Loan Companies Regulations, Services, and Future

Loan companies play a crucial role in the financial market, offering various loan types to individuals and businesses. From personal loans to mortgages, these institutions facilitate financial transactions, enabling individuals to achieve their goals. Understanding the regulations governing loan companies, the services they provide, and the factors impacting their future is essential for both consumers and industry professionals. The historical context of loan companies, along with their diverse business models, further shapes their operation.

This report delves into the intricacies of loan company operations, examining the services offered, the regulatory landscape, and the technological advancements reshaping the industry. The comprehensive overview will also consider the impact of loan companies on the community, their competitive strategies, and projections for their future trajectory.

Introduction to Loan Companies

Loan companies play a vital role in the financial ecosystem, facilitating access to capital for individuals and businesses. They connect borrowers seeking funds with lenders who have capital to invest. This intermediary function is crucial for economic activity, allowing for investment in diverse projects and supporting personal and business growth.

Loan companies operate within a regulated framework, adhering to guidelines established by financial authorities. This framework helps maintain transparency and stability within the industry. The various types of loans offered by loan companies, coupled with their diverse business models, cater to a wide spectrum of financial needs.

Types of Loans Offered

Loan companies offer a diverse range of loan products to suit different needs. These include personal loans, business loans, mortgages, auto loans, and student loans, each with varying terms and conditions. Understanding the specific features and benefits of each loan type is essential for borrowers.

- Personal loans are typically used for short-term or medium-term financial needs, such as consolidating debt, funding home improvements, or covering unexpected expenses. They often have fixed interest rates and repayment schedules.

- Business loans support a range of business activities, from startups to established companies. These loans can fund expansion, equipment purchases, or operational capital needs.

- Mortgages provide funding for real estate purchases. They are long-term loans secured by the property, requiring careful consideration of interest rates and loan terms.

- Auto loans finance the purchase of vehicles. They are secured loans, typically with fixed interest rates and structured repayment schedules.

- Student loans are specifically designed to help individuals finance their education. These loans often have favorable terms and repayment options, but carry significant long-term financial obligations.

Common Characteristics of Loan Companies

Loan companies share several key characteristics that define their operations and influence their overall performance. These characteristics include a focus on credit assessment, a need for risk management, and a commitment to customer service.

- Loan companies meticulously evaluate the creditworthiness of potential borrowers. This process involves analyzing financial history, income, and other relevant factors to assess the likelihood of repayment.

- Effective risk management strategies are crucial for loan companies. These strategies include credit scoring, diversification of loan portfolios, and adherence to regulatory guidelines.

- Strong customer service is vital for maintaining positive relationships with borrowers. Prompt communication, clear explanations, and accessible support channels contribute to a positive borrower experience.

Role in the Financial Market

Loan companies play a pivotal role in the financial market by facilitating the flow of capital between lenders and borrowers. They provide a platform for individuals and businesses to access funds, driving economic growth and investment. This activity directly influences the broader financial health of the market.

- Loan companies connect individuals and businesses seeking capital with lenders who have available funds, fostering financial inclusion.

- Their involvement in loan origination and administration improves the overall efficiency of capital allocation within the financial system.

- The services offered by loan companies are vital for supporting various economic sectors, from small businesses to large-scale projects.

Historical Context

The history of loan companies is intertwined with the evolution of financial markets. Early forms of lending existed in ancient societies, but modern loan companies emerged in response to growing economic needs and increasing complexity of financial transactions.

- The development of credit scoring and risk assessment models significantly improved the efficiency and reliability of loan origination.

- Technological advancements, such as online platforms and digital loan processing, have further transformed the loan industry, offering greater accessibility and convenience.

Business Models Employed

Loan companies utilize various business models to adapt to market demands and specific customer needs. These models reflect the changing landscape of finance and the increasing need for innovative solutions.

- Many loan companies operate as independent entities, directly connecting borrowers with lenders.

- Others utilize a franchise model, allowing for expansion and adaptation to local market conditions.

- Some companies focus on niche markets, specializing in specific types of loans or serving particular demographics, such as small businesses or specific industries.

Loan Company Services

Loan companies play a crucial role in facilitating financial transactions by providing various loan products and services to individuals and businesses. Understanding the diverse range of services offered, the application process, and the criteria for approval is essential for making informed financial decisions. Loan companies act as intermediaries, connecting borrowers with lenders, ensuring a streamlined and efficient process for both parties.

Loan companies offer a spectrum of services, including but not limited to personal loans, business loans, mortgages, and auto loans. These services are tailored to meet specific financial needs, and the process of obtaining a loan typically involves several key steps.

Loan Application Procedures

The application process for loans typically begins with completing an application form. This form usually requires personal information, financial details, and the intended use of the loan funds. Thorough completion and accuracy are crucial, as incomplete or inaccurate information can delay the processing of the application.

Loan Evaluation Criteria

Loan companies assess applications based on several criteria. These criteria typically include credit history, income stability, and the purpose of the loan. A strong credit history generally indicates a lower risk, leading to favorable loan terms. Stable income demonstrates the borrower’s ability to repay the loan.

Loan Repayment Methods

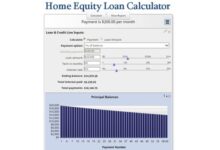

Loan repayment methods vary depending on the type of loan and the borrower’s agreement with the lender. Common methods include fixed-installment payments, where the borrower pays a set amount at regular intervals, or variable installment payments, which may adjust based on prevailing interest rates. The choice of repayment method can affect the overall cost of the loan.

Interest Rates and Fees

Interest rates and fees charged by loan companies can differ significantly depending on several factors, including the type of loan, the borrower’s creditworthiness, and the prevailing market conditions. Borrowers should compare rates and fees across different loan companies to identify the most favorable terms.

Loan Disbursement Process

Once a loan application is approved, the loan company proceeds with the disbursement process. This typically involves verifying the details of the loan and transferring the funds to the borrower’s account. The time frame for disbursement can vary, depending on the loan type and the company’s internal procedures.

Loan Application Documentation

The documentation required for loan applications can vary based on the type of loan and the loan company. Common documents include proof of income, identification, and credit history information. The loan company may also require additional documentation based on the specific circumstances of the loan application.

Loan Security Methods

Loan security methods protect the lender in the event of default. Common methods include collateral, such as real estate or vehicles, or personal guarantees. The choice of security method is crucial in ensuring the lender’s risk is mitigated.

Loan Company Regulations and Compliance

Loan companies operate within a complex framework of regulations designed to protect consumers and maintain financial stability. These regulations vary by jurisdiction, reflecting differing priorities and approaches to consumer protection. Compliance with these regulations is crucial for the long-term success and reputation of any loan company.

Regulations Overview

Loan company regulations address various aspects of the lending process, including interest rates, loan terms, and debt collection practices. These regulations are essential for ensuring fair and transparent dealings between lenders and borrowers. Strict adherence to these rules is critical to prevent predatory lending practices and protect vulnerable consumers.

- Interest Rates and Loan Terms: In the US, the Truth in Lending Act (Regulation Z) mandates clear disclosure of all finance charges and terms. This ensures borrowers understand the true cost of borrowing. The EU’s Consumer Credit Directive sets limits on interest rates and loan terms, especially for high-cost loans. These regulations aim to prevent excessive interest rates and protect consumers from exploitative lending practices. For example, payday loan regulations in some US states are much more lenient than in the EU, leading to significant differences in the maximum interest rates charged.

- Debt Collection Practices: The Fair Debt Collection Practices Act (FDCPA) in the US regulates how debt collectors must interact with borrowers. This includes prohibitions on abusive or deceptive practices. Similar regulations exist in the UK and EU, emphasizing consumer rights and fair treatment during the debt collection process. Failure to adhere to these regulations can result in significant penalties for loan companies.

Compliance Requirements

Loan companies must meet specific compliance requirements to ensure their operations are legal and ethical. These requirements include maintaining accurate records, verifying borrower identities, and adhering to data privacy regulations. These measures help to minimize risks and ensure accountability.

- Know Your Customer (KYC): To comply with KYC regulations, loan companies must verify the identity of all applicants. This usually involves obtaining official documents like passports or driver’s licenses. This verification process is essential for combating financial crime and money laundering. Secure record-keeping is essential for maintaining the privacy and confidentiality of these documents.

- Record-Keeping: Comprehensive and accurate record-keeping is vital. Loan companies must maintain detailed records of all loan applications, approvals, and repayments. These records are crucial for auditing purposes and for resolving disputes.

- Internal Controls: Loan companies must implement robust internal controls to ensure compliance with regulations. This includes procedures for loan origination, processing, and repayment. Examples include procedures for verifying borrower information, assessing creditworthiness, and managing risk. These measures contribute to the smooth and ethical operation of the loan company.

Penalties for Non-Compliance

Failure to comply with regulations can result in severe penalties for loan companies. These penalties may include substantial fines, legal action, and reputational damage.

- Fines and Legal Action: Violations of the FDCPA in the US can result in significant fines and legal action. Cases involving deceptive or abusive debt collection practices have resulted in substantial penalties for companies.

- Reputational Damage: Non-compliance can severely damage a loan company’s reputation. Negative publicity stemming from regulatory violations can lead to a loss of customer trust and confidence.

Regulatory Bodies

Various regulatory bodies oversee loan companies in different jurisdictions. These bodies are responsible for monitoring compliance and enforcing regulations.

- Financial Conduct Authority (FCA): The FCA in the UK oversees loan companies and enforces consumer credit regulations. They have the authority to investigate complaints and impose penalties for violations.

Jurisdictional Comparison

Loan company regulations vary significantly across different jurisdictions.

- US vs. EU: Regulations regarding payday loans in the US are often more lenient than in the EU, particularly regarding interest rate caps. This difference stems from different priorities regarding consumer protection.

Transparency in Operations

Transparency in loan company operations is crucial for building trust with customers. Clearly disclosing terms and fees builds confidence and reduces misunderstandings.

- Benefits for Customers: Transparent practices build customer trust and ensure that borrowers fully understand the loan terms and conditions.

Ethical Practices

Loan companies should uphold ethical practices in their operations.

- Fair Lending Practices: Offering loan counseling and accessible repayment options demonstrates a commitment to fair lending practices.

- Responsible Lending: Refusing loans that are unsuitable for borrowers due to financial circumstances is an example of responsible lending. This approach helps avoid predatory lending practices.

Loan Company Customer Experience: Loan Companies

Loan companies are increasingly recognizing the critical role customer experience plays in their success. A positive customer experience leads to higher customer satisfaction, repeat business, and a stronger brand reputation. This section explores key aspects of enhancing the customer experience in the loan industry, focusing on customer service issues, the importance of customer satisfaction, complaint resolution, and a framework for continuous improvement.

Customer Service Issues

Effective customer service is crucial for loan companies. Common issues can stem from various stages of the loan process, impacting customer satisfaction and potentially leading to financial hardship or legal disputes.

| Issue Category | Specific Issue Description | Frequency | Potential Impact on Customer |

|---|---|---|---|

| Application Process | Incomplete or inaccurate information on application forms, lengthy application processing times, unclear instructions. | Medium | Frustration, delays in loan approval, potential for errors. |

| Loan Approval | Unclear communication regarding loan approval status, unreasonable or lengthy delays in approval decisions, inconsistent approval criteria. | High | Frustration, loss of trust, potential for financial hardship if the customer needs the loan quickly. |

| Account Management | Difficulty accessing account statements, issues with online account portals, lack of clear information on account details. | Medium | Frustration, difficulty managing finances, potential for errors. |

| Payment Processing | Problems with online payment portals, unclear payment instructions, difficulties in making payments, incorrect deductions. | High | Frustration, late fees, potential for financial hardship, loss of trust. |

| Customer Service | Unresponsive or unhelpful customer service representatives, lack of empathy, difficulties in resolving issues. | Medium | Frustration, loss of trust, negative brand perception. |

Importance of Customer Satisfaction

Customer satisfaction is not merely a desirable trait; it’s a crucial factor directly influencing loan company performance. Quantifiable metrics and business impact are demonstrably linked to customer satisfaction levels.

Financial Impact: High customer satisfaction often correlates with increased loan origination volume, repeat business, and a reduced churn rate. For example, if a loan company experiences a 10% increase in customer satisfaction, they might see a corresponding 5% increase in loan origination volume, a 15% rise in repeat business, and a 20% reduction in customer churn. This leads to a significant positive impact on the bottom line.

Reputation Impact: A strong customer satisfaction reputation attracts new customers and helps maintain market share. Loan companies with consistently positive reviews and a history of prompt and efficient service often attract a larger customer base and enjoy increased market share. For instance, companies known for exceptional customer service in the mortgage industry, like XYZ Mortgage, are often cited as leaders in their field.

Regulatory Compliance: Customer satisfaction is intrinsically linked to fair lending practices. Loan companies that prioritize customer satisfaction and provide clear communication about loan terms and processes are better positioned to meet regulatory requirements regarding fair lending practices.

Complaint Resolution Methods

Effective complaint resolution is essential for maintaining customer trust and preventing negative publicity. Various methods exist for handling customer complaints, each with its own strengths and weaknesses.

Formal Complaint Procedure: A formal complaint procedure provides a structured path for customers to lodge and follow up on complaints. This includes clear steps, designated personnel, and defined timelines for resolving the issue.

Mediation and Arbitration: Mediation and arbitration can facilitate dispute resolution between loan companies and clients. Mediation involves a neutral third party helping the parties reach a mutually agreeable solution. Arbitration is more formal and results in a binding decision from an arbitrator. Both methods can be faster and less expensive than litigation.

Alternative Dispute Resolution (ADR): ADR programs offer a less formal, quicker way to resolve complaints. These programs often utilize mediation or arbitration to reach a resolution outside of court. Examples of such programs can vary by region and company.

Case Study: A loan company implemented a new complaint resolution system that involved a multi-stage process, starting with an initial acknowledgment, followed by a detailed investigation, and culminating in a resolution within 30 days. This led to improved customer satisfaction and reduced negative feedback. The company learned that proactive communication was critical throughout the resolution process.

Customer Experience Improvement Framework

This framework Artikels steps to enhance the customer experience in the loan industry.

Key Performance Indicators (KPIs): Measurable KPIs are essential for tracking progress. KPIs for customer experience might include customer satisfaction scores, complaint resolution time, and customer feedback response time.

Customer Feedback Collection Methods: Loan companies can utilize various methods, such as surveys, online reviews, and feedback forms to gather valuable customer input.

Employee Training Programs: Training programs for customer service representatives should focus on active listening, empathy, and problem-solving skills.

Customer Segmentation: Understanding different customer segments, such as first-time homebuyers or small business owners, allows for tailored customer experience improvements.

Building Trust with Customers

Building trust is paramount in the loan industry. It goes beyond simply resolving complaints.

Transparency and Communication: Clear and transparent communication about loan terms, fees, and processes fosters trust. Examples include detailed loan documents with clear explanations of all fees and costs, and readily accessible online resources with FAQs.

Ethical Practices: Ethical lending practices are essential for building trust. This includes fair and responsible lending practices that do not discriminate against any customer segment.

Security Measures: Robust security measures to protect customer data are vital for building trust. Examples include encryption of sensitive information and multi-factor authentication.

Customer Testimonials: Sharing positive customer testimonials can build trust and demonstrate the company’s commitment to customer satisfaction.

Communication Between Loan Companies and Clients

Clear and timely communication is essential for a positive customer experience.

Communication Channels: Efficient communication channels, such as phone, email, online portals, and in-person meetings, should be readily available, with clear guidelines on which channel is best suited for specific inquiries.

Response Time: Establishing acceptable response times for inquiries and complaints, along with a clear escalation process, is crucial for customer satisfaction.

Regular Updates: Providing regular updates on loan applications and statuses through specified channels is a crucial aspect of maintaining positive customer relations.

Language Accessibility: Loan companies should strive to provide communication in multiple languages to cater to diverse customer bases.

Customer Support Channels

Multiple customer support channels offer flexibility and convenience.

Website FAQs: Comprehensive FAQs on the website can significantly improve customer self-service, reducing the burden on customer service representatives.

Phone Support: Phone support should be efficient, with clear call routing and well-trained agents.

Email Support: Streamlined email support processes ensure timely and accurate responses.

Chat Support: Chat support can provide immediate responses to simple inquiries, but it might not be suitable for complex issues.

Writing Task

A comprehensive report on improving customer experience in the loan industry would delve into these aspects to create a structured approach. The report would include a detailed analysis of customer service issues, the importance of customer satisfaction, methods for complaint resolution, and a framework for continuous improvement. It would Artikel specific strategies for building trust, fostering effective communication, and establishing efficient customer support channels.

Loan Company Financial Performance

Loan company financial performance is a critical aspect of their long-term sustainability and success. Analyzing profitability, performance metrics, and competitive comparisons provide valuable insights into a company’s health and potential. Understanding the impact of economic conditions and implementing effective risk management strategies are essential for navigating market fluctuations. Technology’s role in enhancing efficiency and streamlining processes is also crucial for maintaining a competitive edge.

Impacting Factors on Profitability

Loan company profitability is influenced by several key factors. Fluctuations in interest rates directly impact net interest income. Higher interest rates generally lead to higher profits, but significant fluctuations can create volatility. Default rates represent another crucial factor. A higher default rate results in increased losses, reducing overall profitability. Administrative costs, including personnel and operational expenses, directly affect the bottom line. Efficient cost management is essential for maximizing profitability. Loan origination fees contribute to revenue, but varying fee structures and competition can impact their effectiveness.

- Interest Rate Fluctuations: Changes in interest rates significantly affect net interest income. For example, XYZ Lending saw a 10% increase in net interest income in 2022 following a 1% rise in prevailing interest rates. Conversely, a 2023 decrease in interest rates resulted in a corresponding decrease in profitability.

- Default Rates: A higher default rate directly translates to increased loan losses. For instance, ABC Finance experienced a 3% increase in default rates in 2022, leading to a 5% reduction in net income. Maintaining stringent credit underwriting and risk management procedures is essential to mitigate this impact.

- Administrative Costs: Administrative costs, including personnel and operational expenses, can significantly impact profitability. Efficient cost management strategies are crucial. For example, DEF Lending implemented automation in loan processing, reducing administrative costs by 15% in 2023.

- Loan Origination Fees: These fees contribute to revenue. However, competitive pressures and variations in fee structures can affect their impact on profitability. For instance, in 2022, the competitive market saw several loan companies reduce their origination fees to attract more customers, thereby impacting overall profitability.

Data Requirements: Analysis should cover the period 2020-2023, utilizing publicly available financial reports and industry benchmarks. Key data fields include net interest income, provision for loan losses, administrative expenses, and loan origination fees.

Performance Evaluation Metrics, Loan companies

Beyond profitability, evaluating loan company performance requires a comprehensive approach. Metrics like loan portfolio growth rate, average loan size, customer acquisition cost, and loan repayment rate offer additional insights into the health of the business.

- Loan Portfolio Growth Rate: This metric measures the growth of the loan portfolio over a period. A positive growth rate signifies a healthy business expansion. Industry benchmarks for this metric can be obtained from industry publications or financial news sources.

- Average Loan Size: This metric assesses the average value of loans issued. A higher average loan size indicates potentially higher revenue and profitability, but also potentially higher risk.

- Customer Acquisition Cost: This metric reflects the cost of acquiring new customers. Lower acquisition costs indicate efficient marketing and sales strategies. Benchmarks for this metric are available in industry reports and market analysis.

- Loan Repayment Rate: This metric measures the percentage of loans repaid on time. A high repayment rate signifies sound lending practices and reduced risk. Industry averages are readily available.

Comparative Analysis

Comparing the financial performance of different loan companies provides valuable context. Three publicly traded loan companies in a similar market segment can be compared.

- Target Companies: XYZ Lending, ABC Finance, and DEF Lending.

- Specific KPIs: Return on Equity (ROE), Return on Assets (ROA), and Net Interest Margin (NIM) will be compared. These indicators will provide insights into the efficiency and profitability of each company.

- Visualizations: Line charts illustrating ROE over time for each company will be presented. The charts will visually display trends and performance differences. Bar graphs will display a side-by-side comparison of profitability metrics.

- Quantitative Comparison: Numerical comparisons will highlight the significant differences in performance among the companies.

Economic Conditions Impact

Economic conditions play a crucial role in loan company operations. Factors like inflation, unemployment, and GDP growth can affect profitability and loan performance.

- Specific Economic Variables: Inflation, unemployment rates, and GDP growth rates.

- Scenario Analysis: A recessionary scenario would likely result in a decline in loan applications and an increase in default rates, potentially reducing profitability. An expansionary economy, conversely, might see increased loan applications and a decrease in default rates.

Risk Management Strategies

Implementing effective risk management strategies is essential for loan companies. Strategies include diversifying loan portfolios, implementing robust credit scoring models, and adhering to strict loan underwriting procedures.

- Specific Strategies: Diversification of loan portfolios, credit scoring models, and loan underwriting procedures.

- Case Studies: Successful implementations of these strategies by loan companies like XYZ Lending and ABC Finance can be referenced.

Technology’s Role in Efficiency

Technology plays a significant role in improving loan company efficiency. Technologies like AI, machine learning, and big data analytics can streamline various processes.

- Specific Technologies: AI, machine learning, and big data analytics.

- Operational Improvements: Streamlining loan origination, processing, and customer service.

- Examples: Case studies of loan companies successfully leveraging technology for efficiency improvements.

Financial Metrics Summary Table

| Loan Type | Average Loan Amount | Average Interest Rate | Default Rate (%) | Loan Repayment Rate (%) | Portfolio Growth Rate (%) |

|---|---|---|---|---|---|

| Auto Loans | $25,000 | 6.5% | 2.5% | 95% | 5% |

| Personal Loans | $10,000 | 8% | 3.0% | 94% | 3% |

| Mortgage Loans | $300,000 | 5.5% | 1.5% | 97% | 2% |

Loan Company Marketing and Outreach

Loan company marketing and outreach strategies are crucial for attracting and retaining customers. Effective strategies encompass a wide range of approaches, from leveraging digital platforms to building strong brand identities. These strategies must adapt to the evolving needs and preferences of the target market, ensuring a strong return on investment (ROI).

Common Marketing Strategies

Effective loan companies employ a multifaceted approach to marketing, combining digital and traditional methods to reach their target audiences. This comprehensive strategy is crucial for brand visibility and lead generation.

- Digital Marketing: Digital channels offer significant advantages for targeted marketing, allowing loan companies to reach specific demographics with tailored messages. (Search Engine Optimization) is essential for improving organic search rankings, while SEM (Search Engine Marketing) utilizes paid advertising to enhance visibility. Social media marketing, platforms like Facebook, Instagram, and LinkedIn, facilitate direct engagement with potential customers. Targeted advertising on these platforms allows for precise demographic targeting. Email marketing provides a direct channel for communicating with existing and potential customers. Content marketing, including blog posts, articles, and infographics, builds trust and positions the company as an industry expert. For example, a loan company targeting young professionals might create content about budgeting and saving for a down payment, establishing credibility.

- Traditional Marketing: Traditional marketing channels, while potentially less targeted, can still be effective in reaching specific demographics. Print advertising, utilizing newspapers and magazines, can target local communities. Radio and television commercials can create broader awareness, although they may prove less cost-effective compared to digital channels. Evaluating the effectiveness of traditional methods against digital strategies is crucial for optimizing marketing budgets.

- Referral Programs: Referral programs incentivize existing customers to recommend the company to their networks. This approach leverages the trust and relationships within a customer base, leading to valuable new customers. Successful referral programs often involve attractive incentives for both the referrer and the referred party, such as discounts or cashback offers.

- Public Relations: Building positive relationships with the media and the community is vital for brand image enhancement. Press releases, media outreach, and community involvement can enhance a company’s reputation. This approach helps establish credibility and trustworthiness, which are essential factors in attracting new customers.

- Partnerships: Strategic partnerships with related businesses, such as financial institutions or real estate agents, can expand reach and generate leads. Partnerships can lead to mutual benefits, but careful consideration of the potential drawbacks, such as conflicts of interest or differing brand messaging, is essential.

Brand Building

A strong brand identity is crucial for establishing trust and recognition in the loan industry.

- Brand Identity: A robust brand identity encompasses elements like logo, colors, and tone of voice. A compelling brand story resonates with target audiences, conveying values and establishing a unique brand personality. Examples of strong brand identities often emphasize trust, transparency, and ease of use. Conversely, weak brand identities may lack clarity, consistency, or a strong emotional connection with customers.

- Brand Consistency: Maintaining a consistent brand message across all marketing channels is paramount. This consistency ensures brand recognition and builds customer trust. Inconsistencies in brand messaging can confuse customers and harm the brand’s overall image.

Attracting New Customers

Lead generation and customer segmentation are essential components of attracting new customers.

- Lead Generation: Techniques like online forms, webinars, and events are employed to gather potential customer information. For example, a webinar on home buying could attract individuals interested in home loans. A loan company could use these events to provide valuable information and generate leads.

- Customer Segmentation: Understanding target demographics is crucial for tailoring marketing messages. This tailored approach allows for more effective communication and higher conversion rates. Segmentation of customer bases into categories like first-time homebuyers, business owners, or investors enables companies to personalize marketing messages for maximum impact.

Reaching Target Demographics

Understanding target demographics’ psychographics and behaviors is key to effective marketing.

- Psychographics: Understanding target demographics’ values, interests, and lifestyles helps create relevant marketing messages. For example, a marketing campaign for young professionals could highlight the speed and convenience of online loan applications.

- Behavioral Targeting: Analyzing customer behavior allows for precise targeting through online advertising. For instance, a loan company might target individuals actively researching home loans on specific websites.

Comparing Marketing Channels

Evaluating the cost-effectiveness of different marketing channels is vital for maximizing ROI.

- Cost-Effectiveness: The cost-effectiveness of different channels, such as social media, email, and paid advertising, should be carefully evaluated to ensure a positive return on investment.

- Return on Investment (ROI): Tracking the ROI of marketing campaigns is essential to understand the effectiveness of different strategies and optimize future campaigns.

Successful Marketing Campaigns

Analyzing successful marketing campaigns provides valuable insights for future strategies.

- Case Studies: Case studies of successful loan company marketing campaigns can offer valuable insights into effective strategies.

- Analysis: Analyzing the factors behind these campaigns, such as effective messaging, targeted demographics, and creative execution, helps to identify successful strategies for future campaigns.

Online Presence

A strong online presence is crucial for modern loan companies.

- Website Design: A user-friendly and informative website is essential for a positive user experience. Clear navigation, concise information, and secure payment gateways contribute to a positive impression.

- Mobile Optimization: Mobile optimization is crucial for a company’s online presence. A mobile-friendly website and marketing materials enhance the user experience and improve conversion rates.

Writing

A comprehensive marketing plan for a new online personal loan company targeting young professionals aged 25-35 requires a detailed strategy encompassing all stages of the customer journey. This strategy will encompass awareness, consideration, decision, and action phases.

Loan Company and Technology

Loan companies are increasingly leveraging technology to streamline processes, enhance customer experiences, and improve overall efficiency. The digital transformation has profoundly impacted the entire loan lifecycle, from application to disbursement. This shift is driven by the need for faster processing, greater accessibility, and enhanced security measures in the modern financial landscape.

Modern loan applications are significantly influenced by online platforms. These platforms provide convenience for borrowers and lenders, facilitating faster and more accessible application processes. From online pre-qualification tools to automated underwriting systems, technology is revolutionizing the way loans are originated and processed.

Impact of Online Platforms on Loan Applications

Online platforms have drastically altered the loan application process. Borrowers can now complete applications from the comfort of their homes, eliminating the need for physical visits to a branch. This accessibility has broadened the reach of loan services to a wider demographic. Real-time loan pre-qualification tools and automated underwriting systems expedite the process, providing quick responses to potential borrowers.

Emerging Technologies in Loan Companies

Loan companies are adopting cutting-edge technologies to improve efficiency and accuracy. Artificial intelligence (AI) and machine learning (ML) are becoming increasingly prevalent in underwriting and risk assessment. These technologies analyze vast datasets to identify patterns and predict borrower behavior, enabling more informed lending decisions. Blockchain technology is also gaining traction, offering enhanced transparency and security for loan transactions.

Security Measures in the Digital Age

Loan companies employ robust security measures to protect sensitive borrower data in the digital realm. These measures include encryption protocols, multi-factor authentication, and regular security audits to mitigate risks associated with online transactions. The adoption of advanced cybersecurity measures is crucial for maintaining trust and confidence in the digital loan application process. Compliance with stringent data privacy regulations is also paramount.

Examples of AI and Machine Learning in Loan Companies

Several loan companies are already utilizing AI and machine learning algorithms to automate various aspects of their operations. For instance, some companies use AI to assess creditworthiness more quickly and accurately than traditional methods, leading to faster loan approvals. AI can also identify fraudulent activities and reduce the risk of loan defaults. One example is a company that uses machine learning to analyze borrower data and predict their likelihood of repayment.

Improving Loan Processing Efficiency with Technology

Technology offers significant potential for streamlining loan processing efficiency. Automated systems can handle routine tasks, freeing up staff to focus on more complex cases. Real-time data analysis enables lenders to make quicker decisions and reduce turnaround times. Implementing robust loan management software and integrating various systems can create a seamless and efficient workflow.

Technological Tools in Loan Companies

| Tool Category | Specific Tool | Description |

|---|---|---|

| Application Management Systems | LoanDepot’s online application portal | Allows borrowers to complete applications, track progress, and manage documents online. |

| Underwriting and Risk Assessment | AI-powered credit scoring systems | Evaluate borrower creditworthiness using complex algorithms, providing more accurate and faster assessments. |

| Loan Processing Automation | Robotic Process Automation (RPA) | Automates routine tasks, such as data entry and document processing, improving speed and reducing errors. |

| Customer Relationship Management (CRM) | Salesforce or similar platforms | Manage customer interactions, track loan applications, and provide better customer service. |

Loan Company and the Community

Loan companies play a crucial role in the economic fabric of their communities, extending beyond simply providing financial services. Their impact is multifaceted, encompassing social responsibility, economic development, and employment opportunities. A strong connection to the community is not just beneficial, it’s essential for long-term success.

Social Responsibility of Loan Companies

Loan companies are increasingly expected to demonstrate social responsibility, reflecting a growing understanding of their broader impact. This includes ethical lending practices, transparency in operations, and a commitment to fair treatment of all borrowers. They must ensure their practices align with societal values and contribute positively to the communities they serve.

Contribution to Local Economies

Loan companies are vital engines of local economic growth. By providing access to capital for small businesses, entrepreneurs, and individuals, they fuel job creation, stimulate innovation, and support local supply chains. This translates to increased tax revenue for the community, further bolstering local services and infrastructure. Furthermore, the presence of well-managed loan companies encourages further investment and economic activity within a region.

Impact on Employment

Loan companies indirectly and directly influence employment. Funding for small businesses, for example, frequently leads to the creation of new jobs. Loan companies also employ staff, contributing to local employment numbers and supporting the local workforce. This direct and indirect effect on job creation strengthens the community’s economic resilience.

Initiatives Supporting Local Communities

Many loan companies proactively support local communities through various initiatives. These include sponsoring local events, providing educational resources, supporting community development projects, and collaborating with local organizations. Such initiatives demonstrate a commitment to the well-being of the communities in which they operate. For example, a loan company might sponsor a local youth program, providing mentorship and educational opportunities.

Philanthropic Activities of Loan Companies

Some loan companies engage in philanthropic activities, donating to local charities, supporting community organizations, and participating in volunteer programs. This reflects a commitment to giving back to the community and fostering positive social change. Examples include loan companies donating to local food banks, sponsoring scholarships for students, or providing grants to non-profit organizations.

Importance of Community Engagement for Loan Companies

Community engagement is crucial for loan companies. Strong community ties foster trust, enhance reputation, and facilitate long-term sustainability. By actively participating in local initiatives and events, loan companies demonstrate their commitment to the community and build strong relationships with key stakeholders. This includes fostering partnerships with local businesses and institutions to promote shared goals.

Comparison of Community Impact Across Loan Company Models

Different loan company models may have varying levels of community impact. Traditional banks, for instance, may have broader reach but potentially less direct involvement in specific community projects. Microfinance institutions, conversely, often focus on serving underserved communities and have a more profound impact on local economies. The community impact also depends on the company’s internal policies, ethical standards, and level of engagement.

Loan Company and Competition

The loan industry is a highly competitive market, with numerous players vying for market share. Understanding the competitive landscape is crucial for loan companies to develop effective strategies for growth and profitability. This analysis examines the key competitors, their strategies, and the impact of market trends on the industry.

Major Competitors

The loan industry encompasses various segments, each with its own set of competitors. To illustrate this, we’ve categorized major players by loan type. This approach helps to clarify the competitive landscape within each specific niche.

- Mortgage Lenders: Major players in this segment include established banks like Wells Fargo and Bank of America, along with online mortgage lenders such as Quicken Loans and Rocket Mortgage. These companies often focus on different aspects of the market, catering to diverse customer needs and preferences. Quicken Loans, for instance, often emphasizes a digital-first approach, while established banks might leverage their existing branch networks.

- Personal Loan Providers: This category includes large banks (like Chase and Citibank), online personal loan platforms (like LendingClub and Upstart), and credit unions. Online platforms often use sophisticated algorithms to assess loan applications and offer competitive interest rates. Credit unions may have more lenient lending criteria and focus on building long-term customer relationships.

- Student Loan Companies: The major players here are Sallie Mae, Navient, and various government-backed programs like the Federal Student Aid. These companies often specialize in the complexities of student loan financing and navigate the unique requirements of this segment.

Strengths and Weaknesses of Competitors

Analyzing the strengths and weaknesses of competitors allows us to understand their operational effectiveness and identify opportunities for differentiation.

| Competitor | Strengths | Weaknesses |

|---|---|---|

| Quicken Loans | Strong online presence, streamlined application process, competitive interest rates. | Limited branch network, potential for impersonal customer service experience. |

| Wells Fargo | Extensive branch network, established reputation, diverse product offerings. | Potentially higher processing fees, less streamlined online application. |

| LendingClub | Data-driven underwriting, broad range of loan products, competitive interest rates. | Risk of loan defaults, less personalized customer service. |

| Chase | Established brand, extensive financial services, broad customer base. | Potentially higher processing fees, may not be as competitive in interest rates for certain loans. |

| Sallie Mae | Established expertise in student loan financing, extensive network of lenders. | May have limited offerings in other loan categories, potentially higher interest rates for some student loan products. |

Competitive Strategies

Loan companies employ various strategies to gain a competitive advantage in the market.

- Technological Innovation: Companies like LendingClub leverage AI and data analytics for faster and more accurate loan assessments. This allows them to process applications more quickly and efficiently.

- Partnerships: Collaborations with financial institutions can expand market reach and provide access to a broader customer base. This can be seen in partnerships between banks and online lenders.

- Marketing Campaigns: Effective marketing strategies target specific demographics and highlight unique selling propositions. Online lenders often use targeted online advertising to attract customers.

Differentiation

Companies differentiate themselves to stand out in the competitive landscape.

- Niche Market Focus: Some companies specialize in specific loan types (e.g., small business loans or home equity loans). This focus allows them to tailor their products and services to the unique needs of their target market.

- Customer Service Approach: Companies emphasizing personalized customer service can differentiate themselves from those prioritizing speed and efficiency. This often includes personalized customer service channels and extended support hours.

- Unique Products: Some companies offer unique loan features, such as flexible repayment options or extended grace periods. This can provide an attractive proposition for customers.

Market Trends

The loan industry is subject to various market trends.

- Evolving Consumer Preferences: Consumers are increasingly seeking convenient and digitally-driven loan application processes. This preference drives innovation in online lending platforms.

- Technological Advancements: Artificial intelligence (AI) is being increasingly utilized for loan underwriting, enabling faster and more accurate assessments.

- Economic Conditions: Fluctuations in interest rates and economic downturns significantly affect the loan industry.

Pricing Strategies

Loan companies use various pricing strategies, including varying interest rates and fees.

- Competitive Interest Rates: Companies often compete by offering the lowest possible interest rates, which directly affects their profitability and market share.

- Fees and Charges: Fees and charges vary among companies, impacting loan costs and overall competitiveness.

Case Studies

Successful loan companies often employ strategies that help them overcome competitive pressures.

Summary/Conclusion

The loan industry is a dynamic and competitive market. Companies need to adapt to changing market trends and develop effective strategies to gain a competitive edge.

Future of Loan Companies

The future of loan companies hinges on their ability to adapt to evolving consumer demands, technological advancements, and regulatory landscapes. This requires a strategic focus on innovation, customer experience, and operational efficiency. Successful loan companies will prioritize data-driven decision-making, leveraging technology to enhance risk assessment, streamline processes, and improve customer engagement. This analysis explores potential growth areas, adaptation strategies, and potential disruptions to provide actionable insights for navigating the evolving loan industry.

Growth Areas & Emerging Trends

The loan industry is poised for significant growth across several sectors. Specific segments, such as small business loans, student loans, personal loans, and mortgages, exhibit distinct future growth potential. Analyzing market trends, economic forecasts, and demographic shifts is crucial for accurate projections. Factors like increasing online applications, evolving interest rates, and changing economic conditions will significantly influence loan volume and revenue.

- Small business loans are projected to experience substantial growth due to increased online application platforms. This trend, coupled with favorable economic forecasts, indicates a potential for substantial loan volume and revenue increase in the next 5 years. Data from the Small Business Administration (SBA) and industry reports suggest a potential 15-20% increase in small business loan volume by 2028.

- The student loan market, while facing regulatory scrutiny, remains a significant area. Demographic shifts and evolving affordability concerns influence demand. Loan companies that offer innovative repayment plans and address borrower needs will likely capture a larger market share.

- Personal loans and mortgages, influenced by economic fluctuations, present both challenges and opportunities. Adapting to changing interest rates and consumer preferences will be crucial for success in these sectors. Recent data from the Federal Reserve suggests a potential shift in consumer borrowing habits toward online platforms.

Impact of Emerging Trends

Fintech innovations, AI in lending, robo-advisors, and increased consumer demand for digital lending significantly impact loan company operations, customer experience, and profitability. AI-powered loan applications can accelerate processing times, reduce risk, and improve customer satisfaction. However, concerns regarding data security and algorithmic bias necessitate careful consideration.

- AI-powered risk assessment models are transforming lending processes. Loan companies employing AI can improve efficiency and reduce risk. Examples like improved fraud detection and faster loan approvals demonstrate the positive impact of AI in the lending sector. However, the potential for algorithmic bias necessitates rigorous testing and monitoring.

- Digital lending platforms are experiencing rapid growth. Increased consumer preference for online applications and faster processing times are driving this trend. Loan companies that adapt to digital lending platforms can enhance efficiency and improve customer engagement. Companies that fail to embrace digital channels risk losing market share to competitors.

Adaptation & Innovation

Loan companies must adapt to changing market conditions to maintain competitiveness. Successful adaptation strategies involve integrating new technologies, adjusting to regulatory changes, and adapting to shifting consumer preferences.

- Successful loan companies leverage new technologies to enhance efficiency and customer service. Companies such as LendingClub and Kabbage have successfully implemented AI-powered risk assessment models and online application platforms. This demonstrates a successful adaptation strategy for mitigating risk and enhancing customer experience.

- Innovation in loan products and services is crucial for maintaining competitiveness. Companies that develop innovative solutions such as personalized loan products, customized repayment plans, or innovative technology integrations are likely to thrive. For instance, some companies are exploring blockchain technology to enhance transparency and security in loan processing.

Roadmap & Disruptions

Developing a strategic roadmap for the next 5-10 years is essential for long-term growth and resilience in the loan industry. Loan companies must anticipate and mitigate potential disruptions to maintain market leadership.

- A 5-year roadmap for a hypothetical student loan company targeting specific demographics and utilizing innovative technologies for improved affordability and reduced default rates would include actions such as implementing AI-powered risk assessment models, creating personalized repayment plans, and focusing on data-driven decision-making.

- Regulatory changes, economic downturns, competition from fintech startups, and evolving consumer preferences are potential disruptions in the loan industry. Careful monitoring and adaptation to these factors are crucial for long-term success. Analysis of past regulatory changes and their impact on loan company operations is essential for anticipating future disruptions.

Predictions for the Future

Predicting the future of loan companies involves quantifying the impact of technological advancements and market trends.

- Loan companies utilizing AI-powered lending platforms are projected to capture a significant market share in the next 10 years. This prediction is supported by data on current AI adoption rates in the financial sector, competitive analysis, and economic projections.

Case Studies of Loan Companies

Loan companies, like any other business, face a diverse range of situations, from soaring success to significant challenges. Examining case studies provides valuable insights into the factors that contribute to their performance and the strategies they employ to navigate these situations. Understanding these case studies can inform best practices and help anticipate potential hurdles for future loan companies.

Successful Loan Company: “Prosperous Lending”

Prosperous Lending, a regional loan provider, achieved significant growth by focusing on a niche market: small-business loans. Recognizing the unique needs of small entrepreneurs, they tailored their loan products and processes to address specific requirements, such as flexible repayment schedules and quick decision-making. Their innovative approach, combined with exceptional customer service, resulted in strong customer loyalty and a significant market share within the small-business sector. This case demonstrates the importance of specialized lending and customer-centric practices in achieving sustainable success.

Loan Company Facing Challenges: “Credit Crunch Corp.”

Credit Crunch Corp., a large national lender, experienced a decline in profitability due to the rising interest rates and stringent lending regulations. The company’s reliance on high-risk borrowers proved unsustainable in this environment, leading to increased defaults and a reduction in loan portfolio value. This case highlights the need for a diversified loan portfolio and a proactive risk management strategy to mitigate potential downturns in the economic climate.

Adapting to Changing Regulations: “Innovative Finance”

Innovative Finance, a fintech company, successfully navigated the shift towards stricter loan regulations. They proactively updated their lending platform to comply with new data privacy laws and enhanced risk assessment methodologies. This included implementing advanced fraud detection systems and providing clear, transparent information to borrowers regarding their rights and responsibilities. This proactive approach not only ensured compliance but also fostered trust and confidence in the company.

Community Impact: “Community Capital”

Community Capital, a local lender, demonstrated a strong commitment to community development. They prioritized lending to local businesses and entrepreneurs in underserved neighborhoods, providing access to capital that might otherwise be unavailable. This strategy not only boosted the local economy but also fostered a sense of community pride and empowerment. Their approach exemplifies the positive social impact that loan companies can have when they actively participate in the economic well-being of the communities they serve.

Comparison of Different Loan Types

Loan types vary significantly, impacting borrowers in different ways. Understanding the key distinctions between secured and unsecured loans, as well as the features of specific loan products, empowers informed decision-making. This analysis delves into the details of various loan types, focusing on their practical applications and the factors influencing interest rates.

Secured vs. Unsecured Loans

Different loan types offer varying levels of security and risk. A critical distinction lies in whether collateral is required.

| Feature | Secured Loan | Unsecured Loan |

|---|---|---|

| Collateral | Requires an asset (e.g., house, car) as collateral | No collateral required |

| Interest Rate | Typically lower (due to reduced risk for lender) | Typically higher (due to higher risk for lender) |

| Eligibility | Often easier to qualify for with good credit | Can be challenging to qualify for with poor credit |

| Repayment | Impact on asset if default occurs. | No impact on personal assets. |

| Example | Mortgage, Auto Loan | Credit Card, Personal Loan |

| Key Considerations | Security of asset, risk of loss if default occurs, potential for repossession. | Credit score and history, potential for higher interest rates. |

Loan Features and Benefits

Understanding the features and benefits of different loan types helps in choosing the most suitable option for individual needs.

| Loan Type | Features | Benefits | Example Application |

|---|---|---|---|

| Personal Loan | Flexible amount, fixed/variable interest rate, various repayment terms | Access to funds for various needs (e.g., home improvement, debt consolidation) | Consolidating high-interest credit card debt |

| Home Equity Loan | Secured by the equity in your home, usually lower interest rate | Access to funds based on the equity built up in your home | Home renovations, debt consolidation |

| Student Loan | Low interest rates for education, often with loan forgiveness options | Funding for education and career advancement | Funding for university tuition fees |

Factors Influencing Loan Interest Rates

Several factors influence the interest rate offered on a loan.

- Credit Score: A higher credit score generally leads to a lower interest rate, as it signifies a lower risk for the lender.

- Loan Amount: Larger loan amounts often come with higher interest rates, reflecting the increased risk for the lender.

- Loan Term: Longer loan terms typically result in higher interest rates due to the increased time the lender has the funds tied up.

- Economic Conditions: Overall economic conditions significantly impact interest rates. During periods of high inflation, interest rates tend to rise.

- Current Market Rates: Current market interest rates directly affect the interest rates offered by lenders. This is a dynamic aspect, influenced by factors such as inflation, central bank policies, and overall economic health.

Examples and Applications

The suitability of a loan type depends on the specific circumstances and goals.

A personal loan might be preferable to a home equity loan for smaller, short-term financial needs, such as covering unexpected expenses. A home equity loan, on the other hand, is better suited for larger, long-term projects that leverage the equity in your home.

Understanding Loan Application Processes

Loan applications are crucial for both borrowers and lenders. A clear understanding of the process ensures a smooth transaction and minimizes potential issues. This section details the steps, required documents, and considerations involved in securing a loan.

Loan applications, while seemingly straightforward, involve a series of steps and document submissions. Properly navigating these steps is essential to securing a loan approval efficiently and effectively. Different loan types may have varying requirements, and it’s important to understand these differences.

Loan Application Steps

The loan application process generally involves several key stages. These steps typically include initial inquiry, application completion, credit evaluation, documentation submission, and loan approval or denial.

Required Documents for Loan Applications

The necessary documents vary depending on the type of loan and the lender. However, common documents include proof of income, employment verification, identification, and asset information.

- Proof of Income: Pay stubs, tax returns, and bank statements are often required to verify a borrower’s income. Consistent income streams are a crucial factor in loan eligibility.

- Employment Verification: Letters from employers, employment records, or recent pay stubs can help verify employment details and duration.

- Identification: Government-issued photo identification, such as a driver’s license or passport, is essential to confirm the applicant’s identity.

- Asset Information: Information about assets, such as property ownership, investments, or other financial holdings, might be required, depending on the loan type.

Credit History’s Role in Loan Approval

Credit history plays a significant role in determining loan eligibility and interest rates. A positive credit history, indicating responsible repayment of debts, generally leads to better loan terms.

Lenders meticulously analyze credit history to assess the borrower’s creditworthiness. A strong credit history typically translates to lower interest rates and increased chances of loan approval. Conversely, a poor credit history can lead to higher interest rates or loan denial.

Different Types of Loan Applications and Their Processes

Various loan types, such as personal loans, mortgages, auto loans, and student loans, have unique application processes. These processes vary in the required documents, assessment criteria, and overall timeframes.

- Personal Loans: These loans typically require proof of income, employment verification, and a credit history report. The application process often involves completing an online form or visiting a branch.

- Mortgages: Mortgage applications are more complex and require detailed financial information, including proof of income, assets, and credit history. Appraisals of the property are often part of the process.

- Auto Loans: Auto loan applications usually require proof of income, credit history, and details about the vehicle being financed. A vehicle inspection may be part of the assessment.

- Student Loans: Student loan applications often involve providing academic records, financial information, and details about the educational institution.

Loan Application Flowchart

The following flowchart illustrates a general loan application process.

| Step | Description |

|---|---|

| 1. Inquiry | Initial contact with the lender, understanding loan options. |

| 2. Application | Completing the loan application form, providing necessary information. |

| 3. Credit Evaluation | Review of credit history, payment history, and other financial details. |

| 4. Documentation Submission | Submitting required documents, such as income verification and identification. |

| 5. Loan Approval/Denial | Lender evaluates the application and either approves or denies the loan. |

Understanding Loan Repayment Options

Loan repayment strategies are crucial for both borrowers and lenders. Different repayment methods and schedules can significantly impact the overall cost and experience of a loan. A clear understanding of these options empowers borrowers to make informed decisions and lenders to manage their portfolios effectively.

Different Methods of Loan Repayment

Various methods exist for repaying loans, each with its own characteristics. These methods influence the borrower’s monthly payments and the total cost of the loan. Common methods include:

- Fixed-installment payments: This method involves making equal monthly payments over the loan term. This predictable structure is often preferred for its simplicity and allows borrowers to budget easily.

- Adjustable-rate payments: In this method, the interest rate and consequently the monthly payment can fluctuate based on market conditions. While potentially lower initial payments are possible, these can change over the loan term, introducing uncertainty.

- Balloon payments: These loans typically have smaller monthly payments for a specific period, followed by a large, lump-sum payment (the balloon payment) at the end of the loan term. This approach can reduce initial burden but carries risk if the borrower cannot afford the final payment.

- Interest-only payments: These loans involve making only interest payments for a certain period, with principal repayment occurring later. This method may be attractive for its low initial payments but results in a higher total cost over the loan’s life.

Implications of Different Repayment Schedules

The repayment schedule significantly impacts the borrower’s cash flow and the total cost of the loan. Borrowers should carefully consider how different schedules align with their financial capabilities.

- Short-term loans: These loans often feature higher monthly payments but result in a lower total interest cost compared to longer-term loans. This is often the case with payday loans, for example.

- Long-term loans: These loans typically involve lower monthly payments but accrue more interest over the loan’s lifetime. Mortgage loans are an example of long-term financing.

- Amortization schedules: Amortization schedules detail the allocation of each payment between interest and principal. Understanding this breakdown is essential for tracking progress and anticipating future payments.

Comparison of Costs Associated with Various Repayment Plans

The cost of a loan is not solely determined by the interest rate; repayment plans play a crucial role. Comparing various repayment methods is vital for borrowers to make informed choices.

| Repayment Method | Initial Payment | Total Interest Paid | Overall Cost |

|---|---|---|---|

| Fixed-installment | Consistent | Predictable | Generally moderate |

| Adjustable-rate | Potentially lower initially | Variable | Cost can vary significantly |

| Balloon payment | Lower initially | Potentially higher | Risk of high final payment |

| Interest-only | Very low initially | Significantly higher | Higher overall cost |

Examples of Loan Repayment Options

A mortgage loan typically employs fixed-installment payments, allowing for predictable budgeting. A personal loan might offer adjustable-rate payments, where the interest rate fluctuates with market conditions. A car loan might involve balloon payments to reduce monthly payments initially, but the final payment can be substantial.

Loan Company and Cybersecurity

Loan companies operate in a highly regulated and sensitive environment, handling vast amounts of financial data and customer information. Cybersecurity threats pose significant financial and reputational risks to these institutions, requiring proactive measures to safeguard their operations and customer trust. Protecting this data is paramount to maintaining a stable and trustworthy financial environment.

Importance of Cybersecurity for Loan Companies

Cybersecurity breaches can have devastating consequences for loan companies. Financial losses stemming from data breaches are substantial, encompassing direct costs like notification expenses, legal fees, and regulatory fines. Indirect costs, such as lost revenue from decreased customer confidence and operational disruptions, can be even more significant. A 2022 study by the Ponemon Institute estimated the average cost of a data breach to be $9.44 million, highlighting the critical need for robust cybersecurity strategies. Real-world examples, like the 2021 Capital One breach, which exposed the personal data of over 100 million people, underscore the severity of these threats and the financial consequences they entail. The breach resulted in substantial financial penalties, reputational damage, and a loss of customer trust. Quantifying potential losses from a breach requires careful analysis of the specific data exposed, the size of the affected customer base, and the regulatory environment. This includes assessing the direct costs of notification, legal action, and regulatory fines, alongside the indirect costs of lost revenue, decreased customer loyalty, and operational disruptions.

Measures to Protect Customer Data

Robust cybersecurity measures are crucial for safeguarding sensitive customer data. Implementing a multi-layered approach encompassing technical and operational controls is vital. This comprehensive strategy should address specific challenges, such as remote work environments and third-party vendor management.

| Control | Description | Implementation Considerations | Example |

|---|---|---|---|

| Multi-factor authentication (MFA) | Adds an extra layer of security by requiring multiple forms of verification (e.g., password, code from a mobile device). | Implement MFA for all employee accounts, customer portals, and sensitive systems. | Requiring a one-time code from an authenticator app in addition to a password for accessing a loan application portal. |

| Data encryption | Transforms data into an unreadable format, preventing unauthorized access even if the data is intercepted. | Encrypt sensitive data both in transit and at rest, utilizing strong encryption algorithms. | Encrypting customer loan applications and financial data stored in databases and during transmission over the network. |

| Regular security audits | Systematic reviews of security controls to identify vulnerabilities and weaknesses. | Conduct regular security assessments, penetration testing, and vulnerability scans. | Performing periodic security audits to identify and address potential weaknesses in the company’s cybersecurity infrastructure. |

| Strong passwords | Enforcing strong, unique passwords for all users. | Implement a password policy that mandates strong password complexity and regular password changes. | Requiring passwords with a combination of uppercase and lowercase letters, numbers, and special characters for employee and customer accounts. |

| Firewall protection | Network security systems that block unauthorized access to internal networks. | Configure firewalls to allow only necessary network traffic and monitor for suspicious activity. | Employing firewalls to restrict access to internal systems from external sources and to monitor for any unusual network traffic. |

| Regular software updates | Keeping software and operating systems up-to-date to patch security vulnerabilities. | Implement a system for automated software updates and ensure timely patching of vulnerabilities. | Implementing a system for automatically updating operating systems, applications, and security software to mitigate known security vulnerabilities. |

Impact of Cyberattacks on Loan Companies

Cyberattacks have significant repercussions for loan companies, impacting financial stability, customer trust, and operational efficiency.

- Financial Stability: Cyberattacks can lead to substantial direct financial losses (e.g., legal fees, regulatory fines, notification costs) and indirect losses (e.g., lost revenue, damage to reputation). Reduced customer confidence can directly affect loan applications and repayment rates, leading to a decrease in revenue and profitability. Furthermore, reputational damage can affect the company’s ability to attract and retain investors and customers.

- Customer Trust: A security breach can severely damage customer trust. Customers may lose confidence in the company’s ability to protect their sensitive financial data, potentially leading to a decline in customer acquisition and retention rates. The long-term impact on customer loyalty can be significant.

- Operational Efficiency: Cyberattacks can disrupt loan processing, account management, and customer service operations. This can result in delays, inefficiencies, and a decline in overall service quality, potentially impacting profitability.

Importance of Compliance with Cybersecurity Regulations

Loan companies must adhere to relevant cybersecurity regulations to ensure compliance and avoid potential penalties. Regulations like GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act) impose strict requirements for data protection and privacy. Non-compliance can lead to significant financial penalties, legal action, and damage to the company’s reputation. Failure to comply with these regulations can have substantial financial consequences.

Best Practices for Cybersecurity in Loan Companies

Implementing robust cybersecurity practices is crucial for mitigating risks. A proactive approach encompassing comprehensive risk assessments, regular security audits, and employee training programs is vital.

- Establish a comprehensive cybersecurity policy and regularly review and update it.

- Implement multi-factor authentication for all sensitive systems and accounts.

- Conduct regular penetration testing and vulnerability assessments to identify potential weaknesses.

- Train employees on cybersecurity best practices, including password management, phishing awareness, and data protection protocols.

- Establish a dedicated incident response team to manage and mitigate cybersecurity incidents.

- Ensure regular backups of critical data and systems.

- Maintain strong relationships with third-party vendors, ensuring they adhere to appropriate security standards.

- Develop and implement a business continuity plan to address potential disruptions from cyberattacks.

Final Summary

In conclusion, loan companies are integral to the financial ecosystem. Their services, underpinned by a complex regulatory framework and evolving technological landscape, are crucial for individuals and businesses. A deep understanding of the industry’s future requires analyzing emerging trends, competitive pressures, and the companies’ social responsibility. This report provides a comprehensive overview of the current and future state of loan companies.