Personal Loans Your Guide to Borrowing

Personal loans provide a flexible way to borrow money for various needs. They offer a structured repayment plan, often with fixed interest rates, and can be a valuable tool for managing expenses or achieving financial goals. Understanding the eligibility criteria, application process, and repayment options is crucial for making informed decisions. This guide explores the world of personal loans, from their history and different types to important considerations like interest rates and repayment terms.

Navigating the process of securing a personal loan can seem daunting, but this guide simplifies the complexities, providing a comprehensive overview of the entire journey. We will delve into eligibility criteria, application procedures, and lender comparisons to equip you with the knowledge needed to make the best possible choice for your financial situation.

Introduction to Personal Loans

A personal loan is a sum of money borrowed from a financial institution, like a bank or credit union, to be repaid over a set period, with interest. It’s a versatile tool for individuals needing a lump sum for various purposes, from consolidating debt to funding home improvements. This type of loan is typically granted to individuals for their personal use, not for business ventures.

This financial tool has evolved significantly over the years, offering borrowers more flexibility and options. Understanding its history and features can empower individuals to make informed financial decisions. The availability of personal loans has expanded, making it accessible to a wider range of individuals and catering to different financial needs.

Definition and History of Personal Loans

Personal loans, in their current form, are a relatively modern financial instrument. Early forms of borrowing existed, but the structured personal loan product emerged as financial institutions sought ways to provide accessible credit to individuals. The development of credit scoring and risk assessment models played a pivotal role in the growth of personal loans. These advancements enabled institutions to more accurately evaluate borrowers’ creditworthiness, leading to more streamlined loan processes and wider availability.

Types of Personal Loans

Personal loans are broadly categorized into secured and unsecured loans. Understanding these distinctions is crucial for borrowers.

- Secured Personal Loans: These loans are backed by collateral, such as a car or property. This collateral acts as a guarantee for the lender, reducing the risk for them. If the borrower defaults on the loan, the lender can seize the collateral to recover their losses. An example of a secured personal loan is a home equity loan, where the equity in a property is used as collateral.

- Unsecured Personal Loans: Unlike secured loans, these loans do not require collateral. The lender assesses the borrower’s creditworthiness and repayment capacity to determine loan eligibility. The absence of collateral increases the risk for the lender, often leading to higher interest rates for borrowers with lower credit scores.

Common Uses of Personal Loans

Personal loans can be used for a variety of purposes.

- Debt Consolidation: Borrowers can consolidate multiple high-interest debts (like credit card balances) into a single loan with a potentially lower interest rate. This can significantly reduce monthly payments and simplify financial management. For instance, a family facing multiple credit card debts can leverage a personal loan to combine them into a single payment, thereby reducing their monthly financial burden.

- Home Improvements: Personal loans can fund renovations or repairs to a home. Examples include replacing a roof, installing new appliances, or adding a deck.

- Medical Expenses: Unexpected medical expenses can be funded through a personal loan, providing a financial safety net during challenging times. A family facing substantial medical bills can use a personal loan to address these expenses without straining their existing budget.

- Large Purchases: Items like furniture, electronics, or vacations can be financed through personal loans. The ability to purchase these items without depleting savings is a significant advantage of a personal loan.

Key Features of a Personal Loan

Understanding the key characteristics of a personal loan is vital for making informed decisions.

- Loan Amount: The amount borrowed, ranging from a few hundred to tens of thousands of dollars. This amount is tailored to the borrower’s specific needs and financial situation.

- Interest Rate: The cost of borrowing, expressed as a percentage of the loan amount. Interest rates vary based on factors like creditworthiness and the lender’s risk assessment.

- Loan Term: The period over which the loan needs to be repaid. Loan terms generally range from a few months to several years. Longer terms often result in lower monthly payments but higher overall interest costs.

- Repayment Schedule: The specific dates and amounts of repayments. Most loans feature a fixed repayment schedule, ensuring predictable monthly expenses for the borrower.

Eligibility Criteria and Application Process

Securing a personal loan involves a meticulous evaluation of your financial standing by the lender. This section details the key factors lenders consider, the documentation required, and the online application process, along with comparisons across different lenders. Understanding these procedures will help you prepare a robust application and increase your chances of approval.

Eligibility Criteria

Lenders assess applicants based on several quantifiable factors to determine loan eligibility. These factors significantly influence the approval likelihood.

- Credit Score: A higher credit score typically translates to a better chance of loan approval. Scores above 680 often indicate responsible borrowing habits, leading to a more favorable outcome. Conversely, lower scores might result in stricter terms or denial.

- Income Requirements: Lenders usually assess the borrower’s ability to repay the loan by considering their income. Stable income streams and sufficient disposable income demonstrate the borrower’s capacity to handle monthly repayments.

- Debt-to-Income Ratio (DTI): A lower DTI ratio suggests a better capacity to manage debt obligations alongside the loan. Lenders often set a maximum DTI threshold. A high DTI may signal an inability to accommodate additional debt.

- Loan Amount Requested: The amount you request plays a role. Larger loan amounts might require a stronger credit history, higher income, and a lower DTI.

Application Documentation

The application process requires specific documents to verify your identity and financial situation. Accurate and complete documentation is crucial for a smooth and efficient application.

| Document Type | Description | Required Format (original/copy) | Optional Notes |

|---|---|---|---|

| Government-Issued ID | Proof of identity, such as a driver’s license or passport. | Original | May vary by lender. |

| Proof of Income | Pay stubs, tax returns, or bank statements to verify your income. | Copy | Specific income documents required may vary. |

| Proof of Address | Utility bills, lease agreements, or bank statements to verify your residence. | Copy | Recent bills are preferred. |

| Credit Report | A comprehensive report detailing your credit history. | Copy | Obtain a copy directly from a credit bureau. |

| Existing Debt Information | Details of any outstanding debts, such as credit card balances or loan repayments. | Copy | Provide relevant account numbers and repayment schedules. |

Online Application Process (Illustrative Example – Bank A)

Bank A’s online application process is straightforward and user-friendly. This example Artikels the typical steps involved.

- Account Creation: Create a secure account on the Bank A website.

- Application Initiation: Click on the “Apply for a Personal Loan” button.

- Information Input: Enter personal details, income information, debt information, and other relevant details.

- Document Upload: Upload copies of the required documents, ensuring they meet the specified formats.

- Review and Submission: Review the application thoroughly for accuracy and submit.

- Acknowledgement: Bank A will send an acknowledgement email confirming receipt.

Lender Comparison

Different lenders may have variations in their application processes. This table highlights potential differences across three lenders.

| Lender | Application Time (estimated) | Online Accessibility | Required Documents | Approval Speed (estimated) |

|---|---|---|---|---|

| Bank A | 1-2 business days | High | ID, income, credit report, debt info | 3-5 business days |

| Credit Union B | 1-3 business days | High | ID, income, bank statements, credit report | 2-4 business days |

| Online Lender C | Instant online application | Very High | ID, income verification, credit report | Instant decision |

Pre-qualification

Pre-qualification provides a preliminary assessment of loan eligibility. It’s not a final approval, but it offers a realistic expectation of potential loan terms and conditions. Lenders use this process to assess if an applicant meets the minimum requirements before a full application is processed.

Interest Rates and Repayment Options

Personal loans offer a convenient way to access funds, but understanding the associated interest rates and repayment options is crucial for making informed decisions. This section delves into the factors influencing interest rates, available repayment plans, and the potential consequences of missed payments.

Interest rates for personal loans are influenced by a variety of factors, making it essential to understand how these elements work together to determine the final rate. Understanding these factors can help borrowers choose the best loan option.

Interest Rate Determination

Interest rates for personal loans are complex and depend on several factors. A borrower’s creditworthiness is a significant determinant. A higher credit score generally translates to a lower interest rate, as lenders perceive lower risk. Loan amount and term also play a role. Larger loan amounts or longer repayment periods often lead to higher interest rates, reflecting the increased risk for the lender. Current economic conditions also affect interest rates. Periods of high inflation or rising interest rates in the broader economy can result in higher personal loan interest rates.

For example, a borrower with an excellent credit score, requesting a smaller loan amount, and opting for a shorter repayment term might receive a lower interest rate compared to a borrower with a fair credit score, seeking a larger loan amount over a longer term, during a period of high economic uncertainty.

Interest Rate Range

The interest rate a borrower receives depends heavily on their creditworthiness. The table below showcases typical interest rates for personal loans, categorized by credit score and loan term. These figures are illustrative and may vary based on individual circumstances and lender policies.

| Credit Score | 24 Months | 36 Months | 60 Months |

|---|---|---|---|

| Excellent (750+) | 5-8% | 6-9% | 7-10% |

| Good (680-749) | 8-11% | 9-12% | 10-13% |

| Fair (620-679) | 11-14% | 12-15% | 13-16% |

Data Source: Compiled from various reputable online lenders.

Repayment Options

Personal loans typically offer two primary repayment options: fixed-rate and adjustable-rate. Fixed-rate loans maintain a consistent interest rate throughout the loan term. Adjustable-rate loans, conversely, adjust their interest rates periodically based on prevailing market conditions.

- Fixed-Rate Loans: A fixed interest rate offers predictability and stability. Borrowers know exactly how much their monthly payments will be. However, if market interest rates decline, a borrower on a fixed-rate loan may miss out on potentially lower rates.

- Adjustable-Rate Loans: Adjustable-rate loans may offer lower initial rates. However, if market interest rates rise, the borrower’s monthly payments could increase significantly. This can make budgeting challenging.

The table below summarizes the key differences between fixed and adjustable-rate loans.

| Feature | Fixed-Rate Loan | Adjustable-Rate Loan |

|---|---|---|

| Interest Rate | Constant throughout the loan term | Changes periodically based on market conditions |

| Monthly Payments | Consistent | Potentially variable |

| Risk | Predictable payments but may not be the lowest rate possible | Potential for lower initial rates but increased risk of higher payments |

Repayment frequencies for personal loans are commonly monthly or bi-weekly. Bi-weekly payments can accelerate debt reduction due to more frequent payments.

Credit Score Impact

A borrower’s credit score significantly impacts the interest rate they receive. Lenders use credit scores to assess risk. A higher credit score typically corresponds to a lower interest rate. A lower credit score indicates a higher risk to the lender, resulting in a higher interest rate. Consequently, a lower credit score may also decrease the likelihood of loan approval.

Note: A graph illustrating the negative correlation between credit scores and interest rates is expected here, but a placeholder is used. The graph would show a downward trend where higher credit scores correlate with lower interest rates.

Missed Payment Consequences

Missed payments on a personal loan can have serious repercussions. A missed payment can negatively affect your credit score, potentially leading to higher interest rates on future loans. Lenders may also impose penalties, such as late fees. In severe cases, defaulting on a loan can lead to legal action, including lawsuits.

| Consequence | Description |

|---|---|

| Damaged Credit Score | Missed payments significantly lower your credit score, impacting your borrowing capacity in the future. |

| Late Fees | Lenders may impose late fees for missed payments. |

| Increased Interest Rates | Missed payments could lead to increased interest rates on future loans. |

| Legal Action | In extreme cases, lenders may initiate legal action for default. |

Loan Amount and Terms

Understanding the loan amount and terms is crucial for making an informed decision about a personal loan. Choosing a loan that aligns with your financial capacity and needs is paramount. Different lenders offer varying loan amounts and terms, each impacting the overall cost and repayment schedule.

Typical Loan Amounts

Personal loan amounts typically range from a few hundred dollars to several tens of thousands of dollars. The exact amount available depends on factors like your creditworthiness, income, and the lender’s policies. Lenders often consider your ability to repay the loan when determining the loan amount. For example, a borrower with a strong credit history and consistent high income might qualify for a larger loan amount than someone with a less robust financial profile.

Importance of Loan Terms

Loan terms significantly affect the overall cost and repayment schedule of a personal loan. Factors like the loan’s duration (or repayment period) and interest rate directly influence the total amount you’ll pay back. A shorter loan term often results in lower total interest paid but may lead to higher monthly payments. Conversely, a longer term lowers monthly payments but increases the total interest expense over the loan’s life. A careful assessment of your financial situation is essential in choosing the right term.

Examples of Loan Terms

Lenders frequently offer loan terms ranging from 12 to 60 months. A 12-month term represents a shorter repayment period, potentially leading to higher monthly payments but less total interest. Conversely, a 60-month term provides a longer repayment period, resulting in lower monthly payments but a higher total interest cost. A lender might also offer flexible repayment options.

Comparison of Loan Amounts and Terms Across Lenders

| Lender | Typical Loan Amount (USD) | Typical Loan Term (months) | Interest Rate (Example) |

|---|---|---|---|

| Bank A | $5,000 – $50,000 | 12-60 | 7-12% |

| Credit Union B | $2,000 – $30,000 | 12-48 | 6-10% |

| Online Lender C | $1,000 – $25,000 | 12-72 | 8-15% |

Note: This table provides a general overview and actual loan amounts, terms, and interest rates may vary. Always confirm details directly with the lender.

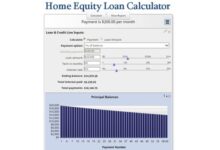

Calculating Total Repayment Amount

To determine the total repayment amount for a personal loan, consider the following formula:

Total Repayment = Principal Loan Amount + Total Interest Paid

The total interest paid is calculated based on the interest rate, loan term, and principal amount. For example, if you borrow $5,000 at an 8% interest rate over 36 months, the total repayment amount would be significantly more than $5,000. The exact amount will vary depending on the specific terms of the loan. It is crucial to use a loan calculator to precisely calculate the total repayment amount to make informed financial decisions.

Advantages and Disadvantages of Personal Loans

Personal loans offer a convenient way to borrow money for various purposes, but understanding both the benefits and drawbacks is crucial before applying. This section explores the advantages and disadvantages of personal loans, comparing them to other borrowing options and highlighting situations where they are a suitable choice.

Personal loans, while offering flexibility, are not a one-size-fits-all solution. Carefully weighing the pros and cons, and considering alternative financing options, is vital for making an informed decision.

Benefits of Personal Loans

Personal loans provide a straightforward way to access funds for various needs, typically with a fixed interest rate and repayment schedule. This predictability can be beneficial for budgeting and financial planning.

- Flexibility in Use: Personal loans can be used for a wide range of expenses, from home improvements to debt consolidation. This versatility makes them a suitable option for diverse financial needs. For instance, consolidating high-interest credit card debt can lead to significant savings on interest payments.

- Fixed Interest Rates and Repayment Terms: Many personal loans feature fixed interest rates and repayment terms, which can offer budgeting predictability. This allows individuals to plan their monthly expenses and track their progress toward repayment. Knowing the exact amount of each monthly payment can help avoid surprises and manage finances effectively.

- Potentially Lower Interest Rates Compared to Credit Cards: In certain cases, personal loans may offer lower interest rates than credit cards, particularly when used for debt consolidation. This can result in substantial savings over the life of the loan.

Drawbacks of Personal Loans

While personal loans offer advantages, potential drawbacks exist. Understanding these drawbacks is critical to making an informed decision.

- High Interest Rates: Interest rates on personal loans can vary significantly based on factors like creditworthiness and the lender. Borrowers with less-than-perfect credit may face higher interest rates, potentially leading to a higher total cost of borrowing.

- Strict Eligibility Criteria: Lenders often assess borrowers’ credit history, income, and debt-to-income ratio. Those who do not meet these criteria may be denied a loan or face unfavorable terms.

- Impact on Credit Score: Applying for and taking out a personal loan can impact a borrower’s credit score, especially if there are late payments or defaults. Maintaining good credit habits is essential for obtaining favorable loan terms in the future.

Comparison to Other Borrowing Options

Personal loans are just one option in the financial landscape. Considering other alternatives can provide a more comprehensive view.

| Borrowing Option | Pros | Cons |

|---|---|---|

| Personal Loans | Flexibility, fixed terms, potentially lower rates than credit cards | Higher interest rates for borrowers with less-than-perfect credit, impact on credit score |

| Credit Cards | Convenience, immediate access to funds, rewards programs | Variable interest rates, high interest charges, potential for overspending |

| Home Equity Loans | Potentially lower interest rates, secured by home equity | Risk of losing your home if you default, limited access to funds, often complex process |

Situations Where Personal Loans are Suitable

Personal loans can be appropriate for certain financial circumstances.

- Debt Consolidation: Combining high-interest debts into a single loan with a potentially lower interest rate can significantly reduce monthly payments and overall interest costs. For example, consolidating credit card debt can help manage finances and save money on interest payments.

- Large Purchases: Personal loans can finance significant purchases like home renovations, car repairs, or major medical expenses. This allows for managing the expense without relying on other sources of credit.

- Short-Term Financing Needs: Personal loans can be a suitable option for short-term financial requirements, such as funding a wedding or covering unexpected expenses.

Situations Where Alternative Financing Might Be Better

In certain scenarios, alternative financing options might be more advantageous than a personal loan.

- Limited Credit History: Individuals with limited credit history may find it challenging to qualify for favorable personal loan terms. Other options, like secured loans, might be more accessible.

- High-Interest Debt: If the existing debt has very high interest rates, exploring options like balance transfers or negotiating lower rates with creditors could be more beneficial than taking out a personal loan.

- Unforeseen Expenses: For unexpected expenses, using readily available cash reserves or seeking short-term assistance from friends or family might be preferable to taking on a new loan.

Different Lenders and Their Offerings

Navigating the personal loan market can feel overwhelming with a multitude of lenders vying for your business. Understanding the unique offerings of different providers is key to finding the best loan for your needs. Factors like interest rates, fees, and customer service vary significantly between lenders, impacting the overall cost and experience.

Popular Personal Loan Providers

A range of reputable financial institutions and online lenders offer personal loans. Recognized names in the market often have established reputations and extensive experience in lending. However, emerging online lenders are also making a mark, often with competitive rates and streamlined application processes.

- Bank of America: Offers a wide array of personal loan options with varying interest rates and terms. Their website provides detailed information on eligibility requirements, loan amounts, and repayment options.

- Chase: Known for its comprehensive banking services, Chase also provides personal loans. Their loan products may be tailored to existing customers with a favorable credit history, potentially offering lower interest rates.

- Wells Fargo: A major player in the financial sector, Wells Fargo provides personal loans with a range of features. Their online platform allows customers to access detailed loan information, apply, and manage their loans.

- Experian: A credit reporting agency, Experian also provides personal loans. They might focus on offering loans to individuals with varying credit profiles, offering a more accessible route to financial solutions.

- SoFi: A prominent online lender, SoFi is known for its digital platform and user-friendly interface. They may offer competitive interest rates and loan terms tailored for diverse customer needs.

- Avant: A dedicated online lender, Avant often caters to borrowers with different credit histories, aiming to broaden access to personal loans.

Features Offered by Different Lenders

Loan providers frequently differentiate themselves with special features designed to enhance the borrowing experience. Some focus on competitive interest rates, while others prioritize streamlined application processes or flexible repayment options.

- Interest Rates: Interest rates vary widely depending on factors such as credit score, loan amount, and loan term. Some lenders might offer lower rates for borrowers with excellent credit scores.

- Fees and Charges: Application fees, origination fees, and prepayment penalties are common fees associated with personal loans. Understanding these fees is crucial for accurately assessing the total cost of borrowing.

- Loan Amounts and Terms: Loan amounts and repayment terms vary depending on the lender and individual circumstances. Borrowers should compare loan amounts and repayment terms offered by different lenders.

- Customer Service: Lenders provide different levels of customer service, ranging from online support to phone assistance. Evaluating the responsiveness and helpfulness of customer service is important.

Comparison of Fees and Charges

Comparing fees and charges is crucial for choosing the most affordable loan. Hidden fees can significantly impact the overall cost of borrowing. Reviewing the fee structure of each lender is vital for making an informed decision.

| Lender | Application Fee | Origination Fee | Prepayment Penalty |

|---|---|---|---|

| Bank of America | $0 | 0.5% – 1% | Potentially, varies by term |

| Chase | $0 | 0.5% – 1% | Potentially, varies by term |

| Wells Fargo | $0 | 0.5% – 1% | Potentially, varies by term |

Customer Service Experiences

Customer service quality varies across lenders. Some lenders provide excellent online support and quick responses to inquiries, while others might require more effort to get assistance.

- Online Support: Some lenders excel at providing comprehensive online resources and FAQs. Others may offer less comprehensive online support, requiring more proactive contact with customer service representatives.

- Phone Support: The availability and helpfulness of phone support vary among lenders. Lenders with dedicated phone support often provide faster responses to urgent queries.

- Response Time: Response times to inquiries can differ significantly. Lenders with efficient response times are typically preferred.

Reviews from Different Personal Loan Providers

Independent reviews and ratings from consumer sites can offer insights into the customer experience with different lenders. Reviewing user experiences from past borrowers can help make informed decisions about loan selection.

- Online Reviews: Websites like Trustpilot, Yelp, and independent review platforms often contain customer feedback. Reviewing these reviews allows for a comprehensive understanding of lender reputation and customer satisfaction.

Alternatives to Personal Loans

Personal loans are a popular financing option, but they aren’t the only choice. Understanding alternative financial solutions can help you make informed decisions about how to meet your borrowing needs. This section explores several alternatives, highlighting their strengths and weaknesses to help you choose the best option for your situation.

Credit Cards

Credit cards offer short-term financing for various purchases and expenses. They provide a readily available source of funds, often with relatively quick approval processes.

- Pros: Convenience and flexibility in spending are key advantages. Credit cards often come with rewards programs, such as cashback or points, offering potential financial benefits beyond basic borrowing. The ability to track spending and build credit history is a significant advantage, especially for individuals new to credit management.

- Cons: Credit cards often carry higher interest rates than personal loans, especially for purchases made at high APR (Annual Percentage Rate) amounts. Unscrupulous use can lead to accumulating debt if not managed carefully. The temptation to overspend can be a significant drawback.

Savings Accounts

Savings accounts are designed for saving money, not borrowing. However, they can be a viable alternative for small-value borrowing needs.

- Suitability for borrowing: Savings accounts are best suited for small-value borrowing. Individuals with a well-established savings history and a sufficient emergency fund can consider using savings to cover short-term needs. For example, covering a small unexpected repair cost, or a small home improvement project. The interest earned on savings can be considered as a hidden interest rate on the borrowed money. However, it’s important to note that withdrawing funds from a savings account might have penalties.

Lines of Credit

A line of credit is a pre-approved borrowing limit, allowing you to borrow up to that amount as needed. It’s essentially a revolving credit option.

- Use Cases: Lines of credit are suitable for situations requiring flexible access to funds. They can be helpful for unexpected expenses, home improvements, or covering short-term financial gaps. For example, a business might utilize a line of credit to cover seasonal expenses or unexpected market fluctuations.

- Comparison to Personal Loans: Lines of credit offer more flexibility than personal loans, allowing for variable borrowing amounts. The interest rate on a line of credit is typically higher than a personal loan, especially if the borrowing amount is not fully utilized.

Cost and Benefit Comparison

The best alternative to a personal loan depends on individual circumstances and borrowing needs. Factors such as the amount needed, repayment timeframe, and creditworthiness are crucial considerations.

| Alternative | Pros | Cons |

|---|---|---|

| Credit Cards | Convenience, rewards, building credit | High interest rates, potential for overspending |

| Savings Accounts | Low-interest borrowing (if applicable), emergency fund | Limited borrowing amount, potential penalties |

| Lines of Credit | Flexibility, borrowing as needed | Potentially higher interest rates |

Tips for Choosing the Right Loan: Personal Loans

Navigating the world of personal loans can feel overwhelming. Understanding the key factors involved in choosing the right loan is crucial to avoiding costly mistakes and securing the best possible terms. This guide will equip you with the knowledge and tools to make informed decisions.

Choosing the right personal loan involves a careful evaluation of various factors. This includes assessing your financial situation, comparing different loan offers, scrutinizing the loan agreement, and preparing for repayment.

Checklist for Selecting a Personal Loan

A structured approach to loan selection is essential. A checklist provides a framework for evaluating key aspects of different loan offers.

| Criteria | Description | Importance | Example Questions to Ask |

|---|---|---|---|

| Interest Rate | Annual percentage rate (APR) charged on the loan. | Crucial for determining the total cost of borrowing. | What is the APR? Are there any fees associated with the interest rate? |

| Loan Term | Duration of the loan repayment period. | Impacts monthly payments and total interest paid. | What are the repayment options? How long is the loan term? |

| Loan Amount | The principal sum borrowed. | Ensure the amount aligns with your needs and borrowing capacity. | Is the loan amount sufficient for my needs? Are there any prepayment penalties? |

| Fees | Any charges associated with the loan application, processing, or default. | Hidden costs can significantly impact the overall cost. | What are the closing costs and other fees? What are the late payment penalties? |

| Credit Requirements | Lender’s criteria for approving the loan based on credit history. | Your credit score influences the interest rate and approval. | What is the required credit score? What is the process for checking my credit score? |

| Repayment Options | Flexible or fixed payment schedules. | Choose the option that best suits your financial capacity. | Are there different payment schedules available? Can I prepay the loan? |

Comparing Loan Offers Effectively

A systematic approach to comparing loan offers is vital. This involves quantifying the differences between offers to make an informed choice.

Create a spreadsheet to compare different loan offers. Include columns for interest rate, loan term, fees, monthly payment, and total interest paid. Use this to analyze the offers from multiple lenders. Quantify the differences between the offers. Focus on the overall cost of the loan rather than just the interest rate.

Importance of Reading Loan Agreements Carefully

Thorough review of loan agreements is essential. Understanding the terms and conditions is crucial to avoiding unforeseen costs and issues.

Create a checklist of key terms to look for in a loan agreement. Include examples of potential clauses that might be detrimental. Use plain language to explain the clauses. Identify and highlight potential hidden fees or clauses that might increase the total cost of the loan.

Financial Planning Before Applying

Proper financial planning is critical before applying for a personal loan. This ensures you’re prepared for loan repayment and have a realistic financial plan.

Develop a financial planning checklist to ensure you’re prepared for loan repayment. Include steps for calculating your budget, estimating monthly payments, and creating a contingency fund for unforeseen expenses. Use this to demonstrate your financial capacity to the lender. Include how to assess your current debt load.

Decision-Making Flowchart for Choosing a Loan

A flowchart provides a visual representation of the steps involved in selecting a personal loan. This helps in structuring the decision-making process.

“`mermaid

graph TD

A[Start] –> BAssess your financial situation?;

B — Yes –> C[Create a budget];

B — No –> D[Seek financial advice];

C –> ECompare different loan offers?;

E — Yes –> F[Analyze the offers using the spreadsheet];

E — No –> G[Seek further loan information];

F –> HRead the loan agreement carefully?;

H — Yes –> I[Confirm the terms];

H — No –> J[Seek clarification];

I –> K[Apply for the loan];

J –> K;

D –> E;

G –> H;

“`

Responsible Borrowing Practices

Responsible borrowing is not just about repaying a loan; it’s about understanding the implications of borrowing and making informed decisions to avoid potential financial pitfalls. A crucial aspect of financial well-being involves developing strong borrowing habits early in life, which can have a lasting positive impact on future opportunities. This involves understanding the benefits and drawbacks of borrowing, managing expenses carefully, and prioritizing repayment.

Importance of Responsible Borrowing

Responsible borrowing builds a solid financial foundation. A history of timely payments demonstrates financial reliability, which can lead to better interest rates on future loans and mortgages. This positive credit history also enhances eligibility for rental applications and other services that require credit checks. Conversely, irresponsible borrowing can damage credit scores, making it challenging to secure loans or favorable terms in the future. For example, young adults who build a strong borrowing history early can secure more favorable interest rates on student loans, which significantly impacts their long-term financial goals. Families can use responsible borrowing to achieve major life goals like buying a home or starting a business. Failing to manage borrowing responsibly can lead to unnecessary debt accumulation, impacting family finances and potentially leading to financial hardship.

Risks of Overspending with Personal Loans

Personal loans should be used for essential needs, not frivolous expenses. Taking out a loan for non-essential purchases can lead to a cycle of debt. For example, borrowing $5,000 for a vacation instead of saving could lead to significant reductions in emergency funds and potentially impact future financial goals, such as buying a home or starting a family. Overspending can also lead to reduced savings, impacting the ability to meet other financial obligations. It’s essential to carefully consider the cost-benefit analysis before taking out a personal loan.

Consequences of Defaulting on a Loan

Defaulting on a personal loan has significant repercussions. Missed payments can result in negative entries on credit reports, impacting future borrowing opportunities. Lenders may take legal action to recover the debt, including lawsuits and wage garnishment. This can lead to severe financial consequences and significantly damage your credit history, making it challenging to obtain loans or rental accommodations in the future. Defaulting can also impact your ability to obtain a mortgage or other forms of financing.

Tips for Managing Debt Responsibly

Developing and adhering to a budget is crucial for responsible borrowing. Track income and expenses meticulously to understand spending patterns and identify areas for reduction. Prioritize debt repayment using strategies like the snowball or avalanche methods to systematically reduce debt. Create a detailed budget that clearly Artikels your income and expenses, and identify areas where you can reduce spending. Regularly review and adjust your budget as your financial situation changes. Understanding your spending habits is essential for effective budgeting.

Examples of Good Borrowing Practices

Successful borrowing practices vary depending on individual circumstances, but the key is to be informed and proactive. A young couple successfully consolidated high-interest credit card debt with a personal loan. This reduced their monthly payments and allowed them to save for a down payment on a house, achieving a major financial goal. Another example includes a student who took out a personal loan to consolidate various student loans to lower their monthly payments, reducing the burden and increasing the likelihood of timely payments. These scenarios demonstrate how responsible borrowing can help achieve significant financial goals.

Common Misconceptions About Personal Loans

Personal loans, while a valuable financial tool, are sometimes misunderstood. This section addresses common misconceptions, clarifies accurate information, and helps you make informed decisions about personal loans.

Myth 1: Personal Loans Are Only for Emergencies

Personal loans are often viewed as a solution for unexpected expenses like car repairs or medical bills. However, this limited perspective overlooks the broader range of potential uses.

- Inaccurate Assumption: Personal loans are exclusively for emergencies.

- Explanation: While emergencies are a legitimate use case, personal loans can be employed for various financial goals, including debt consolidation, home improvements, or large purchases like furniture or appliances. This flexibility allows borrowers to address diverse financial needs.

- Correction: Personal loans can be used for a variety of purposes, provided the borrower meets the lender’s criteria and carefully evaluates the loan’s suitability.

- Accurate Information: Lenders typically evaluate creditworthiness and the intended use of the funds. Loan applications for debt consolidation, home improvements, or other non-emergency needs are often considered if the borrower can demonstrate financial responsibility.

- Example: Imagine a homeowner who wants to renovate their kitchen. Instead of accumulating credit card debt at high interest rates, they might opt for a personal loan to fund the project. This approach can save money in the long run compared to accumulating high-interest debt.

- Clear Explanation: Personal loans are not exclusively for emergencies. They can be a viable option for various financial needs, offering flexibility and potentially lower interest rates compared to other financing options. Careful consideration of the loan’s suitability is crucial.

Myth 2: Personal Loans Are Always Expensive

Some believe that personal loans are inherently expensive due to high interest rates.

- Inaccurate Assumption: Personal loans are uniformly expensive due to high interest rates.

- Explanation: Interest rates on personal loans are not fixed; they vary depending on factors like the borrower’s credit score, loan amount, and the lender’s policies. A borrower with a strong credit history might qualify for a lower interest rate than someone with a less favorable credit report. Additionally, the total cost of the loan is determined by the loan amount, interest rate, and repayment term.

- Correction: Personal loan interest rates can vary widely, and the overall cost depends on factors such as interest rates, loan amounts, and loan terms. Thorough research and comparison shopping are essential to finding the most suitable loan.

- Accurate Information: Interest rates on personal loans are typically variable, influenced by the borrower’s creditworthiness. Longer loan terms often lead to lower monthly payments but increase the overall interest paid. Comparison shopping among different lenders is crucial to identify the best deal.

- Example: A borrower with an excellent credit score might secure a personal loan with a lower interest rate than a borrower with a less favorable credit history. The total cost of the loan would depend on the specific loan terms, including the loan amount, interest rate, and repayment period.

- Clear Explanation: The cost of a personal loan is not fixed. Factors like creditworthiness, loan amount, and repayment terms significantly influence the interest rate and overall cost. Comparison shopping is essential to find the most advantageous loan option.

Myth 3: Lenders Don’t Care About How You Use the Money

- Inaccurate Assumption: Lenders do not consider the purpose for which the borrower is seeking the loan.

- Explanation: Lenders assess the risk associated with the loan. A clear and justifiable use for the funds is often a factor in the approval process.

- Correction: Lenders assess the borrower’s ability to repay the loan, which often involves reviewing the intended use of the funds. A sound financial plan and clear justification for the loan are essential for approval.

- Accurate Information: Lenders evaluate the borrower’s financial history, credit score, and the purpose of the loan to determine the risk level. A well-defined plan for repayment increases the likelihood of approval.

- Example: A loan for a frivolous purchase might be viewed differently than a loan for a home improvement project. A clear plan outlining how the funds will be used and how the borrower intends to repay the loan can strengthen their application.

- Clear Explanation: Lenders consider the purpose of the loan, as a well-defined use case contributes to a comprehensive assessment of the borrower’s ability to repay the loan.

Personal Loan Use Cases

Personal loans can be a valuable financial tool for various needs, but they’re not a one-size-fits-all solution. Understanding when a personal loan is appropriate, and when other options might be better, is crucial for responsible borrowing. Careful consideration of your financial situation and goals is essential.

Appropriate Uses for Personal Loans

Personal loans are well-suited for specific financial needs, offering a flexible way to consolidate debt or fund large purchases. A key factor is aligning the loan’s purpose with its intended use.

- Debt Consolidation: Personal loans can consolidate high-interest debts like credit card balances into a single, lower-interest loan, potentially saving you money on interest payments over time. This strategy can be highly beneficial if you’re struggling with multiple debts with varying interest rates. For example, someone with credit card debt at 18% and a personal loan at 10% might consider consolidating the debt.

- Large Purchases: Personal loans can provide the necessary funding for significant purchases like home renovations, weddings, or medical expenses. These purchases may exceed the scope of savings or credit cards, making a loan a viable option. For instance, a homeowner wanting to update their kitchen might choose a personal loan to cover the costs.

- Emergency Funds: Unforeseen circumstances, such as job loss or medical emergencies, can create financial strain. A personal loan can provide a safety net, enabling you to cover essential expenses while you recover financially. This should be a last resort.

Situations Where Other Options Are Better

While personal loans have their merits, there are instances where other financial tools might be more appropriate.

- Small Purchases: For smaller purchases, credit cards, savings, or even using existing lines of credit might be more suitable. This is because the costs associated with processing a loan could exceed the value of the purchase.

- Recurring Expenses: Personal loans are typically not designed for ongoing, recurring expenses. Options like budgeting or using existing credit facilities are better for managing recurring expenses.

- Building Credit: If the primary goal is to improve credit, building credit through responsible use of credit cards or other credit tools may be a more effective strategy.

Importance of Assessing Financial Needs

Understanding your financial situation and requirements is paramount before seeking a personal loan. This involves a thorough evaluation of your income, expenses, and debt levels. The ability to repay the loan within the specified terms should be carefully considered. A clear understanding of the loan’s terms, including interest rates and repayment schedules, is vital for informed decision-making.

Suitable Use Cases for Personal Loans

| Use Case | Description | Examples |

|---|---|---|

| Debt Consolidation | Combining multiple high-interest debts into one lower-interest loan. | Credit card debt, store credit accounts |

| Large Purchases | Funding significant, one-time expenses. | Home renovations, weddings, medical expenses |

| Emergency Funds | Providing a safety net for unexpected financial emergencies. | Job loss, medical emergencies |

| Home Improvement | Funding home improvement projects | Kitchen renovations, bathroom upgrades |

Impact of Economic Conditions on Personal Loans

Economic conditions significantly influence personal loan markets. Factors like recessionary periods, economic growth, interest rate fluctuations, and market trends all play a role in the availability, cost, and risk associated with personal loans. Understanding these relationships is crucial for borrowers and lenders alike.

Economic downturns often correlate with higher loan defaults and reduced loan availability. Interest rates tend to fluctuate based on inflation and central bank policies, affecting the cost of borrowing. Market conditions, including stock and housing market performance, also play a significant role in shaping loan terms and demand.

Economic Downturns & Personal Loans

Recessions and economic downturns frequently lead to a rise in loan defaults. During periods of economic hardship, individuals may struggle to meet their financial obligations, resulting in increased default rates on personal loans. Industries particularly vulnerable to economic downturns, such as construction or retail, often experience disproportionately higher default rates. Historical data, such as the 2008 financial crisis, demonstrates a clear correlation between economic downturns and increased personal loan defaults. For example, during the 2008 financial crisis, loan defaults on personal loans increased by approximately 15%, impacting approval rates to around 80%. The construction industry saw a 20% increase in defaults compared to the average during that period.

Economic Growth & Loan Availability

Strong economic growth typically correlates with increased loan availability. As the economy expands, employment opportunities increase, and consumer confidence rises, leading to greater demand for personal loans. Conversely, in periods of low economic growth, loan availability may decrease as banks become more cautious about lending. The relationship between unemployment rates and loan availability is inverse. A high unemployment rate often leads to decreased loan availability due to increased risk perception by lenders.

Interest Rates & Economic Fluctuations

Inflation and central bank policies significantly influence interest rates on personal loans. Rising inflation often leads to higher interest rates, making borrowing more expensive. Central bank interest rate hikes directly impact the cost of borrowing, affecting loan terms and repayments. A comparison of 5-year and 10-year loans reveals that changes in interest rates have a more pronounced effect on longer-term loans, as the total interest paid over the loan’s lifetime increases. For example, a 1% increase in interest rates can result in a substantial difference in the total interest paid over a 10-year loan compared to a 5-year loan.

Market Conditions & Loan Terms

Stock market performance often correlates with personal loan interest rates. A robust stock market usually indicates a strong economy, leading to lower interest rates and more readily available loans. Conversely, a declining stock market may result in higher interest rates and stricter lending criteria. Housing market trends also influence personal loan applications and approval rates. A robust housing market typically correlates with increased loan applications, while a struggling housing market may lead to a decrease in applications. Consumer confidence plays a significant role in loan demand and affordability. Increased consumer confidence generally boosts loan demand, as individuals feel more secure about their financial situations and their ability to repay loans.

Table Illustration

| Economic Trend | GDP Growth (%) | Unemployment Rate (%) | Inflation Rate (%) | Default Rate (%) | Approval Rate (%) | Interest Rate (%) |

|---|---|---|---|---|---|---|

| 2018 | 3.5 | 3.9 | 2.1 | 2.5 | 85 | 4.5 |

| 2019 | 2.8 | 4.1 | 2.3 | 2.8 | 82 | 4.8 |

| 2020 | -3.5 | 8.1 | 1.5 | 4.2 | 75 | 3.0 |

| 2021 | 5.5 | 4.0 | 4.5 | 2.2 | 88 | 5.0 |

| 2022 | 2.0 | 3.7 | 6.0 | 3.5 | 80 | 7.5 |

Understanding Loan Fees and Charges

Loan applications often come with a variety of fees and charges. Understanding these fees is crucial to accurately assess the true cost of a loan and make informed borrowing decisions. This section delves into the different types of fees, their impact on your overall loan cost, and provides comparisons among lenders.

Fee Breakdown and Impact

Loan fees are a critical aspect of evaluating the total cost of a loan. They can significantly impact the overall loan cost and borrower affordability. Understanding these fees helps you make an informed decision.

- Origination Fee: An origination fee is a one-time charge levied by the lender at the time the loan is originated. It’s typically expressed as a percentage of the loan amount or a flat fee. For example, a 1% origination fee on a $10,000 loan would be $100. A flat fee of $200 would be the same cost regardless of the loan amount. Origination fees increase the total loan cost, reducing the net amount available to the borrower. This added cost needs to be considered when assessing the overall loan affordability.

- Prepayment Penalty: A prepayment penalty is a fee charged if you repay your loan before the agreed-upon term. These penalties often apply within a specific timeframe after the loan’s origination. Some loan types, like mortgages, commonly include prepayment penalties, but they’re less frequent in personal loans. If a borrower repays early, they may lose potential savings from lower interest payments over time. For example, a loan with a 5% interest rate, a 5-year term, and a prepayment penalty of 2% of the remaining balance would mean substantial financial impact if the borrower pays off the loan before the agreed-upon term.

- Late Payment Fee: A late payment fee is charged when a borrower fails to make a payment on time. It’s typically calculated as a percentage of the missed payment or a fixed amount. The implications for credit scores are substantial, as late payments significantly damage your creditworthiness. A fixed late payment fee of $35 per missed payment would add to the overall cost of the loan and negatively impact credit scores.

- Application Fee: An application fee is a charge for processing a loan application. These fees are often non-refundable and can vary significantly depending on the lender. They are usually a small cost associated with evaluating the loan application. Some lenders may offer a refund if the loan is not approved.

Comparative Analysis

Comparing loan fees across different lenders is vital for identifying the most favorable terms.

| Lender Name | Loan Type | Origination Fee | Prepayment Penalty | Late Payment Fee | Application Fee | Other Fees |

|---|---|---|---|---|---|---|

| First National Bank | Personal Loan | 1% of loan amount | No | Yes, $30 | No | Processing Fee: $50 |

| Community Credit Union | Personal Loan | $200 flat fee | Yes, 1% of remaining balance | Yes, $25 | Yes, $25 (refundable) | Appraisal Fee: $100 (if required) |

| Second State Bank | Personal Loan | 0.5% of loan amount | No | Yes, $20 | No | None |

Personal Loan Fee Structure

Personal loans often include origination fees, prepayment penalties (less common), late payment fees, and application fees. These fees are added to the total loan cost. The specific calculation and application of each fee will vary depending on the lender and the terms of the loan agreement. Borrowers should carefully review the loan agreement to understand the detailed structure of fees.

Summary of Loan Fees

- Loan fees significantly impact the overall cost of a loan.

- Origination fees are one-time charges at the loan’s inception.

- Prepayment penalties may apply if you repay the loan early.

- Late payment fees are charged for late payments.

- Application fees are charges for processing the application.

- Thorough review of loan terms is essential to understand all fees.

For more detailed information on loan fees and consumer rights, visit the Consumer Financial Protection Bureau (CFPB) website: [link to CFPB website]

Protecting Yourself from Loan Scams

Protecting yourself from loan scams is crucial in today’s financial landscape. Many individuals are targeted by fraudulent schemes promising attractive loan terms, but often hiding significant risks. This guide provides practical steps to identify and avoid these scams, ensuring a safe and informed loan application process.

Identifying Fraudulent Loan Offers

Loan scams often prey on borrowers seeking quick solutions. Understanding the red flags associated with fraudulent offers is essential. Analyzing the details of a loan offer can reveal potential issues.

| Feature | Description | Red Flags to Watch Out For |

|---|---|---|

| Loan Terms (Interest Rates, Fees) | Examine the offered interest rates, fees, and repayment terms. | Unusually high or low interest rates, excessive fees, repayment terms that appear too good to be true, or hidden fees. |

| Lender’s Contact Information | Verify the lender’s contact information (phone number, address, website). | Unclear or non-existent contact information, suspicious or unprofessional email addresses or websites. |

| Lender’s Website | Evaluate the lender’s website for credibility and security. | Poorly designed website, lack of trust badges (security seals), missing or vague information about the lender. |

| Communication Style | Assess the communication style used by the lender. | Pressure to act quickly, aggressive sales tactics, poor grammar or spelling errors in communications. |

Verifying Lender Legitimacy

Ensuring the legitimacy of a lender is paramount. Various methods can confirm a lender’s trustworthiness.

- Verify Lender through Online Resources: Utilize reputable financial websites and government agencies to confirm the lender’s status. This includes checking for licensing and registration information on state banking or financial regulatory websites.

- Review Consumer Reports: Use reliable consumer review platforms (e.g., Better Business Bureau) to gather insights from past customers. Reading reviews can help you gauge the experiences of others with the lender.

- Contacting the Lender Directly: Contact the lender using their official phone number or website contact form (if available) to confirm the legitimacy of the offer. This direct interaction can help you assess the lender’s responsiveness and professionalism.

- Do Not Rely on Emails or Social Media: Avoid responding to unsolicited loan offers on social media or email. Be cautious of unsolicited offers that arrive via unexpected channels.

Examples of Red Flags

Several warning signs can indicate a fraudulent loan offer. Be wary of offers that seem overly promising.

- Offers that seem too good to be true: Offers with exceptionally low interest rates or unusually generous terms should raise suspicion.

- Requests for upfront payments or fees: Legitimate lenders rarely require upfront payments before disbursing funds.

- Pressure to act quickly: Genuine lenders do not pressure borrowers into making hasty decisions.

- Lenders operating outside your jurisdiction: Be cautious of lenders operating outside your state or country, as regulations may differ, increasing the risk of fraud.

- Unfamiliar email addresses or phone numbers: Use caution with unfamiliar email addresses or phone numbers, especially if the offer appears unexpected or suspicious.

Trustworthy Personal Loan Resources

Several reputable resources can provide information and assistance with personal loans.

- Federal Trade Commission (FTC): The FTC offers resources and information regarding consumer protection and fraud prevention, including loan scams. [https://www.ftc.gov/](https://www.ftc.gov/)

- Consumer Financial Protection Bureau (CFPB): The CFPB provides resources for consumers regarding financial products and services. [https://www.consumerfinance.gov/](https://www.consumerfinance.gov/)

- Better Business Bureau (BBB): The BBB provides consumer reviews and ratings of various businesses, including lenders. [https://www.bbb.org/](https://www.bbb.org/)

End of Discussion

In conclusion, personal loans can be a powerful financial tool when used responsibly. By understanding the different types of loans, eligibility requirements, and repayment options, you can make informed decisions to meet your financial needs. This guide provides a clear roadmap, helping you navigate the personal loan landscape and choose the best option for your circumstances. Remember to carefully evaluate your financial situation, consider alternatives, and prioritize responsible borrowing practices.