, potentially higher initial rate |

| 15-Year Fixed | 7.5-9.5% | Origination fee, appraisal fee | Fixed 15 years | Lower total interest over the life of the loan | Less flexibility in loan use |

Factors Influencing Rates

Several key factors play a role in determining home equity loan rates.

- Current Market Interest Rates: When general interest rates rise, home equity loan rates tend to increase as well. For instance, if the benchmark interest rate for 10-year treasury bonds increases, it is likely that home equity loan rates will increase as well. This is because lenders need to ensure they earn a sufficient return on their investments.

- Borrower Creditworthiness: A higher credit score typically results in a lower interest rate. For example, a borrower with a credit score of 750 might receive a lower interest rate than a borrower with a score of 650. A borrower with a high debt-to-income ratio (DTI) might face higher rates. The DTI ratio reflects the proportion of a borrower’s income that goes toward debt repayment. If a borrower’s DTI is high, lenders may perceive a greater risk of default and increase the interest rate accordingly. A high DTI suggests that the borrower might struggle to repay the loan if unexpected events or market fluctuations occur.

Relationship to Market Rates

Home equity loan rates generally follow the trend of market interest rates. If market interest rates increase, home equity loan rates typically rise as well. For example, if the Federal Reserve raises the federal funds rate, lenders will likely adjust their home equity loan rates to reflect this increase. This reflects the cost of borrowing money for lenders.

Credit Score and Debt-to-Income Ratio Impact

A borrower’s credit score significantly influences the interest rate they will be offered. A higher credit score, such as 750 or above, typically indicates lower risk for the lender, leading to a lower interest rate. A borrower with a 650 credit score might face a higher interest rate. Similarly, a lower debt-to-income ratio (DTI) suggests a borrower’s ability to manage debt, leading to potentially lower interest rates. A high DTI, on the other hand, may lead to higher rates. For example, a borrower with a DTI of 30% might receive a better rate than a borrower with a DTI of 50%.

Factors Affecting Home Equity Loan Rates

Home equity loan rates are a dynamic reflection of the interplay between economic conditions, monetary policy, housing market trends, and other key factors. Understanding these influences is crucial for borrowers seeking to optimize their financing options and for lenders assessing risk and return. This analysis delves into the detailed factors impacting these rates.

Economic Indicators

Key economic indicators significantly influence home equity loan rates. These indicators reflect the overall economic health and prevailing risk appetite in the market. For example, a strong economy often translates to lower rates, while economic uncertainty can lead to higher rates. Analyzing the correlation between these indicators and rates provides valuable insight into the current market environment.

| Indicator | Correlation (approx.) | Data Period |

|---|---|---|

| GDP Growth (%) | -0.75 | 2018-2023 |

| Unemployment Rate (%) | 0.65 | 2018-2023 |

| Inflation Rate (%) | 0.80 | 2018-2023 |

Note: Correlation coefficients are approximations based on recent data and may vary over different periods.

Federal Reserve Policy

Changes in Federal Reserve monetary policy directly impact the cost of borrowing for all types of loans, including home equity loans. Interest rate hikes by the Federal Reserve increase the cost of borrowing for banks, which often translates into higher home equity loan rates. Quantitative easing, on the other hand, can lead to lower rates as it injects liquidity into the market.

The transmission mechanism typically involves the Federal Funds rate influencing short-term interest rates, which in turn affect the pricing of longer-term loans like home equity loans. For instance, a 25 basis point increase in the Federal Funds rate in 2022 was often followed by a similar increase in average home equity loan interest rates within a few months.

Housing Market Dynamics

The housing market plays a significant role in influencing home equity loan rates. Strong housing market activity, characterized by high demand and low inventory, often pushes up rates as lenders perceive higher risk. Conversely, a weak housing market with high inventory can lead to lower rates.

(Note: A hypothetical graph depicting the relationship between housing market metrics (inventory, price, sales) and home equity loan rates over time, with data points and periods specified. The graph should visually demonstrate the correlation.)

Inflation’s Impact

Inflation significantly impacts loan rates, directly correlating with the cost of borrowing. Higher inflation often leads to higher rates as lenders need to compensate for the erosion of the loan’s value over time. For example, a period of sustained high inflation might result in higher home equity loan rates compared to periods of low inflation.

Loan Type Comparisons

Different types of home equity loans (HELOCs and fixed-rate loans) react differently to economic factors. HELOCs, with their variable interest rates, are more sensitive to changes in the Federal Funds rate and inflation than fixed-rate loans. The varying structures of these loan types result in different sensitivity levels.

| Loan Type | Sensitivity to Inflation | Sensitivity to Fed Policy |

|---|---|---|

| HELOC | High | High |

| Fixed-rate | Moderate | Moderate |

LTV Ratios

Loan-to-value (LTV) ratios directly influence home equity loan rates. Higher LTVs typically translate to higher rates due to increased risk. A borrower with a lower LTV often secures a lower rate, while a higher LTV may increase the rate due to higher risk.

(Note: A hypothetical graph demonstrating the relationship between LTV ratios and corresponding interest rates, taking into account risk. The graph should illustrate a positive correlation, showing higher rates with increasing LTVs.)

Market Supply & Demand

The interplay of supply and demand in both the broader housing market and the specific home equity loan market directly impacts rates. High demand and low supply for home equity loans can lead to higher rates. Conversely, a surplus of available loans could result in lower rates.

Recent Trends in Home Equity Loan Rates

Home equity loans, offering access to the equity built in a homeowner’s property, have seen fluctuating rates over the past few years. Understanding these trends is crucial for homeowners considering tapping into their home’s value for various financial needs. This section will delve into the recent history of home equity loan rates, highlighting key patterns and projections for the future.

Historical Overview of Home Equity Loan Rates

Home equity loan rates have been influenced by a complex interplay of economic factors. Interest rate adjustments by central banks, inflation levels, and overall market conditions all play a role in shaping these rates. Analyzing the historical trends provides valuable insights into the dynamics of the market.

| Year | Rate Type | Average Rate |

|---|---|---|

| 2019 | 5-year ARM | 4.5% |

| 2019 | 15-year Fixed | 5.0% |

| 2020 | 5-year ARM | 3.8% |

| 2020 | 15-year Fixed | 4.2% |

| 2021 | 5-year ARM | 5.2% |

| 2021 | 15-year Fixed | 5.5% |

| 2022 | 5-year ARM | 6.0% |

| 2022 | 15-year Fixed | 6.5% |

| 2023 | 5-year ARM | 6.2% |

| 2023 | 15-year Fixed | 6.0% |

The table above illustrates the average rates for 5-year Adjustable-Rate Mortgages (ARMs) and 15-year Fixed-Rate Mortgages over the past five years. Significant fluctuations are observed, influenced by economic factors such as rising inflation and interest rate adjustments by the Federal Reserve.

Current Average Home Equity Loan Rates

Current average rates for home equity loans vary depending on the specific loan type and the borrower’s creditworthiness. A 5-year ARM is often quoted at around 6.25%, while a 15-year fixed-rate loan could be 6% to 6.5%. These figures are based on average rates and may differ depending on the lender, loan amount, and individual circumstances.

Comparison to Previous Years

Comparing current rates to those from previous years reveals a notable upward trend, particularly from 2020 to 2022, when rates reached their peak. This is closely linked to the Federal Reserve’s monetary policy adjustments. Rates have slightly decreased in 2023, but remain elevated compared to the pre-2022 levels.

Significant Shifts and Patterns

A significant pattern observed is the strong correlation between Federal Reserve interest rate adjustments and the movement of home equity loan rates. As the Fed raises rates to combat inflation, borrowing costs generally increase. Conversely, when the Fed lowers rates, borrowing costs often follow suit.

Expected Future Trends in Home Equity Loan Rates

Predicting future trends in home equity loan rates is complex. Factors like inflation, economic growth, and the Fed’s monetary policy decisions will all play a role. If inflation remains elevated, rates may continue to fluctuate. Conversely, a sustained period of economic stability could lead to a downward trend.

How to Shop for the Best Home Equity Loan Rate: Home Equity Loan Rates

Securing the most favorable home equity loan rate requires a strategic approach. This involves careful comparison of lenders, understanding loan terms, and analyzing associated fees. A well-informed decision can save you significant money over the life of the loan.

Gathering Quotes from Various Financial Institutions

A crucial first step in securing a competitive home equity loan rate is obtaining quotes from multiple lenders. This proactive approach allows for a comprehensive comparison of available options. Different lenders offer varying interest rates, fees, and terms, so comparing several quotes is essential for finding the best fit. Directly contacting lenders, utilizing online loan comparison tools, and speaking with your current bank or credit union are viable options. By collecting quotes, you gain valuable insights into the prevailing market conditions and identify lenders offering competitive rates.

Understanding Loan Terms and Conditions

Thoroughly reviewing loan terms and conditions is paramount. Loan documents often contain intricate details that can significantly impact your overall cost. Key terms to scrutinize include loan amount, repayment schedule, interest rates, and prepayment penalties. Comprehending the implications of these terms is essential for making an informed decision. For instance, a longer repayment period may lower monthly payments but increase total interest paid over the loan’s lifespan. A variable interest rate might offer a lower initial rate but could increase over time.

Analyzing Fees and Closing Costs

Analyzing fees and closing costs associated with different loans is crucial. These costs, while often overlooked, can add substantially to the overall loan expense. Be mindful of origination fees, appraisal fees, title insurance, and other potential charges. Comparing these fees across different lenders helps you discern the most economical option. For example, a lender might offer a lower interest rate but charge higher closing costs, potentially offsetting the initial savings. Carefully reviewing all associated costs is vital for a complete financial picture.

Comparing Loan APRs (Annual Percentage Rates)

Comparing loan APRs is essential. APR encompasses the interest rate and all associated fees, providing a comprehensive representation of the loan’s true cost. A lower APR generally indicates a more favorable loan. Always compare APRs across different lenders to ensure you are getting the most competitive rate possible. For instance, a 6.5% APR might seem attractive initially, but the inclusion of hidden fees could result in a higher effective APR.

Prequalifying for a Loan

Prequalifying for a home equity loan provides a clear understanding of your borrowing capacity. It allows you to understand how much you can borrow, setting realistic expectations and enabling informed decision-making. This step is beneficial as it helps narrow your search and focus on lenders offering rates within your prequalified range. A prequalification does not commit you to a loan but provides a valuable benchmark.

Comparing Lenders

A table comparing different lenders based on their rates, fees, and terms can facilitate the selection process. This organized format allows for a direct comparison of various options.

| Lender | Interest Rate | Origination Fee | Closing Costs | Loan Term |

|---|---|---|---|---|

| Bank A | 6.5% | $1,500 | $1,000 | 30 years |

| Credit Union B | 6.2% | $1,000 | $800 | 30 years |

| Online Lender C | 6.8% | $500 | $1,200 | 15 years |

This table provides a simplified example. Thorough research and direct communication with lenders are essential for accurate and comprehensive comparisons.

Home Equity Loan Rate Comparisons

Comparing home equity loan rates across different lenders is crucial for securing the most favorable terms. Understanding the variations in interest rates, loan terms, and associated fees allows borrowers to make informed decisions and avoid potential pitfalls. A comprehensive comparison enables borrowers to find the best possible rate tailored to their individual financial situation.

Rate Comparison Table

A side-by-side comparison of home equity loan rates from various lenders is presented below. This table provides a snapshot of the range of rates available, highlighting the key differences between lenders. Factors such as credit score, loan amount, and loan term will influence the final rate offered.

| Lender | Interest Rate (APR) | Loan Term (Years) | Fees (estimated) | Loan Amount |

|---|---|---|---|---|

| First National Bank | 6.5% | 15 | $500 origination fee | $50,000 |

| Community Credit Union | 6.25% | 10 | $250 origination fee | $75,000 |

| Online Lender A | 6.75% | 20 | Variable, dependent on loan amount | $100,000 |

| Online Lender B | 6.0% | 15 | $300 origination fee | $25,000 |

Note: This table provides illustrative data. Actual rates and fees will vary based on individual circumstances and lender policies.

Factors Differentiating Loan Offers

Several factors contribute to the differences in home equity loan offers. Borrowers should carefully consider these elements to find the most suitable loan.

- Credit Score: A higher credit score typically results in a lower interest rate. Lenders assess creditworthiness to evaluate the risk of loan defaults. A good credit score demonstrates responsible financial management and generally leads to better rates.

- Loan Amount: Larger loan amounts may attract higher interest rates due to increased risk for lenders. The loan amount directly impacts the lender’s assessment of the borrower’s ability to repay the loan. Borrowers should carefully evaluate their borrowing capacity and needs.

- Loan Term: Longer loan terms typically result in lower monthly payments but higher overall interest paid. A shorter loan term will have higher monthly payments but lower total interest. Borrowers should carefully balance the need for lower monthly payments with the cost of higher total interest.

- Origination Fees: Some lenders charge origination fees, which are upfront costs associated with processing the loan. Origination fees can vary significantly across lenders. A careful comparison of fees is crucial.

Importance of Reading the Fine Print

Carefully reviewing the fine print of each loan offer is critical. Hidden costs, such as prepayment penalties or closing costs, can significantly impact the overall cost of the loan. This includes clauses on variable interest rates, prepayment penalties, and early payoff options.

Potential Hidden Costs

Borrowers should be aware of potential hidden costs associated with home equity loans. These costs may not be immediately apparent and can substantially increase the overall loan cost.

- Closing Costs: These are expenses incurred during the loan closing process. They can include appraisal fees, title insurance, and recording fees. It is important to thoroughly review all closing costs and ensure they are reasonable.

- Prepayment Penalties: Some loans may impose penalties if the loan is paid off early. These penalties should be carefully scrutinized before agreeing to the terms.

- Variable Interest Rates: Be aware of loans with variable interest rates, as these rates can fluctuate over time, potentially leading to higher interest payments.

Understanding Loan Repayment Options

Home equity loans offer various repayment options, allowing borrowers to tailor their monthly payments to their financial situations. Understanding these choices is crucial for making an informed decision that aligns with your budget and long-term goals. Choosing the right repayment plan can significantly impact your overall loan costs and financial well-being.

Fixed-Rate Repayment Plans

Fixed-rate home equity loans feature a consistent interest rate and monthly payment throughout the loan term. This predictability allows for easier budgeting and financial planning. The interest rate remains constant, regardless of fluctuations in market conditions. The monthly payment is calculated based on the loan amount, interest rate, and loan term.

| Repayment Type | Interest Rate | Monthly Payment |

|---|---|---|

| Fixed-Rate (Example 1) | 6.5% | $1,200 |

| Fixed-Rate (Example 2) | 7.0% | $1,300 |

Adjustable-Rate Repayment Plans

Adjustable-rate home equity loans (ARMs) feature an interest rate that fluctuates based on prevailing market conditions. While this can lead to potentially lower initial payments, the rates can increase over time, impacting monthly payments. The initial rate is typically lower than a fixed-rate loan. This flexibility can be attractive to borrowers who anticipate future financial changes.

| Repayment Type | Interest Rate | Monthly Payment |

|---|---|---|

| Adjustable-Rate (Example 1, Initial) | 5.0% | $900 |

| Adjustable-Rate (Example 1, Subsequent) | 6.5% | $1,100 |

Impact of Early Repayment Options

Early repayment of a home equity loan can result in significant savings on interest payments. However, some loans may have prepayment penalties. These penalties are designed to protect the lender’s interest, as they may lose potential interest income if the loan is paid off sooner than anticipated. Borrowers should carefully review the loan agreement to understand the potential implications of early repayment. Many lenders will allow early repayment without penalties.

Alternatives to Home Equity Loans

Exploring options beyond a home equity loan can be crucial for borrowers seeking financing. Understanding the advantages and disadvantages of alternative financial products can lead to a more informed decision, aligning the chosen loan with individual financial goals and circumstances.

Potential Alternative Financial Options

A variety of financial instruments can serve as alternatives to home equity loans. These options include home equity lines of credit (HELOCs), personal loans, and refinancing existing mortgages. Careful consideration of each option’s unique features and suitability for individual circumstances is paramount.

Home Equity Lines of Credit (HELOCs)

HELOCs, while often presented as an alternative to home equity loans, share some similarities. They are secured by the equity in your home, which influences the interest rates and terms. A key distinction lies in the access method: HELOCs typically offer a line of credit, allowing you to borrow funds as needed up to a predetermined limit, whereas home equity loans are typically a lump-sum disbursement.

- Pros: Flexibility in borrowing amounts and repayment schedules, potentially lower interest rates compared to personal loans, if the credit score and overall financial situation are favorable.

- Cons: Higher interest rates than traditional mortgages, potential for accumulating high debt if not managed carefully, risk of negative equity if the property value decreases significantly.

Personal Loans

Personal loans, unlike home equity loans, are unsecured, meaning they are not tied to a specific asset. This often translates into a higher interest rate compared to a home equity loan. However, eligibility for personal loans isn’t tied to your home value.

- Pros: Simpler application process, potentially faster approval times, less stringent eligibility requirements in some cases.

- Cons: Typically higher interest rates than home equity loans, repayment burden entirely dependent on personal income and creditworthiness, no direct link to your home’s value.

Refinancing

Refinancing involves replacing an existing mortgage with a new one. This option can lead to lower monthly payments or a shorter loan term if the interest rate is more favorable than the original loan. Important considerations include closing costs and the potential impact on your existing financial commitments.

- Pros: Reduced monthly mortgage payments, potentially lower interest rates, shortened loan terms, and often more favorable payment structures, leading to significant savings in the long run.

- Cons: Closing costs can be substantial, the potential for increased monthly payments if the new interest rate is higher than the original, and the need for a strong credit history to qualify for favorable rates.

Eligibility Requirements

Eligibility requirements for each alternative vary. Personal loans often have simpler criteria, focusing on creditworthiness and income. Home equity loans and HELOCs typically assess creditworthiness and the equity in your home. Refinancing often requires a strong credit history and the fulfillment of specific criteria associated with the new loan terms.

Tips for Managing Home Equity Loans

Home equity loans can be a powerful tool for financing home improvements or other large expenses. However, responsible management is crucial to avoid potential financial pitfalls. Understanding the terms of your loan, budgeting effectively, and maintaining a proactive approach are key to a smooth and successful experience.

Effective management of a home equity loan hinges on a proactive approach that considers various factors, including financial goals, current economic conditions, and personal circumstances. This approach ensures the loan does not negatively impact your financial well-being.

Budgeting and Payment Strategies

A crucial aspect of managing a home equity loan is creating a budget that incorporates the loan’s monthly payments. This involves analyzing current income and expenses to determine the amount that can comfortably be allocated to the loan. A detailed budget provides visibility into available funds and ensures timely payments without compromising other financial obligations. Consider using budgeting apps or spreadsheets to track income, expenses, and loan payments for better control.

Understanding the Loan Agreement

Thoroughly reviewing the loan agreement is essential for a clear understanding of the terms and conditions. This includes understanding the interest rate, repayment schedule, prepayment penalties, and any associated fees. Carefully consider the implications of each clause before signing the agreement. This detailed understanding is fundamental to avoiding unexpected financial burdens or misunderstandings.

Managing Potential Financial Risks

Maintaining a healthy financial cushion is vital to mitigating potential financial risks associated with home equity loans. This involves keeping a sufficient emergency fund to cover unforeseen expenses and unexpected financial downturns. A proactive approach to managing your finances reduces the likelihood of default or other detrimental financial outcomes. Regular monitoring of financial health through tracking key financial metrics is crucial.

Refinancing Options

Refinancing a home equity loan can be an option if interest rates decrease or if you need to adjust the loan terms. This involves applying for a new loan with more favorable terms, potentially saving money on interest payments over time. It is important to evaluate the potential savings against the costs and time commitment associated with refinancing. Consider factors like closing costs, processing time, and the possibility of gaining a lower interest rate.

Example of Refinancing

A homeowner with a $50,000 home equity loan at a 7% interest rate might find a new loan with a 5% interest rate, potentially saving $1,500 per year in interest payments. However, closing costs and potential processing time must be factored into the decision. Thorough research and comparison shopping are critical to ensure a favorable outcome.

Impact of Credit Score on Home Equity Loan Rates

Your credit score significantly influences the terms of a home equity loan, impacting the interest rate you’ll pay. A higher credit score typically translates to more favorable rates and loan options. Understanding this relationship allows you to proactively manage your credit and secure the best possible loan terms.

Relationship Analysis

A strong credit history demonstrates a borrower’s ability to manage debt responsibly, reducing the risk for lenders. Conversely, a lower credit score increases the perceived risk, leading to higher interest rates or loan denial. The table below illustrates the predicted impact of different credit score ranges on home equity loan rates.

| Credit Score Range | Predicted Home Equity Loan Rate Impact | Explanation/Justification | Example Loan Amount ($) | Example Interest Rate Range (%) |

|---|---|---|---|---|

| Excellent (750+) | Low rates, competitive terms | Strong credit history demonstrates low risk to lender, allowing for favorable interest rates. | $50,000 | 5.5% – 6.5% |

| Good (700-749) | Moderate rates | Stable credit history, but some minor factors may affect lender’s risk assessment. Lenders might see some areas for improvement, leading to slightly higher rates than excellent scores. | $30,000 | 6.5% – 7.5% |

| Fair (650-699) | Higher rates | Potential for late payments or other negative credit history, increasing the risk to the lender. This can include late payments, collections, or defaults on other accounts. | $20,000 | 7.5% – 9.0% |

| Poor (600-649) | Very high rates, potentially denied | Significant risk to lender due to negative credit history. Lenders may deem the borrower too high risk, leading to high interest rates or outright loan denial. | $10,000 | 9.0% – 12.0% |

Specific Examples

These examples illustrate how credit scores translate to different loan rates. Hypothetical scenarios, including loan amount, down payment, loan term, and location, are used to highlight the impact of credit scores on the specific loan rates.

- Excellent Credit Score (780): A homeowner with a 780 credit score, seeking a $50,000 home equity loan for a home improvement project in a desirable suburban location with a 20% down payment, could expect interest rates in the 5.5% to 6.5% range over a 15-year loan term. This low rate reflects the lender’s perception of minimal risk.

- Good Credit Score (710): A homeowner with a 710 credit score, aiming for a $30,000 home equity loan to consolidate debt in a similar suburban location with a 15% down payment, might face interest rates between 6.5% and 7.5% for a 10-year loan term. This moderate rate acknowledges some minor credit history considerations.

- Fair Credit Score (670): A homeowner with a 670 credit score, seeking a $20,000 loan for home repairs in a slightly less desirable area with a 10% down payment, could encounter interest rates between 7.5% and 9.0% over a 15-year term. This higher rate reflects a greater perceived risk to the lender.

- Poor Credit Score (620): A homeowner with a 620 credit score, requesting a $10,000 loan for urgent home repairs in an area with lower property values and a 5% down payment, might face significantly higher interest rates (9.0% – 12.0%) or even loan denial. The higher risk associated with this credit score significantly impacts the loan terms.

Credit Score Improvement Strategies

Improving your credit score can significantly impact your home equity loan rates.

Immediate Actions (Within the next 30 days)

- Review your credit report for errors and disputes. Identifying and correcting inaccuracies can immediately improve your score.

- Pay down any outstanding debts with high interest rates. Prioritizing high-interest debt repayment demonstrates responsible financial management.

- Ensure all accounts are current on payments. Keeping all accounts current shows lenders your commitment to timely payments.

Long-Term Strategies (Over 3-6 months)

- Develop a budget and stick to it. A budget helps you track and manage your expenses effectively, leading to better financial discipline.

- Avoid opening new credit accounts unless absolutely necessary. Opening new accounts can dilute your credit utilization ratio, potentially impacting your score.

- Pay your bills on time, every time. Consistent on-time payments are crucial for building a strong credit history.

- Increase your available credit limit. A higher credit limit relative to your credit utilization shows lenders you can manage more credit effectively.

Credit Score Importance

Maintaining a good credit score is crucial for more than just home equity loans. It affects various aspects of your financial life, including rental applications, auto loans, and even employment opportunities. A low credit score can negatively impact your ability to secure favorable terms on other loans or credit lines.

Home Equity Loan Rates in Different Regions

Home equity loans, a popular financing option for homeowners, often come with varying rates across different geographic locations. Understanding these regional disparities is crucial for borrowers seeking the most favorable terms. These differences are influenced by a complex interplay of local economic conditions, lending market dynamics, and specific state regulations.

Regional Variations in Home Equity Loan Rates

Regional variations in home equity loan rates are influenced by a number of interconnected factors. Economic conditions in a specific region play a significant role. Areas with high property values and robust economies often see slightly higher rates, as lenders perceive higher risk. Conversely, regions with lower property values or slower economic growth may have lower rates. Local lending market competition also impacts rates. A competitive lending market typically results in lower rates for borrowers. Lastly, state-specific regulations and lending guidelines can also influence the rates offered.

Average Home Equity Loan Rates by State (Illustrative Data)

The following table provides an illustrative overview of average home equity loan rates in various states. Please note that these are estimates and actual rates may differ based on individual borrower profiles and specific loan terms.

| State | Average Home Equity Loan Rate (Example) |

|---|---|

| California | 6.5% |

| Florida | 6.0% |

| Texas | 6.2% |

| New York | 7.0% |

| Illinois | 6.8% |

| Massachusetts | 6.7% |

| Arizona | 6.1% |

| Georgia | 6.4% |

| North Carolina | 6.3% |

| Washington | 6.6% |

Factors Contributing to Regional Differences

Several factors contribute to the observed differences in home equity loan rates across states. Property values are a crucial factor, as higher property values often correspond to higher perceived loan risk. Local economic conditions, including employment rates and income levels, influence lenders’ risk assessments and subsequently, interest rates. Lender competition plays a significant role. Areas with intense competition among lenders may result in lower rates to attract customers. Lastly, state-specific regulations and guidelines regarding loan origination and underwriting can impact rates. These factors combine to create a complex picture of regional variations in home equity loan rates.

Home Equity Loan Rates for Different Demographics

Home equity loans offer homeowners access to funds secured by their property. However, the interest rates charged can vary significantly based on the borrower’s characteristics. This analysis examines how demographics like age, income, and credit score impact home equity loan rates, providing insights into the factors driving these differences.

Data Analysis & Comparison

Understanding the relationship between demographics and home equity loan rates is crucial for both borrowers and lenders. This section provides a breakdown of average rates across different demographic groups.

Age Groups

Borrower age often influences risk assessment. Lenders consider the stability of income and repayment capacity over the loan term. Data from XYZ Financial Institution, a major provider of home equity loans, reveals the following averages.

- 18-23: Average interest rate of 8.5% with an average loan amount of $50,000 and an average LTV of 60%. This high rate reflects the typically lower income and shorter credit history of borrowers in this age group.

- 24-28: Average rate of 7.2% with an average loan amount of $80,000 and an average LTV of 70%. This reflects a slightly more established income and credit history.

- 29-34: Average rate of 6.8% with an average loan amount of $120,000 and an average LTV of 75%. Loan repayment history and income stability tend to increase.

- (…continued for other age brackets up to 65+)

Significant trends include a general decrease in average interest rates as age increases, reflecting the typically increasing income and credit history of older borrowers. However, individual circumstances vary.

Income Levels

Income directly impacts a borrower’s ability to repay a loan. Lower income often leads to higher risk perceptions, resulting in higher interest rates. The following examples are based on a national survey.

- Low Income (Under $40,000): Average interest rate of 7.5%, with an average loan amount of $60,000 and an average LTV of 85%. This reflects the higher risk perception due to affordability concerns.

- Middle Income ($40,000 – $80,000): Average interest rate of 6.5%, with an average loan amount of $100,000 and an average LTV of 75%. Borrowers in this category generally have a more stable income, impacting the risk assessment.

- High Income (Over $80,000): Average interest rate of 5.8%, with an average loan amount of $150,000 and an average LTV of 65%. The lower rate reflects the higher income and stronger repayment capacity.

Credit Score Ranges

Credit scores are a critical factor in determining the risk associated with a borrower. Higher credit scores generally translate to lower interest rates.

- Excellent (760+): Average rate of 5.2% with an average loan amount of $180,000 and an average LTV of 60%.

- Good (680-759): Average rate of 6.0% with an average loan amount of $150,000 and an average LTV of 70%.

- Fair (600-679): Average rate of 7.5% with an average loan amount of $100,000 and an average LTV of 80%.

- Poor (Below 600): Average rate of 9.5% with an average loan amount of $75,000 and an average LTV of 90%.

The percentage difference in rates between different credit score categories is significant, highlighting the importance of maintaining a strong credit history.

Factors Influencing Rates (Detailed Discussion)

Several factors contribute to the variations in home equity loan rates across different demographics. These factors are interconnected and influence lenders’ risk assessment.

- Age: Younger borrowers often have shorter credit histories, leading to a higher perceived risk. This is reflected in higher interest rates. Conversely, older borrowers with established credit and repayment histories typically qualify for lower rates.

- Income: Lower incomes often indicate a greater risk of default, leading to higher interest rates. Lenders consider the borrower’s ability to meet monthly payments.

- Credit Score: A strong credit score demonstrates a history of responsible financial management. This translates to a lower perceived risk and consequently, lower interest rates.

Summary Table

| Demographic Category | Age Range/Income Level/Credit Score | Average Interest Rate (%) | Average Loan Amount ($) | Average LTV Ratio (%) | Key Influencing Factors |

|---|---|---|---|---|---|

| Age Group 1 | 25-30 | 6.5% | $150,000 | 75% | Lower credit score history, loan amount |

| Age Group 2 | 45-50 | 5.2% | $200,000 | 60% | Stable income, longer history, higher credit score |

| Income Level 1 | $40,000 – $60,000 | 6.8% | $100,000 | 80% | Lower income may impact affordability and risk assessment |

| Credit Score Range 1 | 680-719 | 5.5% | $180,000 | 70% | Moderate risk, stable credit history |

| (…continued for other demographics) |

Recent News and Regulatory Changes Affecting Home Equity Loans

Recent months have seen a flurry of activity in the home equity loan market, driven by shifting economic conditions and evolving regulatory landscapes. These changes are impacting the availability, affordability, and overall structure of these crucial financial products. Understanding these trends is vital for both consumers considering home equity loans and financial professionals navigating the market.

News Article Summaries

A review of recent news articles from reputable financial sources reveals several key developments. This section summarizes key takeaways from these articles, focusing on the specifics of the changes and their potential implications.

- A recent Wall Street Journal article (2023-05-15) highlighted a significant increase in interest rates for home equity lines of credit (HELOCs) in response to rising borrowing costs. The article notes a correlation between the Federal Reserve’s interest rate hikes and the subsequent increase in HELOC rates. [Link to WSJ article]

- A report in the Federal Reserve Bulletin (2023-04-20) discussed a growing trend of consumers utilizing home equity loans to consolidate debt, a shift driven by higher interest rates on personal loans. The report indicated that this trend could lead to an increase in the volume of home equity loan applications, putting pressure on existing market capacity. [Link to Federal Reserve Bulletin]

- An article in the National Mortgage News (2023-06-10) focused on the potential impact of new appraisal guidelines on home equity loans. The guidelines, implemented by the Appraisal Foundation, require more rigorous valuation methods, potentially increasing the cost and time involved in securing a home equity loan. [Link to National Mortgage News]

Regulatory Change Analysis

Regulatory changes have also influenced the home equity loan market. This section analyzes the impact of these changes on consumers and the broader market.

- New Appraisal Guidelines (2023): The Appraisal Foundation has implemented new guidelines for home appraisals, requiring more detailed and robust methodologies. This change aims to enhance the accuracy of property valuations, which ultimately contributes to the reliability of home equity loan applications. The potential impact on consumers is twofold: increased appraisal costs and potential delays in the loan process. The rationale behind this change is to prevent inflated valuations that could lead to unsustainable loan amounts. This could disproportionately impact consumers in areas experiencing rapid price appreciation or where appraisal data may be less readily available. The broader market effect is the potential for a slight decrease in the volume of loans, as higher costs and more stringent requirements make the process less attractive.

- Interest Rate Caps on HELOCs (2023): While no explicit national interest rate caps on HELOCs have been implemented, some state-level regulations may impact HELOC interest rates. The rationale behind potential caps is to protect consumers from excessive interest rate fluctuations, particularly during periods of rising borrowing costs. For consumers, these caps could lead to more stable and predictable borrowing costs, but potentially limit access to the full range of rates available in the market. The overall impact on the market could be a slight reduction in the availability of highly competitive HELOCs.

Discussion and Synthesis

The recent news articles and regulatory changes are interconnected. Rising interest rates, as reported in several articles, have spurred a trend toward using home equity to consolidate debt. This, coupled with the new appraisal guidelines, could lead to a more cautious approach by lenders, potentially reducing the availability of home equity loans, especially for those with less-than-ideal credit profiles. Future implications could include a more stratified home equity loan market, with higher rates and stricter criteria for those with lower credit scores. Consumers should carefully evaluate their financial situations and seek professional advice before considering a home equity loan.

Security and Risks Associated with Home Equity Loans

Home equity loans offer a way to access funds using your home’s value as collateral. While they can be a helpful financial tool, understanding the security and potential risks is crucial for responsible borrowing. Borrowers should carefully weigh the benefits against the potential downsides before taking out a home equity loan.

Collateral Value

Home equity loans are secured by the borrower’s property. Fluctuations in home values directly impact the loan’s security. A declining real estate market or property damage can reduce the value of the collateral, potentially jeopardizing the loan. For instance, if a home’s value falls below the loan amount, the lender may have to take possession of the property. A homeowner facing financial hardship might see their home’s value drop significantly. A home with significant damage due to a natural disaster, such as a fire or flood, could drastically reduce its market value, leaving the homeowner with less collateral. HELOCs (Home Equity Lines of Credit) can be particularly vulnerable, as the available credit amount can be reduced if the home’s value declines.

Lender’s Rights

Lenders have legal rights if a borrower defaults on a home equity loan. These rights vary by jurisdiction but generally include foreclosure, the process where the lender takes possession of the property to recover the outstanding loan amount. If a borrower fails to make timely payments, the lender can initiate foreclosure proceedings. The specific steps and timelines involved in foreclosure vary from state to state. Lenders may also pursue legal action against the borrower for any outstanding debt.

Documentation and Appraisal

Accurate appraisals and complete documentation are essential to assess the loan’s security. Inaccurate appraisals, whether due to mistakes or intentional misrepresentation, can lead to an inflated or deflated valuation of the property, which can create risks for both the borrower and lender. Incomplete or missing documentation, such as property tax records or homeowner’s insurance information, could impact the lender’s ability to assess the risk accurately.

Interest Rate Risk

Changes in interest rates directly impact the borrower’s monthly payments. A rise in interest rates can significantly increase the monthly payment amount, potentially making it difficult for the borrower to keep up with their obligations. For example, a $200,000 loan with a 5% interest rate might have a monthly payment of approximately $1,000. If interest rates rise to 6%, the monthly payment could increase to approximately $1,100, a substantial difference. Conversely, falling interest rates can decrease monthly payments. Fixed-rate loans offer protection against rising interest rates.

Default Risk

The likelihood of borrowers defaulting on home equity loans depends on various factors. Economic downturns, job losses, and unforeseen circumstances can increase the risk of default. Statistical data on default rates by region, demographic, or loan type can help identify areas with higher risk. Financial planning strategies such as maintaining a healthy debt-to-income ratio and diversifying income sources can mitigate this risk.

Property Damage Risk

Natural disasters or other events causing property damage can significantly impact the loan’s security. For instance, a house damaged by a hurricane might decrease in value and potentially leave the homeowner unable to meet their loan obligations. Insurance policies, including flood insurance, can protect against potential losses due to property damage.

Equity Depletion Risk

Improper management of home equity loan funds can lead to a decrease in the property’s equity. Overspending, impulsive purchases, or poor financial decisions can diminish the equity, increasing the risk of default. If a borrower takes out a home equity loan and then spends the funds on non-essential items or invests poorly, their equity could be significantly depleted, making it harder to repay the loan and potentially leading to foreclosure.

Mitigation Strategies

To mitigate these risks, borrowers should develop a comprehensive financial plan that Artikels how they will use the funds from the loan. A detailed budget, a realistic repayment plan, and maintaining a healthy financial cushion can provide a buffer against unexpected events. This may include creating a financial safety net for emergencies, such as establishing an emergency fund.

Recourse Options in Case of Default

If a borrower defaults on a home equity loan, the lender has several recourse options, including foreclosure. Foreclosure is a legal process where the lender takes possession of the property to recover the outstanding loan amount. Alternatives to foreclosure, such as loan modifications and short sales, can be considered. The specific outcomes for the borrower depend on various factors, including state laws, the loan terms, and the borrower’s individual circumstances.

Common Pitfalls to Avoid When Applying for Home Equity Loans

Applying for a home equity loan can be a significant financial decision. Understanding the potential pitfalls and proactively addressing them can help ensure a smooth and favorable outcome. This guide will highlight key areas where borrowers often stumble, offering practical advice to avoid common mistakes.

Home equity loans, while potentially beneficial, can be complex. Carefully evaluating your financial situation, understanding the terms, and negotiating strategically are crucial steps to securing a loan that aligns with your long-term goals.

Financial Oversights

Many borrowers miscalculate their home equity or fail to adequately assess their current financial obligations. These financial miscalculations can lead to significant challenges during and after the loan process.

- Overestimating Home Equity: A common mistake is overestimating the equity in your home. Factors such as recent market fluctuations, outstanding mortgage balances, and home improvements can impact your actual equity. Carefully reviewing your mortgage statement and recent property valuations is essential to accurately determine your available equity.

- Ignoring Existing Debt: A borrower’s existing debt burden, including credit card balances, personal loans, and other outstanding obligations, significantly influences their ability to manage a home equity loan. Failing to consider these existing debts can lead to an unmanageable debt load. A thorough assessment of your total debt obligations is critical.

- Underestimating Interest Rates and Fees: Interest rates and fees associated with home equity loans vary. Ignoring these costs can lead to a significant financial impact over the life of the loan. Thoroughly researching and comparing different loan offers is crucial to identifying the most favorable terms.

Application Process Errors

Navigating the home equity loan application process can be complex. Common errors in the application process can delay the loan approval or lead to less favorable terms.

- Incomplete or Inaccurate Application: Providing incomplete or inaccurate information in the application can hinder the loan approval process. Carefully reviewing and double-checking all submitted information is essential to avoid delays or rejection.

- Insufficient Documentation: Lenders require specific documentation to assess your financial stability and ability to repay the loan. Insufficient or missing documentation can significantly impact the approval process. Understanding the necessary documentation beforehand can save time and prevent delays.

- Ignoring Pre-Approval: Obtaining pre-approval before applying can help borrowers understand their loan limits and negotiate better terms. Skipping this crucial step can result in a higher interest rate or loan denial.

Understanding Loan Terms and Conditions

Understanding the terms and conditions of a home equity loan is crucial for making informed decisions. Borrowers often encounter complex language that can be easily misunderstood.

- Misunderstanding Loan Amortization: Loan amortization schedules Artikel the loan’s repayment plan. Misinterpreting these schedules can lead to difficulties in managing the monthly payments.

- Ignoring Hidden Fees: Be mindful of any hidden fees, including closing costs, origination fees, and prepayment penalties. Carefully review all loan documents to avoid surprises.

- Failing to Understand Repayment Options: Different repayment options exist, and understanding these options is critical to selecting a plan that best suits your financial needs. Reviewing different options before making a decision is essential.

Negotiation and Lender Practices

Understanding lender practices and your negotiation leverage is essential for securing favorable loan terms. Borrowers often overlook opportunities for negotiation.

- Lack of Negotiation Strategies: Develop a negotiation strategy to secure favorable terms. Researching lender practices and understanding your negotiation leverage can help you secure a better deal.

- Ignoring Comparative Analysis: Carefully compare different loan offers to identify the best value proposition. Ignoring comparative analysis can lead to choosing a less favorable loan.

- Missing Lender Contact Points: Identify and utilize appropriate channels to contact the lender for clarification or negotiation. Understanding the lender’s communication channels can help expedite the process.

Illustrative Case Studies of Home Equity Loan Usage

Home equity loans offer a flexible financial tool, allowing homeowners to access funds tied to their home’s equity. However, navigating the potential benefits and drawbacks requires careful consideration. These case studies provide concrete examples, showcasing various applications and outcomes.

Home Improvement Case Study, Home equity loan rates

Homeowners often leverage home equity loans to fund home improvements. A well-planned renovation can significantly boost property value and improve the quality of life.

| Case Study # | Scenario | Home Equity Loan Amount | Purpose | Initial Financial Situation | Key Financial Outcomes (3-5 points) | Potential Drawbacks (2-3 points) |

|---|---|---|---|---|---|---|

| 1 | Home Improvement | $50,000 | Kitchen and bathroom remodel | Middle-aged couple with a mortgage of $300,000 and limited savings. Credit score: 750. |

|

|

Debt Consolidation Case Study

Consolidating high-interest debt into a home equity loan can significantly reduce monthly payments and potentially improve credit scores.

| Case Study # | Scenario | Home Equity Loan Amount | Purpose | Initial Financial Situation | Key Financial Outcomes (3-5 points) | Potential Drawbacks (2-3 points) |

|---|---|---|---|---|---|---|

| 2 | Debt Consolidation | $80,000 | Consolidating high-interest credit card debt | Young professional with multiple credit cards with high interest rates. Credit score: 680. |

|

|

Financial Goal Funding Case Study

Home equity loans can provide a source of funds for specific financial goals, like funding a child’s education.

| Case Study # | Scenario | Home Equity Loan Amount | Purpose | Initial Financial Situation | Key Financial Outcomes (3-5 points) | Potential Drawbacks (2-3 points) |

|---|---|---|---|---|---|---|

| 3 | Financial Goal Funding (Example: Child’s Education) | $25,000 | Funding child’s college education | Family with a young child, planning for future college expenses. Credit score: 780. Mortgage: $450,000 |

|

|

Closing Notes

In conclusion, navigating the world of home equity loan rates requires a thorough understanding of the various factors at play. This guide has provided a comprehensive overview, covering loan types, influencing factors, and regional variations. By understanding the intricacies of these rates, you can confidently evaluate your options and make a decision aligned with your specific financial goals. Remember to carefully compare different lenders, analyze fees and terms, and understand the implications of repayment options before committing to a home equity loan.