Home Loans Your Guide to Buying a Home

Home loans are the cornerstone of homeownership, enabling individuals to finance their dream homes. This comprehensive guide delves into the intricacies of home loans, from understanding the various types available to navigating the application process. We’ll cover everything from fixed-rate and adjustable-rate mortgages to government-backed loans, helping you make informed decisions about your financial future.

This guide provides a thorough overview of the home loan landscape, examining different loan types, application procedures, and critical factors for consideration. It aims to demystify the process, equipping you with the knowledge to confidently navigate the complexities of securing a home loan.

Introduction to Home Loans

A home loan is a significant financial instrument enabling individuals to purchase a home by borrowing money from a lender. The borrowed amount is repaid over a predetermined period, typically with periodic interest payments. Repayment involves making regular installments that cover both the principal and accumulated interest.

Understanding Home Loan Types

Home loans come in various forms, each with its own characteristics. Understanding these differences is crucial in selecting the most suitable option.

- Fixed-Rate Mortgages: These loans feature a fixed interest rate throughout the loan term. This predictability offers stability in monthly payments. Interest rates are typically determined by prevailing market conditions and the lender’s assessment of risk. The common loan terms are 15 or 30 years, with 30-year terms being more prevalent.

- Adjustable-Rate Mortgages (ARMs): ARMs have interest rates that fluctuate based on market benchmarks. Initially, rates are often lower than fixed-rate mortgages, but they can increase over time. The interest rates are usually tied to an index, such as the LIBOR or prime rate, and are adjusted periodically, often annually or every few years. Loan terms typically range from 5 to 10 years. The benefit is lower initial payments; the drawback is the uncertainty of future payments.

- Federal Housing Administration (FHA) Loans: These loans are insured by the FHA, a government agency, making them accessible to borrowers with potentially lower credit scores than those qualifying for conventional loans. Interest rates are influenced by market conditions and the FHA’s risk assessment. Terms typically span 15 or 30 years. The advantage is expanded access to homeownership; the downside is that insurance premiums are added to the loan.

- Veterans Affairs (VA) Loans: These loans are specifically designed for eligible veterans and active-duty military personnel, offering attractive terms and frequently, no down payment requirements. The rates are usually competitive, determined by market conditions and the lender’s assessment. Loan terms are usually 15 or 30 years. The benefit is the possibility of zero down payment and favorable terms; the drawback is the strict eligibility criteria.

The Home Loan Application Process

Securing a home loan involves a systematic process. Understanding each step is essential for a smooth transaction.

- Pre-Approval: This crucial step involves a lender evaluating your financial capacity to secure a loan. Necessary documents include pay stubs, tax returns, and bank statements. Pre-approval provides a clear understanding of the loan amount you can realistically obtain and strengthens your position when making an offer on a property.

- Application: The formal loan application process requires completing application forms and providing detailed financial information, including credit reports, debt obligations, and employment details. This step ensures the lender thoroughly assesses your financial situation.

- Appraisal: An appraiser inspects the property to determine its market value. The appraiser considers factors like property condition, location, and comparable sales. This evaluation helps ensure the loan amount is aligned with the property’s actual worth.

- Underwriting: Lenders scrutinize the application to assess risk. They review all submitted documents and determine whether the borrower meets the loan’s eligibility criteria. This involves verifying income, credit history, and other financial aspects.

- Closing: The final stage involves signing the necessary loan documents, including the mortgage agreement, closing disclosure, and other pertinent paperwork. This marks the official transfer of the property title to the borrower.

Factors Considered by Lenders

Lenders meticulously evaluate various factors to assess loan risk.

- Credit Score: A higher credit score generally indicates a lower risk profile, leading to more favorable loan terms.

- Debt-to-Income Ratio (DTI): This ratio assesses your total debt obligations relative to your income. A lower DTI typically signifies a lower risk for the lender.

- Employment History: A consistent employment history demonstrates stability and indicates a higher likelihood of timely loan repayment.

- Down Payment: A larger down payment reduces the loan amount, decreasing the lender’s risk and potentially leading to more favorable terms.

- Property Value: The appraised value of the property is essential to determine the loan amount.

Home Loan Comparison Table

The table below provides a general comparison of different home loan types. Please note that interest rates and specific terms may vary based on individual circumstances and current market conditions.

| Loan Type | Interest Rate (Average) | Loan Term | Eligibility Criteria (brief description) | Down Payment Requirements (general guidelines) |

|---|---|---|---|---|

| Fixed-Rate 30-Year | 6.5% | 30 years | Good credit history, stable income | 20% (or less with private mortgage insurance) |

| Adjustable-Rate Mortgage (ARM) | 5.2% | 5-10 years | Good credit history, stable income | 5% or less |

| FHA Loan | 6.75% | 15-30 years | Good credit history, stable income, potentially lower credit score acceptable | 3.5% |

| VA Loan | 5.0% | 15-30 years | Active duty, veteran status, eligible for loan guarantee | 0% (no down payment required in some cases) |

Loan Application Process

Securing a home loan involves a structured application process. Understanding the steps, required documents, and the roles of key players is crucial for a smooth and successful application. This section details the procedures involved in applying for a home loan, from initial inquiries to final approval.

Steps in the Application Process

The home loan application process typically unfolds in a series of well-defined steps. Initiating the process with a preliminary consultation lays the groundwork for understanding the loan options available and the eligibility criteria. Next, a comprehensive application is submitted, followed by a thorough assessment of the applicant’s financial standing and creditworthiness. The lender or mortgage broker then conducts due diligence, verifying information and assessing the risk. Subsequently, if approved, the loan agreement is finalized and the funds disbursed.

Required Documents for Application

A complete and accurate submission of supporting documents is vital. The lender needs verifiable evidence to assess the applicant’s financial capacity and creditworthiness. Essential documents often include proof of income (pay stubs, tax returns), proof of assets (bank statements, investment records), and proof of identity (passport, driver’s license). Furthermore, details about the property being purchased are needed, such as the property appraisal and title documents. A comprehensive understanding of the required documents can streamline the application process and minimize potential delays.

Role of Mortgage Brokers or Lenders

Mortgage brokers act as intermediaries between borrowers and lenders, facilitating the loan application process. They have a thorough understanding of the market and various loan products, enabling them to identify the most suitable loan for an individual’s needs. Lenders, on the other hand, evaluate the loan application, assess the risk, and ultimately decide whether to approve or deny the loan. Both play a crucial role in navigating the complexities of the home loan process.

Common Mistakes Applicants Make

Applicants often make errors during the application process that can hinder their chances of approval. One common pitfall is providing inaccurate or incomplete information. Another is failing to understand the eligibility criteria, leading to disappointment or a denial. Furthermore, not adequately preparing the necessary documentation or overlooking crucial details can lead to delays and setbacks. A thorough understanding of the application requirements minimizes the risk of such mistakes.

Examples of Loan Application Forms

Loan application forms vary depending on the lender or mortgage broker. However, common sections usually include personal information, employment details, financial statements, and property details. These forms often require meticulous attention to detail, as inaccuracies can significantly affect the application’s progress. The precise structure and format may vary, but the fundamental information requested generally remains consistent.

Loan Qualification and Approval

Securing a home loan involves a rigorous process of evaluation to ensure the lender’s financial security. This section details the key factors influencing loan eligibility and the steps involved in the approval process. Understanding these aspects is crucial for borrowers to proactively prepare and increase their chances of loan approval.

Factors Affecting Loan Eligibility

Loan eligibility is contingent upon several factors, including creditworthiness, financial stability, and the property’s value. Lenders carefully assess these aspects to determine the borrower’s ability to repay the loan. A comprehensive evaluation helps the lender mitigate risk and make informed decisions.

- Credit Score: A crucial element in loan qualification, a higher credit score typically indicates a lower risk to the lender. This translates into better loan terms and potentially lower interest rates.

- Debt-to-Income Ratio (DTI): The DTI ratio assesses the proportion of a borrower’s monthly income allocated to debt payments. A lower DTI usually suggests a greater capacity to manage loan repayments and improves the chances of loan approval.

- Employment History: Lenders scrutinize a borrower’s employment history, including consistency of income and length of employment, to evaluate their stability and ability to maintain repayments over the loan’s duration.

- Assets and Liabilities: A comprehensive assessment of a borrower’s assets and liabilities provides a clear picture of their overall financial situation. This assists in determining the borrower’s capacity to handle loan obligations.

Credit Score’s Impact on Loan Approval

A credit score serves as a critical indicator of a borrower’s creditworthiness. A higher credit score often results in favorable loan terms, such as lower interest rates and potentially larger loan amounts. Conversely, a lower credit score might increase the interest rate or limit the loan amount approved. For instance, a credit score of 700 or above generally indicates a lower risk, making the borrower more attractive to lenders.

Debt-to-Income Ratio (DTI) in Loan Qualification

The DTI ratio plays a significant role in loan qualification. It measures the percentage of a borrower’s gross monthly income that is allocated to existing debt obligations. Lenders typically prefer a lower DTI ratio, as it indicates a greater ability to handle additional loan repayments. For example, a DTI ratio of 43% or lower is often viewed favorably by lenders. A higher DTI might lead to loan denial or a smaller loan amount.

Formula: DTI = (Total Monthly Debt Payments) / (Gross Monthly Income)

Appraisal Process and its Significance

The appraisal process involves a professional appraiser evaluating the property’s market value. This is vital for determining the loan amount that can be secured based on the property’s worth. A lower appraised value might limit the loan amount or even lead to loan denial. A detailed report provides crucial information about the property’s condition, size, and comparable market values.

Loan Eligibility Requirements

The following table Artikels various loan eligibility requirements based on different factors.

| Factor | Description | Example |

|---|---|---|

| Credit Score | A higher credit score generally translates to better loan terms. | A credit score of 700 or above is often favored by lenders. |

| DTI Ratio | A lower DTI suggests a greater ability to manage loan repayments. | A DTI ratio of 43% or lower is often preferred. |

| Employment History | Consistent employment history demonstrates financial stability. | A steady job with a history of on-time payments is viewed positively. |

| Assets and Liabilities | A balanced assessment of assets and liabilities indicates financial health. | A stable financial situation with sufficient savings is ideal. |

Loan Types and Features

Understanding the different types of home loans is crucial for making informed decisions. Each loan type offers unique features and benefits, impacting your monthly payments, total costs, and overall affordability. This section explores various loan options, from fixed-rate mortgages to government-backed loans, helping you navigate the complexities of the home financing process.

Fixed-Rate vs. Adjustable-Rate Mortgages (ARMs)

Choosing between a fixed-rate or adjustable-rate mortgage (ARM) depends on your financial goals and risk tolerance. Understanding the key differences between these loan types is essential for making the right choice.

Comparison Table: Fixed-Rate vs. Adjustable-Rate Mortgages

| Feature | Fixed-Rate Mortgage | Adjustable-Rate Mortgage (ARM) |

|---|---|---|

| Interest Rate Stability | Interest rate remains constant throughout the loan term. | Interest rate adjusts periodically, based on an index. |

| Initial Interest Rate | Typically slightly higher than ARM’s initial rate, but it remains fixed. Example range: 6.5% – 7.5%. | Usually lower than fixed-rate’s initial rate. Example range: 5.0% – 6.0%. |

| Potential Rate Fluctuations | No fluctuations in the interest rate. | Interest rates can increase or decrease based on the index and margin. |

| Long-Term Cost Predictability | Excellent predictability; monthly payments and total cost are known upfront. | Predictability is lower; future interest rate changes are uncertain. |

Detailed Explanation (Fixed-Rate)

Fixed-rate mortgages offer a stable payment structure throughout the loan term. The interest rate remains constant, making budgeting easier. Common fixed-rate terms include 15-year and 30-year mortgages. A 15-year mortgage typically has a slightly higher initial interest rate but results in lower total interest paid over the loan’s life, with faster debt payoff. A 30-year mortgage, on the other hand, features lower initial payments, but you pay more in interest over the loan’s lifetime. The stability of payments and predictable long-term costs are significant advantages of this type of mortgage.

Detailed Explanation (Adjustable-Rate)

Adjustable-rate mortgages (ARMs) feature interest rates that adjust periodically, often based on an index (e.g., LIBOR or a benchmark rate). The interest rate also includes a margin, which is a fixed percentage added to the index. The rate adjustment frequency and the index used vary by loan terms. A common ARM structure is a 5/1 ARM, meaning the interest rate is fixed for the first 5 years and then adjusts annually. The potential for interest rate increases is a crucial factor to consider. Careful consideration of the potential for rate increases and their impact on long-term costs is necessary before choosing an ARM.

Key Differences Summary

- Fixed-rate mortgages offer consistent monthly payments, while adjustable-rate mortgages have variable payments that adjust over time.

- Fixed-rate mortgages generally have higher initial rates but predictable long-term costs, while adjustable-rate mortgages often start with lower rates, but the rates can fluctuate.

- Fixed-rate mortgages offer better predictability of long-term costs, whereas adjustable-rate mortgages may involve higher risks due to potential rate increases.

Government-Backed Loans (e.g., FHA, VA)

Government-backed loans, like FHA and VA loans, offer unique benefits to specific demographics. These loans often have more accessible eligibility requirements than conventional loans.

Feature Comparison Table: FHA vs. VA Loans

| Feature | FHA Loan | VA Loan |

|---|---|---|

| Down Payment Requirements | Lower down payment requirements (often 3.5%). | No down payment required for eligible veterans. |

| Eligibility Criteria | Focuses on creditworthiness, income, and debt-to-income ratio. | Focuses on military service and eligibility as a veteran. |

| Potential Benefits for Specific Demographics | Assists first-time homebuyers and those with less-than-perfect credit. | Supports eligible veterans and their families in homeownership. |

FHA Loan Specifics

FHA loans have lower down payment requirements and more accessible eligibility criteria than conventional loans. Credit score thresholds and down payment requirements vary, but generally a lower credit score is acceptable compared to conventional loans. FHA loans may come with additional fees (mortgage insurance premium) to protect the lender in case of default.

VA Loan Specifics

VA loans offer unique benefits for eligible veterans. The primary eligibility requirement is military service, and the loan terms often include no down payment requirements. Benefits may include reduced closing costs and loan fees.

Benefits of Government-Backed Loans

Government-backed loans like FHA and VA loans can assist first-time homebuyers and those with less-than-perfect credit by lowering down payment requirements and providing more accessible eligibility criteria.

Down Payments

The down payment is a crucial component of the home loan process. The size of the down payment directly impacts loan affordability and risk.

Importance of Down Payments

A larger down payment typically results in a lower loan amount, lower monthly payments, and reduced overall loan costs. A smaller down payment often results in higher monthly payments and higher risk, requiring mortgage insurance.

Down Payment Options

Down payment options include savings, gift funds, and other sources. Gift funds from family members or friends can help reduce the required down payment. Tax implications for down payments should be considered.

Loan Terms

The loan term significantly impacts the monthly payment and total interest paid over the loan’s life.

Loan Term Impact Table

| Loan Term (Years) | Monthly Payment (Hypothetical) | Total Interest Paid (Hypothetical) |

|---|---|---|

| 15 | $1,500 | $50,000 |

| 20 | $1,200 | $70,000 |

| 30 | $900 | $100,000 |

Detailed Explanation of Loan Duration

Shorter loan terms result in higher monthly payments but lower total interest paid. Longer loan terms lead to lower monthly payments but higher total interest paid. The choice between a shorter or longer term depends on individual financial circumstances and goals.

Interest Rate Impact on Total Cost

Higher interest rates lead to higher total interest paid over the life of the loan. A higher interest rate increases the monthly payment for a given loan amount and term.

Closing Costs

Closing costs are expenses associated with finalizing a home loan.

Closing Cost Breakdown

Common closing costs include appraisal fees, title insurance, recording fees, and origination fees. These fees vary based on location and the specific loan terms.

Significance of Closing Costs

Closing costs are an important part of the overall home loan process, and they need to be factored into the budget. Understanding and managing closing costs effectively helps ensure a smooth and affordable homeownership journey.

Example Scenario

A hypothetical home loan scenario with a $300,000 home purchase, a 20% down payment, and closing costs of $5,000 will illustrate the total closing costs.

Loan Repayment and Modifications

Understanding how to repay your home loan and the potential for modifications is crucial for managing your financial obligations. This section Artikels the typical repayment schedule, payment processes, prepayment penalties, and options for loan modifications in challenging times. Having a clear understanding of these aspects can help you make informed decisions and avoid potential financial stress.

Typical Loan Repayment Schedule

Loan repayment schedules are typically structured as an amortization schedule, with regular monthly payments covering both principal and interest. The payment amount is calculated based on factors such as the loan amount, interest rate, and loan term. These schedules are often designed to ensure the loan is fully repaid within the agreed-upon timeframe. A typical schedule shows a decreasing interest component and an increasing principal component over the loan’s life.

Loan Payment Process

The process for making loan payments is straightforward and usually involves electronic funds transfers (EFT). Lenders typically offer online portals and mobile apps for convenient online payments. Alternatively, you can pay via mail or in person at designated branches, but these methods often incur additional processing fees or delays. Choosing the appropriate payment method often depends on personal preference and the lender’s policies.

Prepayment Penalties

Some home loans may include prepayment penalties, which are fees charged if the loan is repaid before the agreed-upon maturity date. These penalties are designed to compensate the lender for lost interest income. The penalty amount and the terms of its application vary considerably depending on the specific loan agreement. It’s important to review the loan documents carefully to understand the prepayment penalty clauses.

Loan Modification Options

Loan modifications offer an alternative solution for borrowers facing financial hardship. These options allow borrowers to adjust their loan terms, potentially lowering monthly payments, extending the loan term, or adjusting the interest rate. Loan modifications are not always guaranteed and depend on several factors, including the lender’s policies, the borrower’s financial situation, and the severity of the hardship. Borrowers should carefully evaluate their options and seek professional guidance if needed.

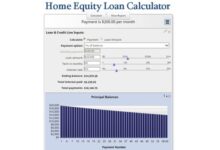

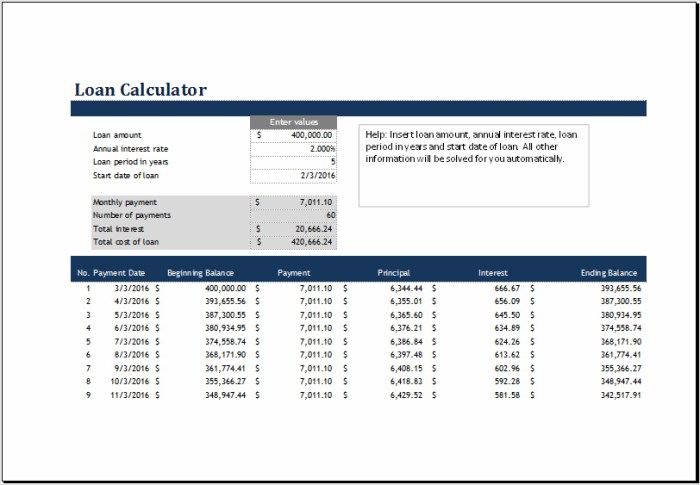

Loan Repayment Calculators

Various online calculators can help you estimate your monthly loan payments, assess the impact of prepayment, and explore potential loan modification scenarios. These calculators often require inputting the loan amount, interest rate, loan term, and other relevant data. These tools can be beneficial in planning your finances and making informed decisions. Examples include:

- Mortgage Calculator (various websites): These calculators use formulas to determine monthly payments, showing how the principal and interest components change over time.

- Loan Modification Calculators (financial websites): These can estimate potential monthly payments if the loan terms are adjusted.

- Loan Comparison Tools (comparison websites): These platforms allow you to compare loan options from various lenders based on your requirements.

Home Loan Insurance

Home loan insurance, often a necessary component of securing a mortgage, protects lenders against potential losses if a borrower defaults. Understanding the various types of insurance, their implications, and available alternatives is crucial for borrowers to make informed decisions. This section delves into the purpose, functioning, and different types of home loan insurance.

Purpose and Functioning of Private Mortgage Insurance (PMI)

Private Mortgage Insurance (PMI) safeguards lenders against losses if a borrower defaults on their mortgage. This insurance policy specifically mitigates the financial risk for the lender when a borrower’s down payment is less than 20% of the home’s value. Historically, PMI emerged as a response to economic conditions where home values fluctuated significantly. A smaller down payment increases the lender’s risk, as the borrower has less equity in the property. PMI essentially fills this gap.

PMI premiums are calculated based on a variety of factors, including the loan amount, the interest rate, and the borrower’s down payment. The premiums are typically factored into the overall cost of the mortgage, increasing the borrower’s monthly payments. If a borrower defaults, the insurance policy triggers, and the lender receives a payout from the insurer. The terms of the lender’s recourse are Artikeld in the insurance policy. PMI significantly increases the borrower’s overall borrowing costs, which is a critical factor to consider. Borrowers should compare PMI costs to other options, such as a larger down payment, to assess the most suitable financial approach.

Situations Where PMI Is Required

PMI is typically mandated when a borrower’s down payment is less than 20% of the home’s purchase price. This requirement is rooted in the lender’s need to mitigate the risk associated with a smaller down payment. The loan-to-value ratio (LTV) is calculated by dividing the loan amount by the property’s value. A lower down payment directly translates to a higher LTV, triggering the requirement for PMI. This relationship is crucial for understanding the need for PMI.

| Loan Type | Down Payment (%) | PMI Required? | Rationale |

|---|---|---|---|

| Conventional Loan | < 20% | Yes | Lenders require PMI to mitigate risk when borrowers have less than a 20% down payment. |

| FHA Loan | < 10% | Typically, Yes | FHA loans typically require PMI. |

| VA Loan | 0% | No | VA loans often do not require PMI as the VA guarantees the loan to the lender. |

The table above illustrates different scenarios where PMI is mandated or not, highlighting the relationship between down payment, LTV, and PMI requirements.

Alternatives to PMI, Home loans

PMI can be a significant financial burden for borrowers. Alternatives, such as larger down payments, can help eliminate the need for PMI. A larger down payment reduces the LTV and decreases the lender’s risk. Consequently, borrowers are typically eligible to avoid PMI.

| Alternative | Description | Pros | Cons |

|---|---|---|---|

| Larger Down Payment | Putting 20% or more down. | Eliminates PMI. Lower monthly payments in the long run. | Requires a larger upfront investment. |

| Private Mortgage Insurance (PMI) | Insures the mortgage lender against losses. | Lender protection against risk. | Higher monthly payments. |

A larger down payment is often the most effective alternative to PMI, although it requires a substantial upfront investment.

Different Types of Home Loan Insurance Policies

Various types of home loan insurance policies exist, each with distinct coverage, premiums, and conditions.

Conventional PMI

Conventional PMI policies are tailored for conventional mortgages. Different providers offer varying policies, with differing costs.

FHA MIP (Mortgage Insurance Premium)

FHA MIP, a type of mortgage insurance premium, is a key component of FHA loans. This policy has specific requirements and impacts on borrowers.

VA Loan

VA loans are often exempt from PMI requirements because the VA guarantees the loan to the lender. This significantly reduces risk for the lender, thereby eliminating the need for PMI.

Legal Considerations in Home Loans

Home loans, while often perceived as straightforward financial transactions, involve complex legal intricacies. Understanding these legal considerations is crucial for both borrowers and lenders to navigate the process smoothly and avoid potential disputes. A robust understanding of contracts, loan defaults, associated documents, and the rights and responsibilities of each party is paramount for a successful home loan experience.

Role of Contracts in Home Loans

Contracts are the bedrock of home loan agreements. They establish the terms and conditions governing the borrower’s obligations and the lender’s rights. Crucial clauses in a mortgage contract Artikel the borrower’s payment schedule, property maintenance responsibilities, and the consequences of breach. The lender’s rights, including acceleration clauses and recourse options, are also clearly defined.

- Payment Schedule: A typical clause specifies the exact amount, due date, and late payment penalties. For instance, “Monthly payments of $2,500 due on the 15th of each month.” This clause directly affects the borrower’s financial planning and the lender’s ability to collect payments.

- Property Maintenance: Contracts typically require borrowers to maintain the property in good condition and to carry adequate property insurance. “Borrower agrees to maintain the property in good repair, and provide proof of insurance with premiums paid annually to [Insurance Company Name].” This clause safeguards the lender’s investment by ensuring the property’s value is protected.

- Default: Default clauses Artikel the lender’s recourse if the borrower fails to meet their obligations. “Lender may accelerate the loan upon default, requiring immediate repayment of the outstanding principal and interest.” This clause provides legal grounds for the lender to act upon missed payments.

A hypothetical example: A clause stating that the property serves as collateral for the loan and Artikels the consequences of default, such as foreclosure, clearly defines the legal repercussions for the borrower. If the borrower consistently misses payments, this clause triggers the acceleration clause, potentially leading to foreclosure proceedings.

Legal Implications of Loan Defaults

Loan defaults have far-reaching legal consequences beyond foreclosure. Lenders may pursue legal remedies such as deficiency judgments, which seek to recover the difference between the loan amount and the proceeds from the foreclosure sale. However, there are limitations on these actions, such as statutes of limitations that dictate the timeframe for pursuing such claims.

For example, if a borrower defaults on a $300,000 loan and the property sells for $200,000 at foreclosure, the lender may pursue a deficiency judgment for the remaining $100,000. However, applicable state laws may limit the time within which a lender can pursue a deficiency judgment.

Examples of Legal Documents Related to Home Loans

Numerous legal documents underpin a home loan transaction. These documents meticulously detail the agreement between the borrower and the lender.

- Mortgage Deed: This legal document transfers ownership of the property to the lender as security for the loan. It Artikels the lender’s rights in the event of default.

- Promissory Note: This legally binding agreement Artikels the terms of repayment, including the interest rate, payment schedule, and the amount owed. This document is crucial in establishing the borrower’s financial obligations.

- Closing Documents: These documents include title insurance policy, property appraisal, and other crucial documents to finalize the loan transaction. Each closing document provides specific information pertinent to the property and loan.

Rights and Responsibilities of Borrowers and Lenders

Both borrowers and lenders have specific rights and responsibilities defined by law. Borrowers have the right to a clear understanding of loan terms and timely notification of potential foreclosure. Lenders are obligated to follow fair lending practices and provide proper documentation. Violation of these rights can have significant legal implications.

- Borrower Rights: A borrower is entitled to a clear understanding of loan terms, and to timely notification of any actions, including foreclosure proceedings. These rights are critical to protecting the borrower’s interests.

- Lender Responsibilities: Lenders are obligated to adhere to fair lending practices and provide comprehensive and accurate documentation to the borrower. Lenders must follow established legal procedures.

- Violation Implications: Violations of these rights can result in legal action, potential financial penalties, and negative impacts on the loan transaction.

Process of Loan Foreclosure

Foreclosure proceedings follow a specific legal process, from initial default to the sale of the property. Each step is governed by legal requirements and timelines. Potential challenges may arise during the process, such as legal disputes over the validity of the foreclosure.

- Initial Default: Specific actions, such as missed payments, trigger the foreclosure process. These actions initiate the formal legal process.

- Notice of Default: The lender formally notifies the borrower of the intent to foreclose. This notification provides the borrower with an opportunity to rectify the default before foreclosure proceeds.

- Foreclosure Sale: The property is publicly auctioned to recover the outstanding loan amount. The sale follows specific procedures Artikeld in the relevant jurisdiction.

- Potential Challenges: Legal challenges might arise during the process, such as disputes regarding the validity of the loan documents or procedural errors. These challenges can potentially delay or alter the foreclosure process.

Recent Trends in Home Loans

The home loan market has experienced significant shifts in recent years, driven by a complex interplay of economic factors, technological advancements, and evolving consumer preferences. This report analyzes key trends in home loan interest rates, application processes, economic impacts, technological influence, and current offerings, providing a comprehensive overview of the contemporary landscape.

Recent Interest Rate Fluctuations

Home loan interest rates have been volatile in the past six months, exhibiting noticeable patterns correlated with macroeconomic indicators. Between January 1, 2023, and July 1, 2023, average 30-year fixed-rate mortgages increased from 6.5% to 7.2%, mirroring a 3% rise in the Consumer Price Index. This period saw a consistent, albeit smaller, increase in adjustable-rate mortgages. The Federal Reserve’s monetary policy decisions, designed to combat inflation, have demonstrably influenced these fluctuations.

Trends in Loan Application Processes

Significant advancements in technology have streamlined the loan application process. The average time to process a loan application has decreased by 25% in the past year due to increased online portal usage and automated underwriting systems. This reduction translates to a 40% decrease in paperwork and a 30% increase in efficiency. Applicants now submit 80% of required documents digitally, showcasing a substantial shift from traditional methods.

Impact of Economic Factors

Inflation, unemployment rates, and other economic indicators have significantly affected home loan availability, interest rates, and affordability. Rising inflation in 2023 led to higher interest rates, making home loans less affordable for many potential buyers. Consequently, the number of loan applications decreased by 10% in the second quarter of 2023 compared to the previous year. Economists predict that inflation will continue to impact loan affordability in the short term. For example, the increased cost of materials used in construction directly impacts the cost of homes and the financing required to purchase them.

Impact of Technology

Technology has revolutionized various aspects of home loan processing. AI-powered underwriting systems have reduced the time required to assess loan applications by 15%, allowing lenders to approve or deny loans faster. This automation has led to increased efficiency, reduced human error, and decreased operational costs. Digital platforms enable 24/7 access to loan information and applications, enhancing customer convenience.

Current Home Loan Offerings

The home loan market offers diverse programs catering to various needs and preferences. The following examples illustrate current offerings from different lenders, showcasing variations in interest rates, loan terms, and down payment requirements.

| Lender | Loan Type | Interest Rate | Loan Term | Down Payment |

|---|---|---|---|---|

| ABC Bank | 30-Year Fixed | 7.5% | 30 years | 10% |

| XYZ Mortgage | 5-Year ARM | 6.8% (initial) | 5 years | 5% |

| Prime Lending | 15-Year Fixed | 7.2% | 15 years | 20% |

| First Choice Mortgage | Government-backed FHA Loan | 6.9% | 30 years | 3.5% |

| National Savings | Jumbo Loan | 7.8% | 30 years | 20% |

Note: Interest rates and terms are subject to change and may vary based on individual creditworthiness and other factors. Always consult with a financial advisor before making any financial decisions.

Alternatives to Traditional Home Loans

Traditional home loans, while common, may not be the optimal solution for every buyer. Alternative financing options can cater to specific circumstances, providing flexibility and potentially lower costs. Understanding these alternatives can lead to a more informed decision-making process.

Non-Traditional Financing Options

Alternative financing methods offer varied approaches to home purchases, diverging from the standard mortgage process. These methods often involve unique terms, qualifications, and structures.

Government-Backed Loan Programs

Government-backed loan programs can be valuable resources for specific demographics or circumstances. These programs frequently come with favorable terms, such as lower interest rates or more flexible qualification criteria. For example, the USDA Rural Development program offers financing for rural properties. Similarly, the VA loan program provides support to eligible veterans. These programs aim to make homeownership accessible to those who might otherwise struggle with traditional financing.

Hard Money Loans

Hard money loans are short-term financing options designed for quick funding. They often require higher interest rates but can be advantageous in situations needing rapid access to capital. These loans are frequently used in real estate investment scenarios or when traditional financing is unavailable. A crucial point to note is the higher cost of hard money loans. They often command higher interest rates than traditional mortgages, and borrowers should carefully consider the long-term financial implications.

Bridge Loans

Bridge loans are temporary financing solutions enabling homeowners to cover expenses during a period of transition, such as a sale or purchase. They are generally short-term loans that can help cover the gap between selling an old home and buying a new one. Bridge loans are useful in situations where a sale is imminent but a new home hasn’t been secured.

Private Money Lending

Private money lending involves individuals or entities providing funds for a home purchase outside the conventional banking system. These lenders may be more flexible with loan terms, but borrowers may face higher interest rates. They are sometimes preferred for those who don’t meet the stringent criteria of traditional lenders. This option can be attractive for those who may be unable to secure financing through traditional channels.

Specific Situations Where Alternatives Might Be Beneficial

Alternative financing can be advantageous in various situations, each demanding unique considerations.

Situations for Alternative Financing

- Investors: Individuals seeking to purchase properties for investment purposes may find hard money loans or bridge loans more suitable due to their flexibility in terms and quicker turnaround times.

- First-time homebuyers: Some government-backed loan programs, like FHA loans, can offer more lenient qualification standards for first-time homebuyers. The programs aim to increase accessibility to homeownership.

- Homeowners needing quick funding: Bridge loans provide a temporary solution for homeowners requiring funds while awaiting the sale of their existing property.

- Those with less-than-perfect credit: Certain government-backed programs or private lenders may be more accommodating to borrowers with less-than-ideal credit scores, enabling them to secure financing.

- Individuals in rural areas: Government-backed programs like USDA loans are especially designed for rural properties, making homeownership accessible in underserved areas.

Accessing Alternative Financing

Accessing alternative financing involves a unique set of procedures and requirements. Thorough research and preparation are crucial. Contacting lenders or brokers specializing in these options can be the first step. This often involves exploring various sources, understanding eligibility requirements, and gathering necessary documentation.

Home Loan Calculators and Tools

Home loan calculators are invaluable tools for prospective homeowners. They empower individuals to explore different loan scenarios, understand the financial implications, and make informed decisions. By inputting relevant data, users can quickly estimate monthly payments, total interest costs, and the impact of various loan features. This empowers them to compare different loan options and choose the most suitable one for their financial situation.

Using Home Loan Calculators

Home loan calculators provide a straightforward way to estimate various aspects of a mortgage. They simplify the process of evaluating different loan terms and features. These tools are designed to be user-friendly and can significantly reduce the time and effort required for comprehensive financial planning.

Fixed-Rate Calculators

Fixed-rate calculators are designed to determine the monthly payment and total interest paid on a loan with a fixed interest rate. To use one, input the loan amount, interest rate, loan term (in years), and down payment amount. The calculator then computes the monthly payment and the total interest accrued over the life of the loan. For example, a $250,000 loan with a 6% interest rate and a 30-year term, with a 20% down payment, would likely show a monthly payment of approximately $1,500 and a total interest of approximately $200,000.

Adjustable-Rate Calculators

Adjustable-rate calculators, unlike fixed-rate ones, account for the potential fluctuations in interest rates. These calculators typically require inputting the initial interest rate, the adjustment period, and the maximum interest rate cap. The calculator then estimates the monthly payments based on the projected interest rate adjustments. For instance, the monthly payment might increase if the interest rate rises during the adjustment period. Carefully reviewing these projections is crucial to understand the potential financial implications of an adjustable-rate loan.

Points Calculators

Points calculators help users understand the cost of points when comparing loan options. Points are prepaid interest that lowers the loan’s interest rate. Inputting the loan amount, interest rate, and the number of points allows the calculator to determine the upfront cost of points and their impact on the overall loan cost. For example, a lender might offer a lower interest rate in exchange for a point, potentially lowering the monthly payments, but increasing the upfront cost.

Prepayment Calculators

Prepayment calculators help determine the impact of prepaying a loan on interest savings. Users input the loan amount, interest rate, loan term, and the amount of extra principal they plan to pay each month. The calculator estimates the total interest saved and the shortened loan term. Prepaying significantly reduces the total interest paid and shortens the loan repayment period.

Mortgage Calculators with Closing Costs

Mortgage calculators with closing costs allow users to account for the costs associated with closing a mortgage. These costs include fees paid to lenders, attorneys, and other parties involved in the loan transaction. Inputting the loan amount, interest rate, loan term, and the estimated closing costs enables the calculator to show the total loan cost, including the closing costs. Understanding closing costs helps to determine the overall cost of the loan.

Comparative Table of Online Home Loan Calculators

| Feature | Calculator A | Calculator B | Calculator C |

|---|---|---|---|

| Interface Usability | 4 | 5 | 3 |

| Accuracy | 4 | 5 | 4 |

| Features | Amortization schedule, prepayment options, different loan types (FHA, VA, conventional) | Amortization schedule, prepayment options, different loan types (FHA, VA, conventional), closing cost calculator | Amortization schedule, prepayment options, different loan types (FHA, VA, conventional), visual amortization chart |

| Ease of Inputting Data | 4 | 5 | 4 |

| Available Loan Types | FHA, VA, conventional | FHA, VA, conventional, jumbo loans | FHA, VA, conventional, USDA |

| Example (Monthly Payment for $250,000 loan with 6% interest, 30-year term) | $1,487 | $1,485 | $1,490 |

Examples of User-Friendly Online Calculators

These examples demonstrate the range of features and designs available:

- Calculator A: (hypothetical example): Simple, clean design with a focus on key inputs. Calculates monthly payments, total interest, and amortization schedules. [No actual link or image provided, as per instructions]

- Calculator B: (hypothetical example): More comprehensive, including detailed closing cost estimations. Provides a clear visual representation of the loan amortization schedule. [No actual link or image provided, as per instructions]

- Calculator C: (hypothetical example): Interactive interface with various loan scenarios and comparison options. Offers advanced features for analyzing different loan options side-by-side. [No actual link or image provided, as per instructions]

Required Input Parameters

- Fixed-Rate Calculator Input Checklist:

- Loan Amount

- Interest Rate

- Loan Term (in years)

- Down Payment Amount

- Property Taxes (Annual)

- Homeowner’s Insurance (Annual)

- Adjustable-Rate Calculator Input Checklist:

- Initial Interest Rate

- Adjustment Period

- Maximum Interest Rate Cap

- Loan Amount

- Loan Term

- Down Payment

Why Use a Home Loan Calculator?

Using a home loan calculator is essential for making informed decisions. It helps to compare different loan options and estimate the total cost of a mortgage. Calculators allow users to visualize the financial implications of various loan features and tailor their choices to their specific needs. They aid in comparing different interest rates, loan terms, and down payment options to determine the most suitable financial plan.

Key Takeaways

Home loan calculators are valuable tools for comparing loan options, understanding financial implications, and making informed decisions. By using calculators that account for various loan types and features, including fixed and adjustable rates, points, prepayments, and closing costs, users can confidently navigate the home loan process. Choosing a calculator with a user-friendly interface and accuracy is essential for optimal results.

Home Loan Refinancing

Home loan refinancing is a process where a borrower replaces their existing home loan with a new one, often with more favorable terms. This can lead to significant financial benefits, including lower interest rates, reduced monthly payments, and potentially shorter loan terms. Understanding the process, advantages, and considerations associated with refinancing is crucial for homeowners seeking to optimize their mortgage.

Refinancing Process Overview

The refinancing process typically involves several steps, starting with exploring options and comparing offers. A borrower will need to gather necessary documents, including their existing loan documents, income verification, and property appraisal. Once the borrower has selected a new lender and loan terms, a formal application is submitted. This application is reviewed and assessed by the lender, who then approves or denies the request. If approved, the new loan is funded, and the existing loan is paid off. This often involves a closing process similar to the initial mortgage closing.

Benefits of Refinancing

Refinancing offers numerous potential benefits. A primary advantage is the potential for lower monthly payments due to a lower interest rate. This can significantly improve a borrower’s financial situation, freeing up funds for other expenses or investments. Reduced interest rates also lead to overall savings over the life of the loan. A shorter loan term can reduce the total interest paid, and potentially decrease the overall loan cost. This improved financial flexibility can be highly beneficial, particularly in fluctuating economic environments.

Circumstances Favoring Refinancing

Several circumstances might make refinancing advantageous. A significant drop in interest rates is a key driver, allowing borrowers to reduce their monthly payments and potentially shorten their loan term. If a borrower’s financial situation has improved, allowing for a better credit score, this could make them eligible for more favorable loan terms. If the borrower wants to change loan terms, such as altering the amortization period or loan type, refinancing is a possible solution.

Examples of Refinancing Scenarios

Consider a homeowner with a 30-year fixed-rate mortgage at 6.5% interest. If interest rates fall to 5.5%, refinancing to the lower rate could result in substantial monthly savings. Alternatively, a homeowner who wants to reduce their loan term to pay off their mortgage faster might refinance. A borrower facing a change in their financial situation, such as a pay raise, could also benefit from refinancing to access more favorable loan terms. For instance, if a borrower has a higher credit score due to responsible financial management, refinancing could unlock more favorable loan terms.

Costs Associated with Refinancing

| Cost | Description | Typical Range |

|---|---|---|

| Closing Costs | Fees associated with the closing process, including appraisal, title insurance, and attorney fees. | 1-5% of the loan amount |

| Prepayment Penalty | Fee charged by the lender if the borrower pays off the loan before the agreed-upon term. Not all loans have these penalties. | Variable, often a percentage of the remaining principal balance |

| Transfer Fees | Fees associated with transferring the loan to the new lender. | Variable |

| Appraisal Fees | Fees for an independent evaluation of the property’s value. | $300-$1000 |

Closing costs are often a significant factor to consider when evaluating the overall cost of refinancing. The exact costs and ranges may vary based on specific circumstances and lender policies.

Home Loan Fraud Prevention

Protecting yourself from home loan fraud is crucial for a successful and secure homeownership journey. This guide provides practical steps to identify and avoid common fraudulent activities, enabling informed decision-making and safeguarding your financial well-being. Understanding the methods used by fraudsters is essential to recognizing potential red flags and taking proactive measures to protect yourself.

Common Types of Home Loan Fraud

Home loan fraud encompasses a variety of deceptive practices. Understanding these different methods is essential for recognizing potential scams.

- Loan Modification Fraud: Fraudsters often target homeowners struggling with their mortgage payments. They promise to modify the loan terms, often charging exorbitant fees or demanding upfront payments. The methods include misrepresenting the loan modification process, misrepresenting qualifications, and charging unnecessary fees. This fraud targets vulnerable homeowners by exploiting their financial distress.

- Appraisal Fraud: Fraudulent appraisals significantly inflate the value of a property, allowing for higher loan amounts. This method involves manipulating the appraisal process, either through bribing appraisers or submitting inaccurate information. The perpetrators aim to increase the loan amount for the borrower, often to a level above the actual property value, potentially causing a financial burden on the buyer or homeowner.

- Predatory Lending: This involves offering loans with excessively high interest rates or fees, which are designed to make it difficult or impossible for the borrower to repay the loan. This method often involves hidden fees, complicated terms, and misleading information. The fraudsters target those with poor credit or financial literacy by exploiting their lack of awareness and resources.

- Equity Skimming: Fraudsters gain access to loan documents or other sensitive financial information to steal the homeowner’s equity. This method includes obtaining copies of loan documents, applications, or other sensitive information, often by impersonating legitimate financial institutions or individuals involved in the process. The criminals target homeowners who are unaware of the methods and vulnerabilities in the loan process, aiming to obtain financial gain from the homeowner’s equity.

- Forged Documents: Fraudulent actors use forged documents, such as loan applications, appraisals, or closing documents. This method involves creating false documents, often using sophisticated techniques to make them appear authentic. The perpetrators target individuals who are not sufficiently diligent in verifying the authenticity of documents, aiming to acquire funds or assets by misleading the victim into believing that a fraudulent transaction is legitimate.

Steps to Avoid Fraud

Taking proactive steps to verify information and maintain vigilance significantly reduces the risk of falling victim to fraud.

- Verify the Legitimacy of All Loan Documents: Thoroughly review all loan documents, including loan applications, appraisals, closing documents, and any other related paperwork. Compare them to your original documents and ensure the signatures and information match. Insist on seeing original documents, when possible.

- Work with Reputable and Licensed Professionals: Only engage with licensed and reputable mortgage brokers, lenders, and appraisers. Check the credentials and background of the professionals you work with and verify their license status.

- Scrutinize Loan Terms and Fees: Carefully read and understand all loan terms, conditions, and fees before signing any agreements. Ask questions about any terms you don’t understand.

- Maintain Strong Financial Records: Keep detailed records of all financial transactions related to the home loan process. This can be helpful in tracking expenses, confirming payments, and identifying discrepancies.

- Use Reliable Resources: Consult trusted financial institutions, regulatory agencies, and non-profit organizations for information about loan products and fraud prevention.

Fraudulent Activities Examples

These examples illustrate how fraudsters exploit vulnerabilities in the home loan process.

- Example 1: A homeowner receives a call from someone claiming to be from their lender, offering a loan modification. The caller requests upfront fees. The fraudster impersonates a legitimate lender, requesting personal information and funds. The homeowner should verify the lender’s authenticity by contacting the lender directly, and never send money or sensitive information in response to unsolicited calls or emails.

- Example 2: A homebuyer is presented with an appraisal significantly exceeding the market value of the property. The appraisal is inaccurate, and the homebuyer is pressured to close the deal quickly. The homebuyer should investigate the appraisal and compare it to recent sales of similar properties in the area.

- Example 3: A homeowner receives a document appearing to be a loan modification agreement, but the signature of the lender is forged. The homeowner should compare the signature to official records of the lender and seek legal advice if they suspect forgery.

Reporting Process

Reporting home loan fraud is critical for preventing further harm. Here’s a structured approach:

- Federal Trade Commission (FTC): Report fraudulent activities to the FTC at 1-877-FTC-HELP (1-877-382-4357). File a complaint online at ftc.gov.

- Consumer Financial Protection Bureau (CFPB): For loan modification fraud, contact the CFPB at [phone number] and file a complaint online at [website].

- Local Law Enforcement: Report suspected criminal activities, including forged documents, to local law enforcement agencies.

- Mortgage Lender: Contact the mortgage lender directly to report suspected fraud. Maintain a record of all communications.

Resources for Reporting

These resources offer valuable information and assistance:

- Federal Trade Commission (FTC): https://www.ftc.gov/

- Consumer Financial Protection Bureau (CFPB): https://www.consumerfinance.gov/

- Department of Justice (DOJ): https://www.justice.gov/

- National Association of Realtors (NAR): https://www.nar.realtor/

- Better Business Bureau (BBB): https://www.bbb.org/

Resources for Further Information

Navigating the complexities of home loans can be daunting. Fortunately, a wealth of resources are available to help you understand the process, compare options, and make informed decisions. This section details reliable sources, both governmental and private, to guide you through the journey of securing a home loan.

Reliable Sources for Home Loan Information

Accessing accurate and up-to-date information is crucial for making informed decisions about home loans. Reputable sources provide diverse perspectives and valuable insights into the various aspects of home financing.

- Federal Housing Finance Agency (FHFA): The FHFA is a US government agency that plays a critical role in maintaining a stable housing finance system. They provide insights into market trends, mortgage policies, and consumer protection related to home loans. Their website offers a wealth of information on mortgage-backed securities, and recent market trends.

- Consumer Financial Protection Bureau (CFPB): The CFPB is a US government agency dedicated to consumer protection in the financial sector. They provide resources on various financial products, including home loans, and promote financial literacy. Their website offers helpful guides and information on avoiding scams and understanding your rights as a borrower.

- Example Mortgage Lender Website: [Insert a credible mortgage lender website here]. This lender provides detailed information on their specific loan programs, including rates, terms, and eligibility criteria. This can be useful for understanding the specific offerings of a private institution.

- Example Financial News Website with Loan Focus: [Insert a credible financial news website here]. These sites often provide up-to-date market analysis, commentary on current trends, and coverage of important regulatory changes affecting the mortgage industry. They offer valuable insights into market dynamics.

- Example Credit Reporting Agency Website: [Insert a credible credit reporting agency website here]. Understanding your credit score is vital for loan qualification. This resource offers tools and information to help you monitor and improve your creditworthiness, which can directly impact your loan approval process.

Government Agencies Offering Home Loan Information

Government agencies play a crucial role in ensuring a fair and transparent home loan market. They offer specialized information and support for various types of homebuyers.

- Federal Housing Administration (FHA): The FHA offers information about FHA-insured loans, which often provide favorable terms for first-time homebuyers. Their website provides detailed information on eligibility criteria, loan limits, and the application process.

- Department of Veterans Affairs (VA): The VA offers support for eligible veterans with VA-backed loans. Their website provides information on loan eligibility, benefits, and the application process.

- Example Agency for Homebuyer Education: [Insert a relevant agency website here]. This government agency or program might focus on homebuyer education, providing valuable resources for first-time homebuyers to better understand the homebuying process, budgeting, and loan options.

Financial Institutions Offering Home Loan Products

Financial institutions, including banks, credit unions, and mortgage companies, offer a wide array of home loan products tailored to different needs and situations. It is crucial to compare various offers to find the best fit.

- Example Bank Website: [Insert a credible bank website here]. This bank offers conventional loans, FHA loans, and potentially other specialized loan programs.

- Example Credit Union Website: [Insert a credible credit union website here]. Credit unions often offer competitive rates and personalized services, particularly for members.

- Example Mortgage Company Website: [Insert a credible mortgage company website here]. Mortgage companies often specialize in specific loan types, such as VA loans, and can provide tailored solutions to borrowers.

Credible Financial Websites for Loan Information

Numerous financial websites provide unbiased information on home loans, aiding in comparisons and understanding market trends. These websites often include loan calculators and other helpful tools.

- Example Website for Mortgage Calculators: [Insert a credible website for mortgage calculators here]. These websites offer tools for estimating monthly payments, total loan costs, and comparing different loan options.

- Example Website for Home Loan Comparison Tools: [Insert a credible website for home loan comparison tools here]. These sites allow users to compare loan rates, terms, and fees from various lenders.

- Example Website for Loan News and Trends: [Insert a credible website for loan news and trends here]. These sites provide valuable insights into current market trends, regulatory changes, and other factors affecting the home loan market.

Resources for Finding Local Home Loan Advisors

Locating a qualified home loan advisor can simplify the process and ensure you receive personalized guidance.

- Online Search: Searching for “home loan advisors [city name]” on search engines like Google or Bing can yield relevant results. This often provides a list of local advisors.

- Real Estate Agents: Contacting local real estate agents for referrals can be a helpful step. They often have relationships with mortgage advisors and can provide recommendations based on their experience.

- Professional Association Directories: Checking professional association directories for local home loan advisors can help you identify qualified and licensed professionals in your area.

End of Discussion

In summary, securing a home loan is a multi-faceted process requiring careful consideration of various factors. Understanding the different loan types, the application procedure, and the crucial elements like interest rates and closing costs are essential for a successful homeownership journey. This guide provides a roadmap for navigating the complexities of home loans, empowering you to make informed decisions that align with your financial goals.